AUSD Agora Finance Price Prediction

2025-10-30

Looking for “AUSD Agora Finance price prediction”? Let's discuss it here in a relaxed manner. AUSD from Agora Finance is a stablecoin. This means that its ideal price is always very close to $1 USD.

So unlike crypto coins that can rise 30 percent one day and then fall 40 percent the next, AUSD is designed to be stable. The goal of AUSD is stability, not price speculation.

Read also: AsetQU Price Prediction 2025 - 2030: Long-Term Analysis of Its Prospects.

What is AUSD Agora Finance and Why is the AUSD Price Stable

AUSD Agora Finance is a digital stablecoin pegged 1:1 to the US dollar. Each 1 AUSD should be equivalent to approximately 1 USD. Why is that? Because AUSD is 100 percent backed by real asset reserves.

These reserves consist of cash, overnight repo agreements, reverse repos, and short-term US Treasury securities that are professionally managed.

These reserves are held by large institutional custodians and managed by experienced asset managers. This model gives the market confidence that AUSD really has a “backup.”

Therefore, the main goal of AUSD is not to “rise high,” but to “stay at $1.” So when we talk about the price prediction of AUSD Agora Finance, the context is not the potential for a moonshot like a meme coin, but how well AUSD can maintain its price close to $1.

Simply put:

- AUSD = a stable on-chain store of value.

- The goal of AUSD = to become the blockchain version of the dollar.

- Not an aggressive speculative instrument.

Read also: What is Edena (EDENA)? How it Works, Price Predictions, and How to Buy

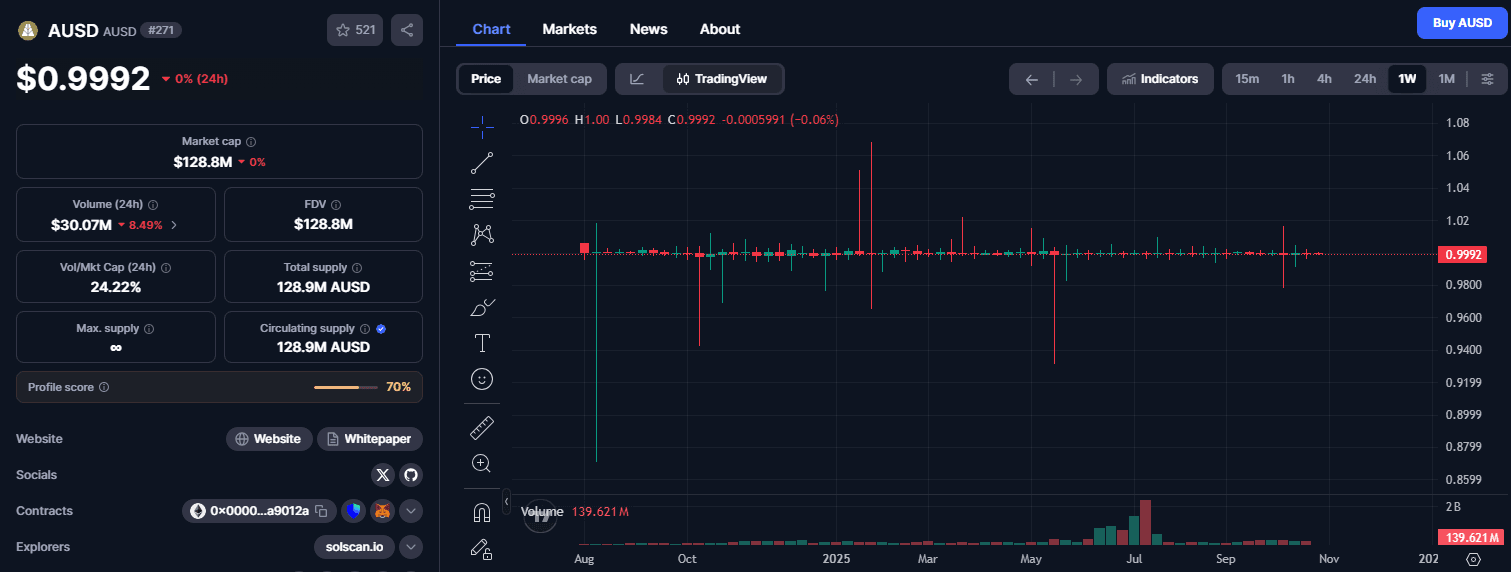

Current AUSD Price Conditions

Currently, the AUSD price is in the range of $0.9992 to $1.0000. This means it is only a fraction of a percent away from $1. This range is considered healthy for a stablecoin and indicates that its price support mechanism is functioning as intended.

Some key points about the current price conditions:

- AUSD has consistently remained around one dollar since its launch.

- Daily price movements tend to be very small.

- Prices that are too far from $1 are usually seen by the market as a sign of liquidity pressure or panic selling, so normally the market will push back towards $1.

So, for users looking for value stability in the crypto ecosystem, this figure is good news. This is what traders look for when they need a temporary parking spot in the form of a stable asset when the market is volatile.

Read also: Palapa (PLPA) Price Prediction 2025: Is Bittime's Local Token Ready for a New Uptrend?

AUSD Short-Term Price Prediction

For short-term predictions, a projection model assuming annual growth of around 5 percent indicates that AUSD will remain close to $1 USD. For example:

- October 28, 2025: $0.9992

- October 29, 2025: $0.9993

- November 4, 2025: $1.0001585

- November 27, 2025: $1.003314

What does this mean?

- Small fluctuations are still possible. For example, moving from $0.999 to $1.003 is still considered reasonable because the global crypto market is not always perfect.

- However, so far there are no signs that AUSD will move wildly like regular altcoins.

So for the weekly to monthly period, the Agora Finance AUSD price prediction remains around one dollar. This is consistent with the design goal of AUSD as a stablecoin.

Read also: What is Aspecta ASP and its Price Prediction?

Long-Term AUSD Price Prediction

This section often sparks curiosity. People often ask: “If I hold AUSD for years, can its price increase exponentially like other cryptocurrencies?”

Let's look at some long-term projections based on assumptions of gradual growth:

- 2025: around $0.999

- 2026: around $1.0492

- 2027: around $1.1017

- 2028: around $1.1568

- 2029: around $1.2146

- 2030: around $1.2753

- 2040: around $2.0774

- 2050: around $3.3839

However, it is important to note that long-term figures such as 2040 and 2050 do not mean that AUSD “will pump 200 percent.”

These figures are usually projections based on dollar inflation scenarios and assumptions of very long-term purchasing power, not projections that stablecoins will move freely as they please.

Practically speaking:

- In the short and medium term, AUSD is expected to remain in the $1 range.

- Price projections decades into the future are more theoretical models than promises of price increases.

- If AUSD were to actually rise to $2 or $3 per token without redenomination, it would mean that AUSD has ceased to function as a stablecoin. That is not a normal scenario.

So for daily investors, the realistic benchmark remains $1.

Read also: Turtle (TURTLE) Price Prediction: Complete & Long-Term Analysis

Key Factors Affecting the Price of AUSD

Although stable, that doesn't mean AUSD is immune to market pressures. Here are the factors that can affect the price of AUSD Agora Finance:

- Confidence in asset reserves

- If the market believes that AUSD reserves are secure, transparent, and sufficiently liquid, the price will remain stable.

- If doubts arise about the reserves or fund management, people may panic and sell off AUSD, causing the price to temporarily drop slightly below $1.

- Global crypto market conditions

- When the crypto market experiences major shocks, stablecoins can sometimes move temporarily below or above $1 due to extreme buying and selling pressure.

- Demand and adoption

- The more people use AUSD for trading, payments, DeFi, and cross-chain transfers, the stronger its liquidity becomes. Strong liquidity tends to keep the price close to $1.

- Regulation

- Stablecoins are under scrutiny by regulators in various countries. Regulatory changes can affect access, exchange listings, and risk perception.

- Technical Mechanism

- AUSD is built with efficient smart contracts and runs on a Proof of Stake network that is gas-efficient. Low transaction fees encourage usage. Healthy usage typically helps stability.

In short, market confidence + liquidity + regulatory clarity = price stability.

Read also: PI Coin Price Rally, Here's the Next Pi Network Price Prediction

Security Notes and Bittime's Role for Indonesian Users

For Indonesian users who want to hold stable assets such as AUSD, there are two important questions: “Is it safe?” and “Where to buy?”

The short answer: use a platform that is credible, legal, and has user protection.

In Indonesia, one option to consider is Bittime. Bittime offers a crypto trading experience with a focus on user security, a beginner-friendly interface, and a clear Rupiah deposit process.

For those of you who want to start exporting stable assets such as AUSD without complicated technical drama, the general recommended steps are:

- Open an account on a trusted platform such as Bittime

- Deposit Rupiah

- Start allocating part of your portfolio to stable assets as a risk balancer

If you want to try to reduce the risk of wild crypto market volatility, you can start with stable assets.

Start your crypto journey safely. Register, deposit, and trade comfortably on Bittime.

Important Things to Consider Before Holding AUSD

Here are some things you should consider before deciding to hold AUSD:

- AUSD is not a get-rich-quick instrument

- AUSD is designed for stability. If you're looking for aggressive price increases, AUSD is not the type of asset for you.

- AUSD is suitable for value parking

- Many traders use stablecoins like AUSD to take a break from volatility. For example, when Bitcoin drops sharply, they temporarily move to stable assets.

- AUSD is suitable for cross-chain value transfers

- Since AUSD is available on several popular blockchain networks, sending funds between wallets can be more efficient.

- Risks remain

- There are always technical risks associated with smart contracts, exchange risks, and policy risks. So never consider crypto assets, including stablecoins, as risk-free.

- Transaction documentation

- Keep proof of deposits, purchases, and wallet addresses. This will be useful if you need clarification from the exchange.

With this mindset, you will be better prepared to use AUSD as a tool for stability, not as a ticket to speculation.

Conclusion

Agora Finance's AUSD price prediction should be read in the context that AUSD is a stablecoin. The current price of AUSD is around $0.999 to $1.000, and its design goal is to stay as close to $1 USD as possible.

Short-term projections show nearly flat daily movements. Long-term projections that appear to be “upward” usually come from theoretical models, not market expectations that AUSD will suddenly become a speculative asset.

In summary:

- AUSD is suitable for value stability, calmer trading, and on-chain fund parking.

- AUSD is less suitable for those expecting prices to multiply.

- Risks remain.

- Use a secure trading platform like Bittime, deposit Rupiah through official channels, and ensure you understand what you are purchasing.

With a cautious approach, AUSD can be a healthy part of your crypto risk management strategy.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

Can AUSD rise above $1?

By design, AUSD aims to remain around $1. If it stays significantly above $1 for an extended period, it signals market imbalance. Therefore, it is not designed to rise sharply under normal circumstances.

Why does the AUSD price forecast appear flat?

Because AUSD is a stablecoin pegged 1:1 to the USD. Its primary goal is not price growth but value stability.

What factors could cause AUSD to fall below $1?

Typically, extreme market pressure, loss of confidence in asset reserves, or a massive sell-off. However, as long as reserves are strong and liquidity is available, the price usually returns to near $1.

Is AUSD suitable for long-term investment?

AUSD is more suitable as a stable store of value and a risk hedging tool. If you are looking for significant upside potential, AUSD is not the right choice. But if you want stability in your crypto portfolio, AUSD is relevant.

How do I start holding AUSD safely?

Register on a trusted trading platform such as Bittime, make a deposit in Rupiah, buy stable assets, activate account security such as 2FA, and keep a record of your transactions.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.