How to Allocate a 4 Million Rupiah Salary: A Practical Guide to Saving and Investing

2025-10-07

Bittime - Managing a salary of Rp. 4,000,000 per month can be challenging, especially if you live in a big city, but it's not impossible.

This article discusses the practical ways of allocating a 4 million (4 million) salary, providing several realistic allocation schemes, detailed calculations, visual charts, and tips on how to start saving and allocating some for investment (including the option to buy 4 million Rupiah).Bitcoin via Bittime as a first step, with a note of risk).

READ ALSO: Understanding the Smart Money Concept from the Crypto Academy: Strategies of Large Institutions

Basic Principles of Salary Allocation

Before getting into the numbers, understand a simple principle:

Differentiate between needs and wants and savings/investments. This prevents money from "fading away" without a plan.

Prioritize emergency funds (3–6× monthly expenses ideally).

Start investing even if it's small — consistency is more important than large amounts at the start.

Automation: set up auto-debit/transfer for savings to maintain discipline.

Many financial planners recommend the 50/30/20 method as a basis, with 50% for needs, 30% for wants, and 20% for savings and investments. This method is flexible and easily adaptable.

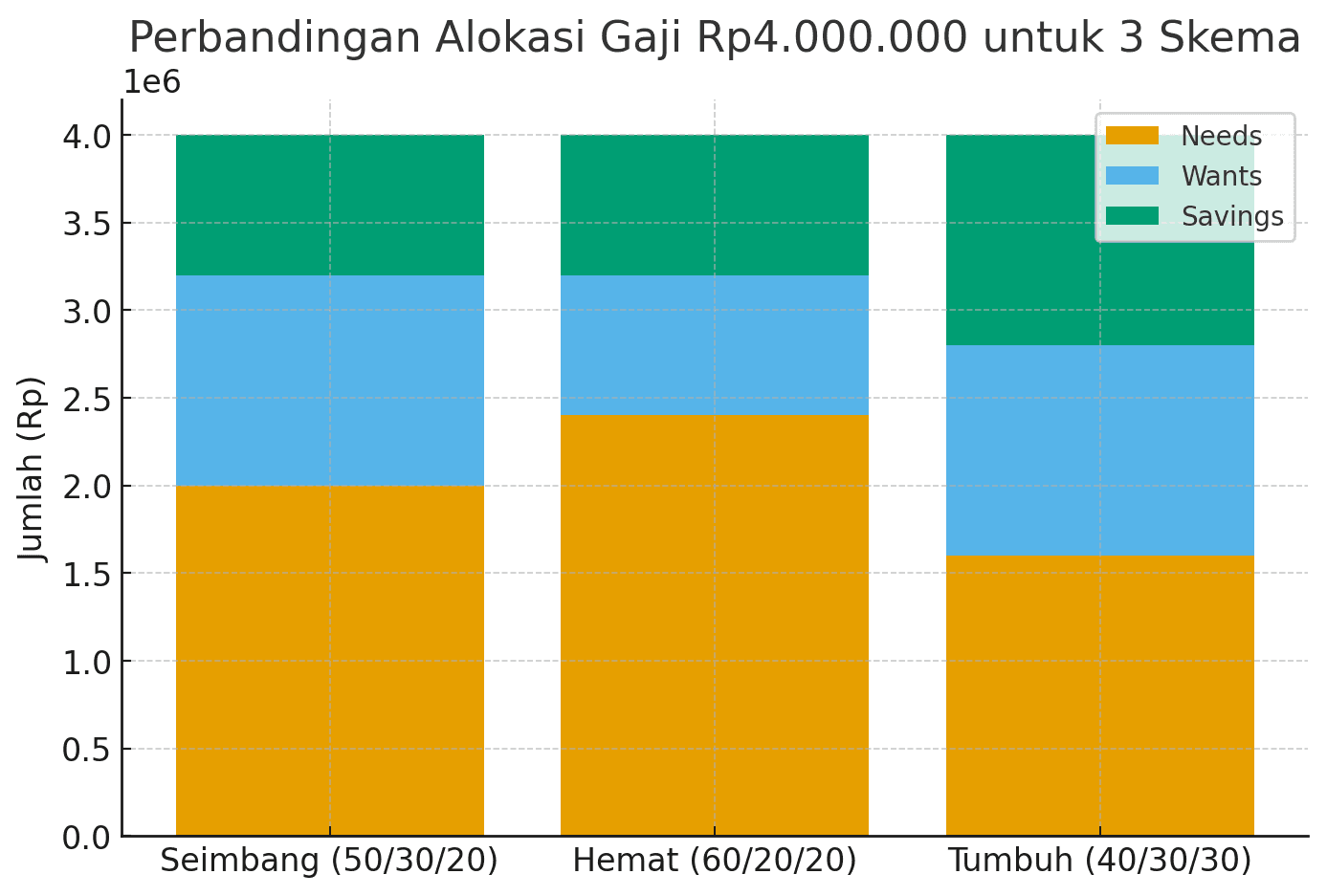

Allocation Model

Here are three practical schemes for a salary of Rp. 4,000,000. Choose according to your priorities (e.g., reducing expenses, growing investments, or balancing).

Balanced Scheme — 50 / 30 / 20 (General recommendation)

Needs 50% = Rp. 2,000,000

(rent/contract, food, transportation, credit/internet, bills)Wants 30% = Rp1,200,000

(entertainment, eating out, non-essential shopping)Savings & Investment 20% = Rp800,000

(emergency funds, deposits, regular investments)

Savings Scheme — 60 / 20 / 20 (For those who prioritize survival & conservative saving)

Needs 60% = Rp2.400.000

Wants 20% = Rp800.000

Savings 20% = Rp800.000

Growth Scheme — 40 / 30 / 30 (For those who want to accelerate investment)

Needs 40% = Rp1.600.000

Wants 30% = Rp1.200.000

Savings & Investment 30% = Rp1,200,000

Detailed Calculation & Example of Fund Usage

Balanced scheme example (50/30/20):

Needs (Rp. 2,000,000):

Rent/contract: Rp. 800,000

Eating & monthly expenses: Rp700.000

Transport & credit/internet: Rp. 300,000

Bills/others: Rp. 200,000

Wish (Rp. 1,200,000):

Eating out/entertainment: Rp. 500,000

Gadget shopping/skin: Rp. 300,000

Small/variable emergency fund: Rp. 400,000

Savings & Investment (Rp800,000):

Monthly emergency fund (target 3–6 months) => save IDR 400,000 in liquid savings

Long-term investment => Rp. 250,000 (e.g. mutual funds / stocks)

High-risk investments (e.g. crypto — only if you are willing to take the risk) => Rp150,000 (e.g. BTC via Bittime)

Note: The above breakdown is just an example. The allocation of each item should be tailored to your actual needs.

Practical Tips for Smooth Allocation

Auto debit & earmark: set automatic transfer to savings/investment account every payday.

Record the withdrawal: use a note-taking app to see spending patterns.

Reduce fixed costs: look for cheaper boarding houses, cook for yourself, or use economical transportation.

Increase income: look for a side job or freelance so that investment allocation can be increased.

Conduct a monthly review: adjust the budget every month (for example, if there are new installments).

READ ALSO: Gold Price Prediction 2026: Goldman Sachs Optimistic, Is It Worth Buying Now?

Conclusion

Managing a salary of IDR 4 million is not a matter of “enough or not”, but rather a matter ofpriority and consistencyThe 50/30/20 plan is a good starting point; if you want to accelerate asset accumulation, shift the savings/investment portion to 30% (Grow plan). Don't forget to set up an emergency fund before investing in risky instruments like stocks or crypto.

How to Buy Crypto on Bittime

Want to trade sell buy BitcoinsLooking for easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDRand other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visitBittime Blogto get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

Is the 50/30/20 method suitable for everyone?

It's a good starting point, but needs to be adjusted to your needs and cost of living location.

How much is the ideal emergency fund?

3–6 times monthly expenses are considered ideal, start with a small target and then increase it.

Can you invest in crypto with a salary of IDR 4 million?

Yes, but allocate only a small portion of your investment and understand the risks.

What if the salary has to support the family?

The allocation changes: prioritize needs and installments, then conservatively allocate the remainder for savings & investments.

What is the first step if you want to save regularly?

Activate auto-debit or automatic transfer to your savings/investment account immediately after payday.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.