Bitcoin Difficulty Will Drop in 2026, What Impact Will This Have on Miners?

2026-01-11

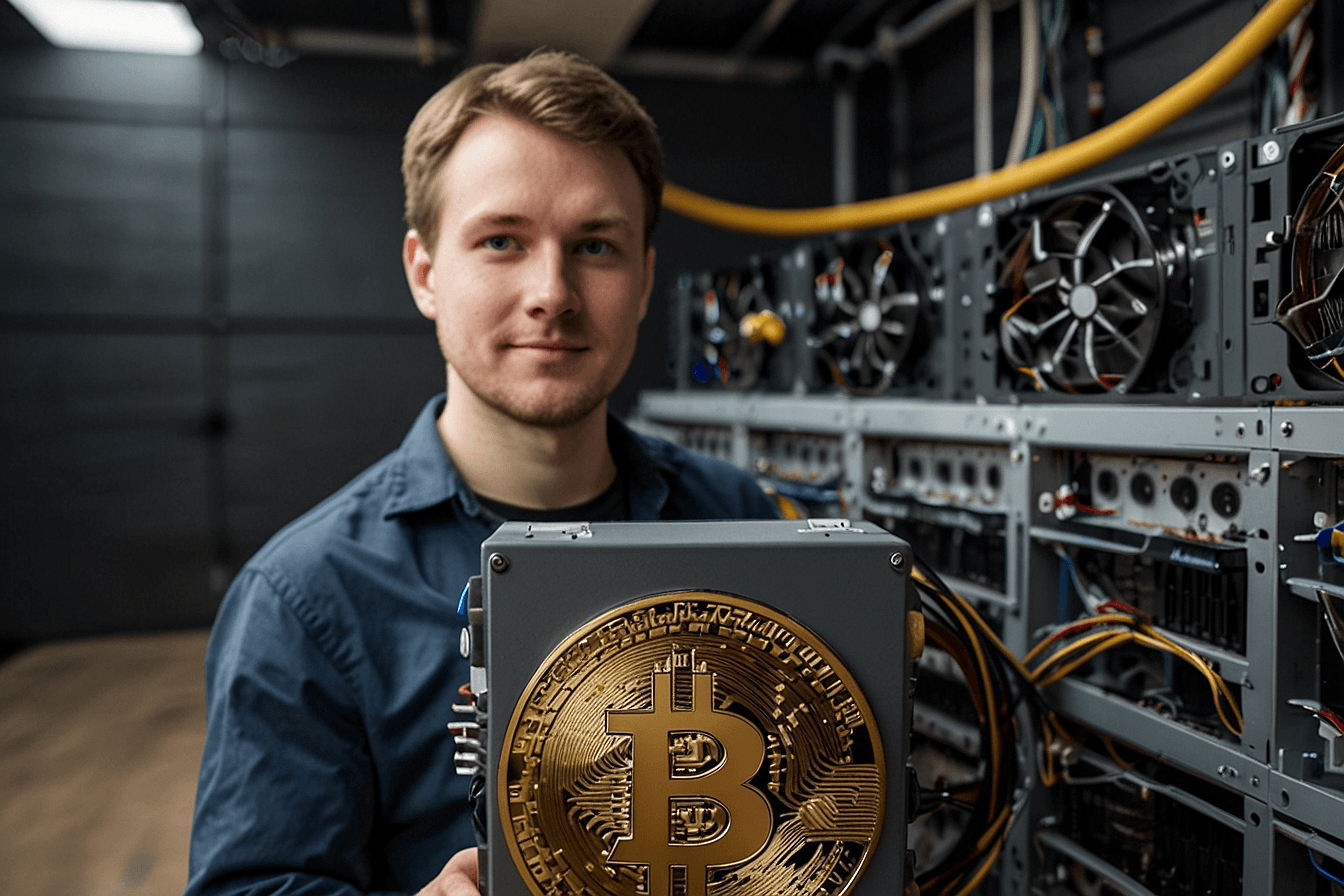

The beginning of 2026 began with a significant event in the Bitcoin network. For the first time this year, Bitcoin's difficulty decreased. To some, this term sounds technical.

However, for miners and crypto market participants, changes in difficulty have a real impact on profitability, network stability, and even Bitcoin's future price movements.

What Is Bitcoin Difficulty and Why It Could Drop

Bitcoin difficulty is an automated mechanism that regulates the difficulty of mining new blocks. Its goal is simple: to maintain a Bitcoin block creation rate of approximately every ten minutes. Difficulty adjustments are made periodically based on changes in the total computing power, or hashrate, on the network.

When many miners are active and the hashrate is high, the difficulty will rise. Conversely, when some miners stop or reduce activity, the hashrate drops, and the difficulty will adjust accordingly. This is what happened in early 2026.

Several factors contributed to this decline. Mining operational costs increased in some regions. High electricity prices led some less efficient miners to shut down their machines. Furthermore, the consolidation of the mining industry following the previous cycle also reduced the number of small players on the network.

This Bitcoin difficulty adjustment actually demonstrates that the network is working as designed. Bitcoin doesn't rely on a single entity. It automatically adapts to market conditions and miner activity. From a technical perspective, a difficulty drop isn't a sign of network weakness, but rather a rebalance.

Read also:Bitcoin to Rise in 2026: Rumors of Venezuela's "Shadow Reserve"

Impact of Difficulty Reduction on Bitcoin Miners 2026

For active miners, the difficulty reduction has an immediate impact. With lower difficulty, the chance of finding a block increases using the same computing power. This means increased potential earnings, especially for miners who persist during difficult periods.

However, the impact is not uniform. Miners with older, low-efficiency machines continue to face challenges. Conversely, miners using modern equipment and low electricity costs actually experience greater profits.

Main Impacts for Miners

- The chance of finding a block increases

- The cost per Bitcoin mined is lower

- Short-term profit margins improve

- Small miners have a chance to become active again

On the other hand, a decrease in difficulty can also attract new miners. If the hashrate rises again, the difficulty will adjust again. This means this condition is dynamic and not permanent.

For the mining industry as a whole, this phase is often considered a transitional period. Efficient miners survive and strengthen their positions, while the industry structure becomes healthier.

Read also:January 2026 Red Dates and Crypto Market Movements

Bitcoin Hashrate, Network, and Stability in 2026

Bitcoin's hashrate is a crucial indicator of network health. Even when the difficulty drops, the network continues to operate normally. Blocks continue to be produced on schedule, and network security remains intact.

A temporary drop in hashrate doesn't automatically weaken Bitcoin. Instead, the difficulty adjustment mechanism ensures that the network remains stable despite significant changes in miner participation.

In the context of the Bitcoin network in 2026, this adjustment demonstrates the system's flexibility. The network doesn't force miners to persist in unfavorable conditions. Instead, it adapts to keep mining economically attractive.

This condition is also often associated with a price bottom. In previous cycles, miner pressure and difficulty drops have often occurred near market bottoms.

Notes for Crypto Market Players

For traders and investors who want to take advantage of market momentum safely, Bittime provides a crypto trading platform that focuses on security and convenience.

Start trading crypto on Bittime and manage digital assets with more confidence.

Read also:Bitcoin Price Prediction 2026: Bullish or Bearish?

Bitcoin Price Movement and Predictions After Difficulty Drop

Historically, difficulty drops often occur when Bitcoin's price is in a consolidation or correction phase. Miner pressure typically arises when the price drops or stagnates while fees remain high.

However, in the medium to long term, this condition often serves as the foundation for recovery. When inefficient miners leave, the supply of mining products tends to decrease. If demand stabilizes or increases, prices have the potential to strengthen.

Bitcoin price predictions after the difficulty drop are uncertain. However, many analysts view this phase as part of a healthy cycle. In a moderate scenario, Bitcoin's price could potentially stabilize before resuming its upward trend when macroeconomic conditions improve.

Long-term investors typically view these signals as structural indicators, not as short-term trading triggers. Their focus is on the balance of supply and demand, not daily fluctuations.

Conclusion

The decline in Bitcoin difficulty in 2026 is not just a technical figure. It reflects the real state of the mining industry and the Bitcoin network's ability to adapt. For miners, this opens up opportunities to improve profitability. For the network, it maintains stability. And for investors, it is a crucial signal for a more comprehensive understanding of Bitcoin's market cycles.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is Bitcoin difficulty

Difficulty is the level of difficulty of mining Bitcoin blocks.

Why Bitcoin difficulty could drop

Because the network hashrate decreases due to reduced miner activity.

Is decreasing difficulty dangerous?

No. This is a normal mechanism to maintain network stability.

Do miners benefit?

Efficient miners tend to profit in the short term.

Does this affect the price of Bitcoin?

Indirectly, it can influence market sentiment and supply.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.