How to Buy MicroStrategy Stock Through Crypto Using MSTR Tokens

2025-10-20

You want exposure to MicroStrategy stock without opening a foreign brokerage account. Now you can do that through crypto assets that track MicroStrategy's price.

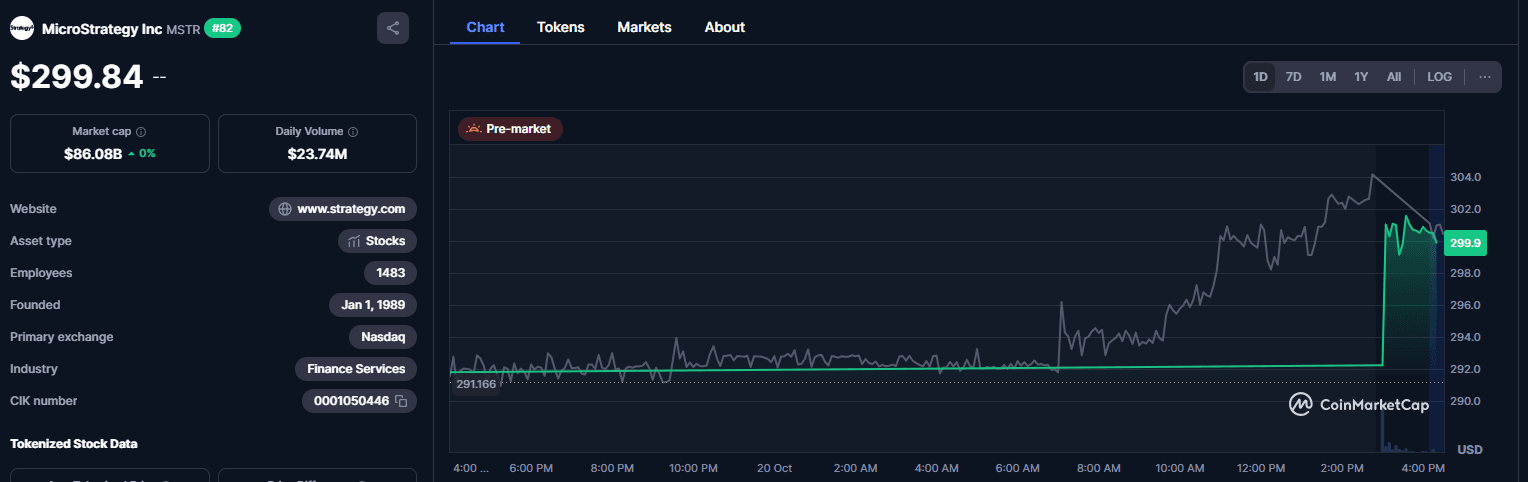

In the crypto world, this exposure comes in the form of tokens that follow the value of the underlying stock. The most commonly discussed are MSTR tokens from several issuers.

There are also variations like MSTRx from Backed Finance, dMSTR from DeFiChain, and iMSTR in the Injective ecosystem for futures contracts. Essentially, you can gain exposure to MicroStrategy's price on a blockchain network you're familiar with.

The concept is simple. Issuers hold real shares in a regulated custodian or create synthetic assets backed by crypto and price oracles. Then they issue tokens on networks such as Ethereum, Arbitrum, or Solana.

These are the tokens you buy on crypto exchanges. There are options on centralized exchanges and decentralized exchanges. Each has its own terms and risks.

Read also: Most Promising Stock Recommendations for October 2025

What is the MSTR token and how does it work?

The MSTR token is an on-chain representation of MicroStrategy stock. It comes in two forms. The first is a token backed by real assets. Examples include MSTRx from Backed Finance and dShares MSTR on Gemini, which collaborates with Dinari.

Tokens like these generally state that each token represents an economic claim on one share or fraction of a share held in custody. Economic rights may include equal dividend distributions if the issuer's policy supports it.

Voting rights are not usually included, so token ownership is not the same as being a shareholder at a general meeting.

The second type is synthetic assets and derivatives. Examples include dMSTR on DeFiChain and iMSTR perpetual on Injective. Synthetic assets rely on crypto collateral and price oracles.

Their value follows the stock price through market mechanisms. Perpetual iMSTR provides exposure through futures contracts with no expiration date.

What you hold is a derivative position, not a spot token. This is suitable for traders who need flexibility but requires an understanding of margin management.

MSTR tokens can exist on multiple networks. MSTRx is available on Ethereum as an ERC-20 token and also exists on Solana as an SPL token.

Gemini launched the MSTR stock token on Arbitrum. DeFiChain has dMSTR on its own network. Injective provides iMSTR in the Cosmos ecosystem. Different networks mean different wallets are used. Metamask for Ethereum and Arbitrum.

Phantom for Solana. Keplr or Injective wallet for iMSTR. The choice of network also determines transaction fees and liquidity availability.

Availability on exchanges is also important. During a certain period, MSTRx appeared on exchanges such as Gate io for spot trading.

Several other platforms have supported stock tokens but then discontinued the service due to compliance policies. Availability may change in line with regulations. Therefore, always check official announcements from exchanges and issuers before trading.

Read also: What are GZCO Shares and What Field Do They Operate In?

Step-by-step guide to buying MSTR tokens

Buying MSTR tokens is similar to buying regular altcoins. The difference is that you need to ensure the correct issuer and token contract. Follow this simple process.

- Choose the CEX or DEX route

CEX simplifies the process with a familiar interface. Examples of exchanges that have supported MSTR tokens are Bitrue and Gate io for MSTRx, as well as Gemini for users in certain regions for Arbitrum-based MSTR tokens.

DEX gives you full control over your wallet. For DEX on Ethereum, you can use Uniswap as long as the token contract is official and liquidity is sufficient. For iMSTR derivatives, use Helix in the Injective ecosystem.

- Prepare your wallet and funds

If using a CEX, simply deposit USDT or other cryptocurrencies into your exchange account. If using a DEX, prepare a wallet that is compatible with the network. Metamask for ERC-20 and Arbitrum. Phantom for Solana. Top up your stablecoin and gas asset balances.

Ethereum requires ETH for transaction fees. Solana requires SOL. Also check regional restrictions and identity verification requirements.

- Find the market and verify the contract

Find the appropriate MSTR pair. For example, MSTRX against USDT. On DEX, import the official contract address to avoid confusion with other tokens with similar names. Compare liquidity and price spreads. If it is thin, consider the order size to avoid large price differences.

- Execute the purchase and store it securely

Place a buy order. Once the tokens are in your balance, consider withdrawing them to a personal wallet if the exchange supports on-chain withdrawals.

Add custom tokens to your wallet to view your balance. Store your wallet recovery phrase securely and consider hardware for additional security.

- Monitor prices and exit plans

The price of MSTR tokens follows the underlying stock but may deviate temporarily due to different trading hours. Stocks have limited market hours. Tokens are traded around the clock. Create a measured exit plan to avoid being hit by volatility outside of exchange hours.

Read also: Sports Stocks: Investment Opportunities in the Booming World of Sports & Crypto

Risks, legality, and risk management tips

Stock tokens operate in a highly regulated space. Many jurisdictions classify them as securities subject to capital market regulations. As a result, services may be restricted in certain regions and require strict know-your-customer procedures.

Similar services that were once popular may be discontinued if they fail to comply with regulations. This has occurred on several international exchanges, so users should be prepared for policy changes.

Liquidity is also a concern. The volume of MSTR tokens is not always as high as that of stocks on traditional exchanges. When liquidity is thin, the price spread widens and large orders are difficult to execute. Pay attention to the order book before placing a transaction.

For synthetic assets and derivatives, additional risks arise from the performance of the oracle, collateral, and pegging mechanisms. Disruption to any of these elements can cause the price to deviate from the underlying stock.

Economic rights and corporate features need to be understood. Many stock tokens do not grant voting rights. Dividend distributions, if any, follow the issuer's policy.

Events such as stock splits will be handled by the issuer through ratio adjustments. Read the official documents to ensure your expectations are accurate.

Quick tips for greater security

- Use clear and regulated issuers.

- Always verify the token contract address.

- Start with a small amount and increase gradually.

- Use a secure wallet and store your recovery phrase.

- Monitor regulatory news and exchange announcements.

With a disciplined approach, exposure to MicroStrategy through crypto tokens can complement your portfolio without the hassle of opening an overseas brokerage account.

Read also: Why Does the JCI Fluctuate? Here Are the Driving Factors

Conclusion

Buying MicroStrategy shares through crypto is now possible thanks to tokenization. You can choose tokens backed by real shares such as MSTRx and options from regulated issuers, or choose synthetic assets and derivatives such as dMSTR and iMSTR for trading flexibility.

The process is similar to buying altcoins. Choose a platform, set up a wallet, verify the contract, then execute the purchase with a clear plan.

Remember the risks of regulation and liquidity. Use secure local platforms like Bittime to set up your crypto funds and manage your portfolio with peace of mind.

With the right understanding, MSTR tokens can be a practical way to gain exposure to MicroStrategy on-chain.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is the MSTR token?

A crypto token that tracks the price of MicroStrategy stock. It can be backed by real shares or be synthetic and derivative-based.

Does the MSTR token grant voting rights?

Generally not. The token focuses more on economic rights. Details follow the issuer's policies.

Where can I buy the MSTR token?

During certain periods, MSTRx was available on exchanges like Gate.io. Gemini offers the MSTR token for supported regions. Availability may change.

What is the difference between MSTRx and iMSTR

MSTRx is a spot token representing an economic claim on shares. iMSTR is a futures contract on Injective, making it a derivative.

Is it safe for beginners

It is safe if you understand the risks. Start small, check the official contract, use a trusted platform, and store your assets in a secure wallet.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.