Solana: Institutional Adoption & Yield Farming Trends 2025

2025-10-27

In the rapidly evolving world of blockchain, Solana has emerged as one of the most talked-about projects, and for good reason.

As we approach 2025, Solana's adoption by institutional players and the growing trend of yield farming on the platform will determine its promising future.

But what exactly is driving this momentum, and how can investors, traders, and crypto enthusiasts make sense of it all?

Solana's advantages in transaction speed, low fees, and scalability have made it an attractive choice for institutions looking to leverage blockchain for decentralized finance (DeFi) solutions.

On the other hand, the trend of yield farming, where investors lock up their crypto to earn returns, is growing within the Solana ecosystem.

Read also: Founder Prepares Solana DEX Percolator: What Is It?

Solana and Institutional Adoption: Why Big Players Are Taking Notice

Solana's Appeal to Institutions

By 2025, Solana has become a popular choice among institutions for several reasons. Its reputation for high throughput and low transaction fees sets it apart from other platforms such as Ethereum.

Its ability to process thousands of transactions per second at minimal cost makes Solana highly attractive to institutions looking to scale decentralized applications (dApps) or manage large transaction volumes efficiently.

However, Solana's appeal extends beyond speed and cost. The rapidly growing DeFi ecosystem on Solana has attracted institutional players.

Investment firms, hedge funds, and other entities seeking to participate in yield farming and liquidity provision.

These institutions see potential for staking and liquidity mining on Solana, which offers opportunities to earn returns by contributing to the network's liquidity and security.

The Solana Foundation continues to drive wider adoption among institutional investors, creating a bridge between traditional finance and decentralized finance (DeFi).

In addition, enterprise-grade solutions are now being built on the Solana blockchain, further cementing its role as the platform of choice for large projects and partnerships.

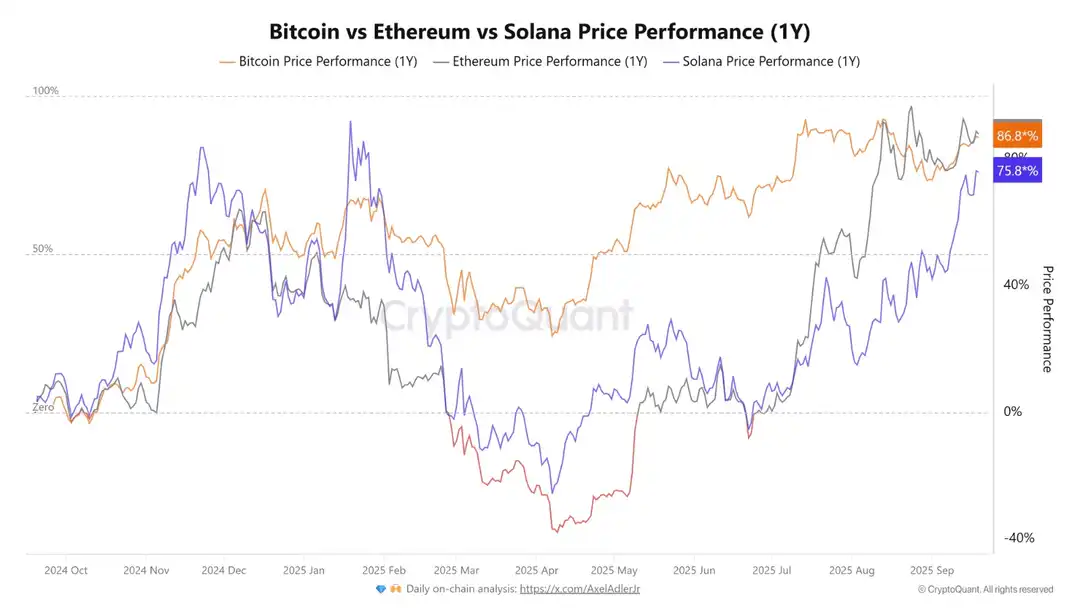

- BTC/ETH: Correlation of 0.57, indicating that macro forces are driving both simultaneously.

- BTC/SOL: Correlation of 0.40, reflecting Solana's independence through network catalysts (e.g., memecoin surges, updates).

- ETH/SOL: Correlation of 0.76, driven by overlapping DeFi demand.

For most of 2025, BTC and ETH moved almost in lockstep (96–100% correlation).

Solana experienced a sharp move in February, rising +80% compared to the moderate gains of BTC/ETH, proving how catalysts create tactical opportunities for SOL positions.

Institutional Yield Farming Trend

In the world of DeFi, yield farming has become a significant strategy for institutional investors. Yield farming involves locking assets in liquidity pools to earn returns.

The Solana ecosystem is increasingly becoming a hub for yield farming due to its low transaction costs and high transaction speeds. This makes it an ideal environment for institutional yield farming, where large-scale transactions are essential.

By utilizing its proof-of-history (PoH) mechanism and high scalability, Solana enables institutions to deploy capital in yield farming strategies with relatively low risk.

As Solana continues to evolve, institutional players will have greater ability to deploy capital into decentralized applications (dApps), farm tokens, and earn yields.

List of factors driving institutional adoption on Solana:

- Fast transactions and low fees make Solana attractive for large transactions.

- A growing DeFi ecosystem creates more yield farming opportunities.

- Solana's scalable infrastructure supports enterprise-level solutions.

- The proof-of-history (PoH) mechanism provides secure and efficient consensus.

- Solana's institutional adoption is in line with the push towards decentralized finance.

Read also: Solana Price Prediction October 2025: Can It Break $260?

Memecoins on Solana: A New Trend in the Crypto World

The Rise of Solana-Based Memecoins

In 2025, the Solana ecosystem continues to evolve in unexpected ways, particularly with the emergence of memecoins.

These lightweight, community-driven tokens are now gaining serious attention. Solana memecoins have emerged as a subset of the Solana ecosystem, attracting interest from both casual investors and serious crypto enthusiasts.

Memecoins have long been part of the crypto community, thanks to projects like Dogecoin and Shiba Inu, which gained mass attention despite offering little more than humor and community engagement.

Solana takes this trend to the next level by enabling the creation of memecoins that have real utility within its ecosystem, driving trading volume and adoption.

These tokens, while often purely for entertainment, benefit from Solana's speed and scalability, enabling faster transactions and lower fees compared to their Ethereum-based counterparts.

Solana's memecoin trend has contributed to an ecosystem diversity that allows serious DeFi projects and fun tokens to coexist.

Memecoins built on the Solana blockchain prove that they are not just for entertainment; they are part of a broader adoption trend that demonstrates the platform's flexibility.

Read also: When is Meteora (MET) TGE? Here's the Schedule and Important Facts for October 2025

Yield Farming on Solana: How to Participate and Maximize Returns

The Basics of Yield Farming on Solana

Yield farming on Solana is increasingly becoming an opportunity sought after by retail and institutional investors. By locking up Solana-based assets, users can earn returns through staking, providing liquidity, or lending.

Solana DeFi protocols, such as Raydium, Saber, and Serum, are quickly becoming popular destinations for yield farming, offering attractive annual percentage yields (APY).

One of the biggest advantages of yield farming on Solana is its low transaction fees, which allow both small and large investors to participate without facing the high gas fees that characterize other blockchains, especially Ethereum.

In addition, Solana's transaction speed allows yield farmers to move in and out of liquidity pools quickly, increasing their ability to capitalize on opportunities.

How Institutions Are Using Solana for Yield Farming

Institutions are increasingly attracted to Solana's yield farming opportunities, particularly for its institutional farming capabilities.

Smart contracts on Solana allow institutions to deploy capital in liquidity pools while earning passive income.

In addition, institutions are attracted to the platform's security and scalability, which ensures that large amounts of capital can be moved without concerns about delays or high costs.

With the growing popularity of institutional yield farming, Solana continues to evolve into a top-tier blockchain for enterprise and DeFi applications.

As the platform grows, we are likely to see more institutional players entering the Solana ecosystem, bringing more capital, liquidity, and innovation to the network.

Read also: PumpFun Solana Narrative: Mechanism, List of Featured Tokens, and Risks for Investors

Bittime: A Secure Crypto Trading Platform

While Solana is making waves in the yield farming space, it's important for investors to use a reliable platform to trade and manage their assets. Bittime is an example of a secure and easy-to-use crypto trading platform that supports a wide range of assets, including Solana-based tokens and other popular cryptocurrencies.

With Bittime, you can trade Solana-based tokens and participate in yield farming with a secure and intuitive interface.

The platform provides two-factor authentication (2FA) and cold storage solutions to keep your investments safe. Open a Bittime account today and enjoy a secure trading experience.

Conclusion: The Future of Solana in 2025

Solana's growth in 2025 looks promising. Its ability to support institutional adoption and the rapidly growing yield farming trend is driving significant changes in the crypto landscape.

As more institutions realize the benefits of Solana's transaction speed and low fees, the platform is expected to remain a dominant player in the blockchain space.

Additionally, the rise of memecoins and the increasing number of institutional farming opportunities on Solana are helping to draw more attention to the platform.

With such tremendous momentum, Solana's future looks bright. Whether you're an institution looking to maximize returns through yield farming or a trader exploring the fun side of Solana memecoins, this platform offers something for everyone.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is institutional adoption on Solana?

Solana's institutional adoption occurs when major players in the financial world begin to utilize the platform for DeFi applications and yield farming strategies.

How can I participate in yield farming on Solana?

You can participate in yield farming by locking Solana-based assets in liquidity pools or staking in DeFi protocols such as Raydium or Saber.

What makes memecoins on Solana attractive?

Transaction speed and low fees make Solana an ideal place for memecoin projects, allowing them to function more efficiently than on other platforms.

Is Solana good for institutional farming?

Yes, Solana offers attractive yield farming for institutions thanks to the platform's scalability and security, which support large-volume transactions at low cost.

What is Bittime and how is it related to Solana?

Bittime is a secure crypto trading platform that allows users to trade Solana-based tokens and participate in yield farming with an easy-to-use interface.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.