What is Semantic Layer (42)? Tokenomics and Price Analysis

2025-10-28

Semantic Layer (42) introduces a unique concept calledApplication-Controlled Execution (ACE), which allows dApps to have full control over how transactions are executed.

So, what is the Semantic Layer (42), what are its tokenomics, and why has the 42 token price seen a sharp decline recently? Let's dive deeper!

What is Semantic Layer (42)?

Semantic Layer (42) is a blockchain infrastructure protocol that functions as an execution layer between dApps and the main blockchain.

This means that the protocol allows dApps to control how user transactions are executed, without relying entirely on validators or block builders from the main network.

With the mechanismApplication-Controlled Execution (ACE), Semantic Layer paves the way for dApps to:

1. Internalizing MEV (Miner Extractable Value): dApps can take advantage of transactions such as backrunning or auctioning search rights to external parties.

2. Improving Scalability: Transactions can be collected and processed online off-chain first, then solved in the formbatch on the main blockchain.

3. Implementing Custom Execution: For example, giving priority to cancellation transactions or merging settlements.

4. Integration with Co-processor: Allows data from external services such as oracles to be included directly into transactions, even if those services are not on the main chain.

This approach makes Semantic Layer (42) an efficient solution for dApps that require high speed without sacrificing security or on-chain interoperability.

Read Also: What is Common Protocol (COMMON)? Features, Tokenomics, and Pricing

Tokenomics of Semantic Layer (42)

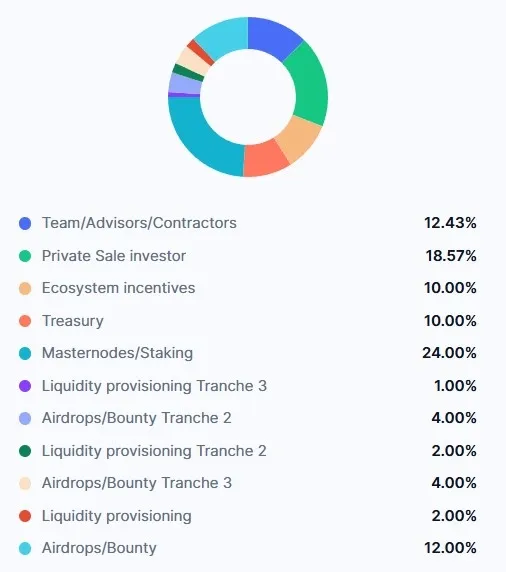

Distribusi token Semantic Layer (42)quite diverse and shows a balance between team contributions, investors, and community incentives.

Here are the details of the $42 token distribution:

This token distribution shows that Semantic Layer (42) is focused on community growth and long-term participation, while ensuring liquidity reserves to maintain market stability.

Read Also: What is Velo (VELO)? Roadmap, Tokenomics, and Pricing

Semantic Layer (42) Price Today

Based on the latest graph, Semantic Layer (42) token price experienced a significant decline in the last 24 hours.

The price had opened at around $0.215, then went down to $0.16at the end of the trading session. This downward trend indicates strong selling pressure following the token launch phase.

Read Also: What is Palapa Token (PLPA) from Bittime Platform?

Semantic Layer (42) Price Analysis

LSo, why did the price of the $42 token drop drastically? The following are a Semantic Layer (42) price analysis:

1. Post-Airdrop Selloff (Dampak Bearish)

Token 42officially launchedon October 27, 2025. Every participant who has a minimum of 210 Alpha Points is entitled to receive 200 42 tokens.

Within 24 hours, trading volume surged by more than 14 million percent until it reaches $66.7 million, showing that many airdrop recipients immediately sold their tokens.

This phenomenon is common in the crypto market, many short-term investors want to quickly cash in on their free tokens.

2. Low Liquidity Causes Volatility

Even though the turnover ratio reached 422.68(showing high volume compared to market capitalization), total liquidity is still relatively thin.

With a capitalization of around $24.9 million, the market is unable to absorb significant selling pressure without significant price impact. This is why even a few transactions can cause a price drop of up to45%.

3. Neutral Market Sentiment

Fear & Greed Crypto Index at 42/100, which indicates that market sentiment remains neutral. At the same time, Bitcoin's dominance has risen to 59.15%, causing many investors to turn to more stable assets.

As a result, tokens like 42 have been impacted by reduced liquidity as investor funds have shifted to BTC and stablecoins.

Read Also: What is Holoworld AI (HOLO)? AI Technology Ready to List on Bittime

Conclusion

Semantic Layer (42) bringing major innovations in the blockchain world with the concept Application-Controlled Execution (ACE) which allows dApps to have more control over their transactions.

However, like many new projects, Token 42 also experienced post-launch challenges, mainly due to selling pressure from airdrops and a lack of initial liquidity.

Going forward, 42's potential will depend heavily on how quickly its ecosystem grows, as well as whether the project can attract major dApp integrations to utilize its infrastructure.

If successful, the Semantic Layer (42) could be a crucial foundation for a more efficient and autonomous future of dApps.

How to Buy Crypto on Bittime

Want to trade sell and buy Bitcoins and easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is the main function of the Semantic Layer (42)?

Its main function is to give dApps direct control over how transactions are executed without relying on the main blockchain validator.

Why did the price of 42 drop drastically after launch?

The decrease is due topost-airdrop selloff,Many recipients of free tokens sold their assets immediately after launch.

What is the total supply of 42 tokens?

The maximum total supply has not been confirmed, but most of it is allocated to staking, the community, investors, and the development team.

Is the 42 token already tradable on major exchanges?

Token 42 was first distributed on October 27, 2025, but for spot trading on major exchanges it is still limited to the innovation zone.

Does Semantic Layer (42) have long-term prospects?

Yes, if this project manages to attract large dApps to build on its infrastructure, then 42 has the potential to become a vital part of the Web3 ecosystem in the future.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.