What Is Momentum (MMT)? Its Development and Roadmap

2025-11-05

Bittime - Momentum (MMT) has seen a significant price increase in the past 24 hours, reaching 255%. So, what is Momentum (MMT)? It's a platform with a grand vision of creating a "financial operating system" for the tokenization era.

Through ecosystem development on the Sui Network and cross-chain expansion plans, Momentum aims to bridge the gap between crypto and real-world assets. This article provides a comprehensive understanding of Momentum (MMT). Stay tuned!

What is Momentum (MMT)?

Momentum (MMT) is a DeFi project designed as a central liquidity engine for the Move ecosystem, particularly on the Move ecosystem on Sui Network.

The goal is to enable seamless trading of both crypto assets and real-world assets within a single platform.

The project combines core products such as DEX (decentralized exchange), liquid staking, vault, and treasury infrastructure to deliver a robust experience for both retail and institutional users.

In other words, when you ask “what is Momentum (MMT)?” the answer is a DeFi ecosystem that seeks to expand the scope of decentralized finance to all assets, not just traditional crypto tokens, but also real-world securities, commodities, and even real estate.

Momentum positions itself as a bridge between blockchain, liquidity, and asset tokenization.

Read also: What is DeAgentAI (AIA)? An AI Token Now Available on Bittime!

How Momentum Works

Momentum works by building several key interconnected infrastructure pillars:

Dexnya (Momentum DEX):

A decentralized exchange platform that uses the Uniswap v3-style liquidity concentration model (CLMM), but is specifically built for the Move and Sui Network networks.

This allows liquidity providers to choose a specific price range for their capital, resulting in higher capital efficiency and reduced slippage.

Liquid staking (xSUI):

Momentum provides liquid staking services for SUI tokens. When you stake SUI, you earn yield tokens (e.g., xSUI), which can be used in DeFi activities such as providing liquidity or as collateral.

This allows capital to remain active while supporting the security of the Sui network.

Treasury & MSafe:

The cash management and token vesting infrastructure for teams and investors is built through MSafe, a multi-signature (multi-sig) wallet aimed at institutional group management and protocol developers.

Real-world asset tokenization (RWA):

In the next phase, Momentum plans to expand to real-world assets such as property, commodities, and securities. This means that previously "off-chain" assets can be represented as tokens and traded on the same platform as crypto tokens.

With this combination of pillars, Momentum offers a working model that allows users, both retail and institutional, to participate in a broader and more flexible DeFi ecosystem.

Momentum Key Features

The Momentum Project is equipped with a number of key features designed to provide an advantage:

Uniform liquidity and low costs: Through the CLMM model, Momentum allows liquidity providers to select specific price ranges, allowing for more efficient use of capital and transactions with tighter spreads.

Cross-chain interoperability: With integrations through protocols like Wormhole, Momentum aims to support trading of tokens from a variety of blockchains, not just those built on Sui Network.

Staking and additional utilities (liquid staking): Features like xSUI allow users to maintain liquidity while staking, meaning capital isn't “locked up” without yield.

Tokenization of real-world assets and institutional access: Momentum is preparing an integrated digital identity (KYC/AML) compliance system to enable larger institutions and users to participate in the asset tokenization market.

Governance and community participation: The MMT token will allow token holders to participate in protocol decisions (governance) and gain early access to new products in the ecosystem.

With these features, Momentum strives to provide a more comprehensive and global experience than many other DeFi projects that focus solely on simple token swaps.

Read also: What Is Portal to Bitcoin (PTB)? A Bitcoin-Ethereum Cross-Chain Token on Bittime

About MMT Token

The primary token in this ecosystem is the MMT Token (ticker: MMT). This token serves several important roles: as a governance tool, a community incentive, and a link for the entire Momentum ecosystem.

Some key points:

The total supply of MMT tokens is set at 1 billion (1,000,000,000) MMT.

In the Token Generation Event (TGE), the initial circulating supply is approximately 204.095.424 MMT (≈20.41% of total).

The MMT token is not intended as a security or guarantee of profit, but rather as a utility within the Momentum ecosystem.

Thus, the MMT token is a token that supports the Momentum ecosystem. It's not just a speculative asset, but rather part of the participation and development structure.

MMT Token Tokenomics

MMT's tokenomics are designed to ensure sustainable ecosystem growth while ensuring fair distribution and control over token circulation. Here's a summary of the tokenomics:

Total supply: 1 000 000 000 MMT.

Initial circulating: ≈ 204,095,424 MMT (~20.41%) during TGE.

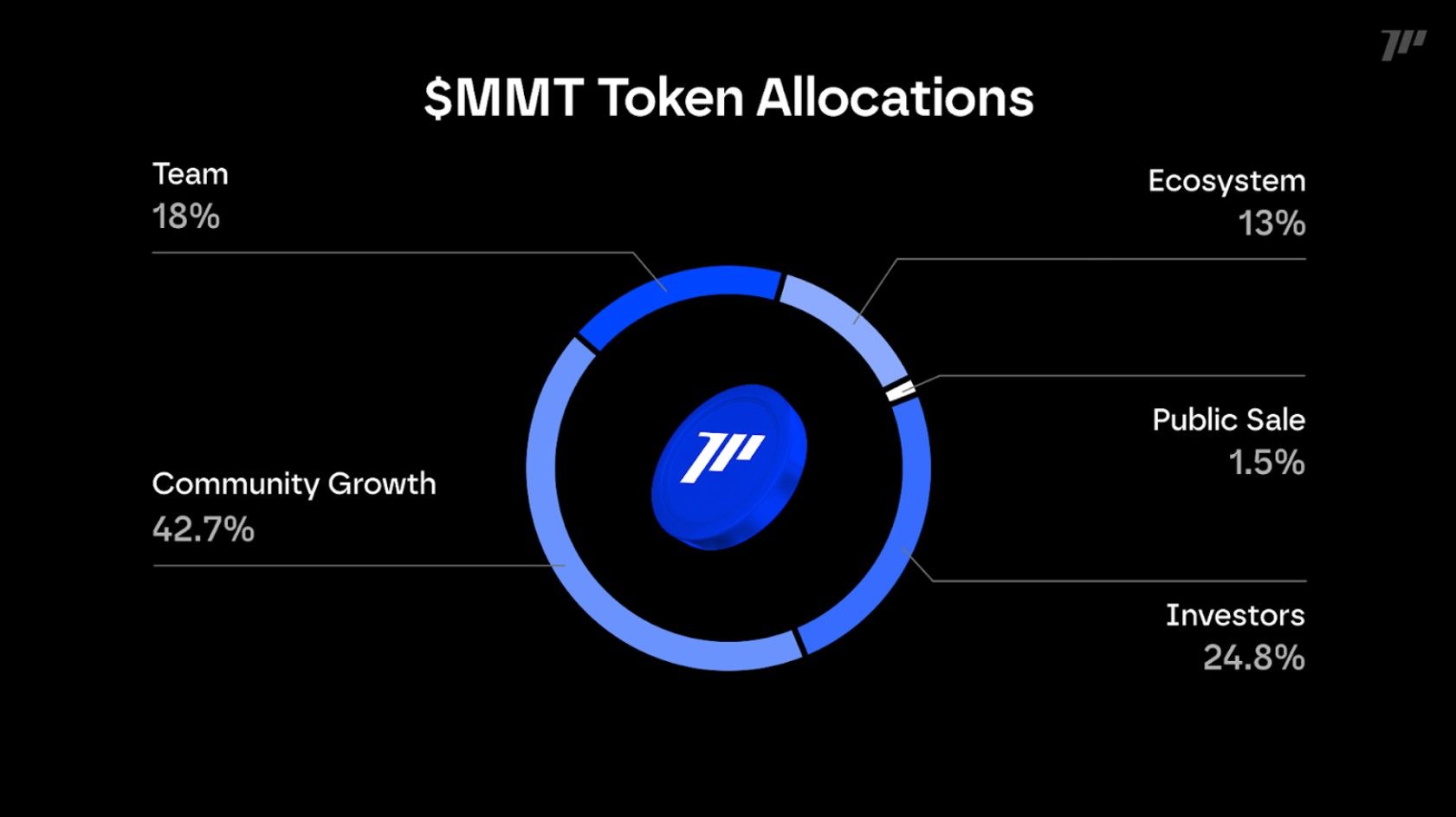

Distribution allocation:

Community Growth around 42.72%: for liquidity incentives, user participation, adoption.

Ecosystem around 13%: for developers, builders, hackathons, technical incentives.

Investors & Early Supporters around 24.78%: early team and early investors, with a strict vesting schedule.

Public Sale around 1.5%: for eligible communities, unlocked during TGE.

Team around 18%: for the core team, with a cliff or lock-in schedule of up to 4 years.

This tokenomics design shows that Momentum is trying to avoid too rapid distribution that could cause selling pressure (dump) and instead focuses on long-term growth.

MMT Token Utility

Some of the uses of MMT tokens in the ecosystem are as follows:

Governance (ecosystem management): MMT holders can bond into the veMMT (vote-escrow) model, the more MMT they lock and the longer the lock duration, the greater the voting rights or benefits they receive.

Community incentives and rewards: Users who provide liquidity, trade, stake, or participate in ecosystem activities can earn rewards in the form of MMT or other benefits.

Priority access to new products: veMMT holders have the potential to gain early access to new vaults, project launches through the Token Generation Lab (TGL), or beta features of the Momentum ecosystem.

Participation in asset tokenization and cross-chain DeFi: As Momentum plans to facilitate the tokenization of real-world assets and cross-chain integration, MMT will play a key role as an “access key” to the ecosystem.

In short, MMT's utility is not just as a speculative token, but as a means of participation in a larger, functional ecosystem.

Read also: What is IDIA Token? Impossible Finance Launchpad

Momentum Roadmap Details

The Momentum project roadmap is divided into three major sequential phases:

Phase One: Establishment in Sui Network

Main focus: building a foundation on the Sui network with the launch of Momentum DEX as the main liquidity engine.

Initial product launches such as xSUI liquid staking and MSafe as security infrastructure for agencies.

Launch of Token Generation Lab (TGL) as a launchpad for bluechip projects in the ecosystem.

Phase Two: Cross-Chain Expansion

Provides support for assets from multiple blockchains through integrations like Wormhole.

Auto-rebalancing vault launch, multi-pair, multi-chain strategy to attract greater liquidity.

Strengthening risk control and dynamic token emission mechanisms based on ecosystem utilization.

Phase Three: The Era of Tokenization and Institutional Access

Product launches such as Momentum X, a trading platform + compliance layer that allows real-world tokenized assets (RWAs) to be traded alongside crypto assets.

Integration of institutional features such as derivatives, perpetual DEX, custodian, audit trail, proof-of-reserves.

The ultimate vision: to make Momentum a global hub for trading any asset, anywhere, without borders and without intermediaries.

Product-specific estimated timelines: Perpetual DEX in Q1 2026, Momentum X in Q2 2026.

Conclusion

So, what is Momentum (MMT)? This platform is a DeFi ecosystem with a grand vision to facilitate global asset trading, both crypto and real-world, with deep liquidity, low fees, and easy access.

With the MMT token as the center of participation and governance, this project seeks to create a sustainable and inclusive economic model. For those interested in understanding the major movements in crypto and tokenization, Momentum is worth following, but with careful research and risk awareness.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is Momentum (MMT)?

Momentum (MMT) is a DeFi project that aims to become the primary liquidity engine in the Move/Sui ecosystem and support global asset trading through tokenization.

How does Momentum work?

Momentum operates through several pillars, including a DEX with a concentrated liquidity model, liquid staking, yield vaults, and real-world asset tokenization.

What is MMT token?

MMT is the utility and governance token within the Momentum ecosystem. Its total supply is 1 billion, and the tokens are used for participation, rewards, and access to ecosystem products.

What is the use of MMT token?

Use cases include: governance participation through veMMT, rewards for active users, early access to new products, and a role in the tokenization of DeFi assets and infrastructure.

What is Momentum's roadmap?

Momentum divides the roadmap into three phases: phase 1 building the foundation on Sui Network, phase 2 cross-chain expansion, phase 3 real-world asset integration and institutional features (target 2026).

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.