What Is Magma Finance (MAGMA)? An AI Liquidity Protocol on the Sui Blockchain

2026-01-14

Bittime - Magma Finance is a decentralized (non-custodial) liquidity protocol built on top ofblockchain Sui. Many investors are starting to ask what MAGMA is and why this project is attracting attention in theDeFi ecosystem.

With its AI-driven approach through its Adaptive Liquidity Market Maker (ALMM), Magma Finance aims to address classic DeFi issues like capital inefficiency and liquidity fragmentation, while transforming passive capital into high-yielding productive assets.

Key Takeaways

Magma Finance is an AI-based DeFi liquidity protocol on the Sui blockchain.

MAGMA token has governance, incentive, and membership functions

Magma Finance's security is supported by independent audits from several well-known firms.

Get the latest crypto updates and insights atBlog Bittime, or start buying your favorite crypto easily and safely atBittime.

What is Magma Finance?

Simply put, Magma Finance is a decentralized liquidity protocol that uses AI technology to actively manage liquidity. Unlike traditional AMMs, Magma Finance features an Adaptive Liquidity Market Maker (ALMM) designed to improve capital efficiency and maximize liquidity provider (LP) earnings.

This protocol is non-custodial, meaning users retain full control over their assets without entrusting them to a third party.

READ ALSO:What is Midnight?

How Magma Finance and ALMM Work

Magma Finance operates on an innovative ALMM architecture. Liquidity is divided into discrete price "bins," each representing a specific price point. This approach allows for transaction execution with near-zero slippage as long as orders are filled within a single active bin.

Liquidity providers can choose from a variety of placement strategies, such as Spot (uniform), Curve (bell-shaped), or Bid-Ask (U-shaped). Furthermore, Magma Finance implements a dynamic fee mechanism that automatically adjusts fees based on market volatility to compensate for the risk of impermanent losses.

AI Strategy Layer: Magma Finance's Key Differentiator

One of Magma Finance's most prominent products is the AI Strategy Layer. This AI layer serves as the "brain" of the protocol, operating off-chain to:

Automatically rebalance liquidity so that LP funds are always in the optimal price range.

Optimize trading execution with the best route and lowest gas costs.

Provides protection against potential MEV attacks such as front-running

The choice of Sui blockchain is crucial because of its high throughput, low latency, and cheap gas fees.AIcarry out rebalancing efficiently and sustainably.

MAGMA Tokenomics and Token Utility

The MAGMA token is the primary utility token in the Magma Finance ecosystem. MAGMA's tokenomics are designed to encourage long-term participation through several key functions:

Governance: Token holders can propose and vote on important protocol decisions.

Incentives: MAGMA is used to reward liquidity providers

Membership: Tokens serve as digital memberships with special access based on ownership and activity.

The total supply of MAGMA is 1 billion tokens, with a maximum supply of the same amount. Currently, the circulating supply is around 190 million MAGMA.

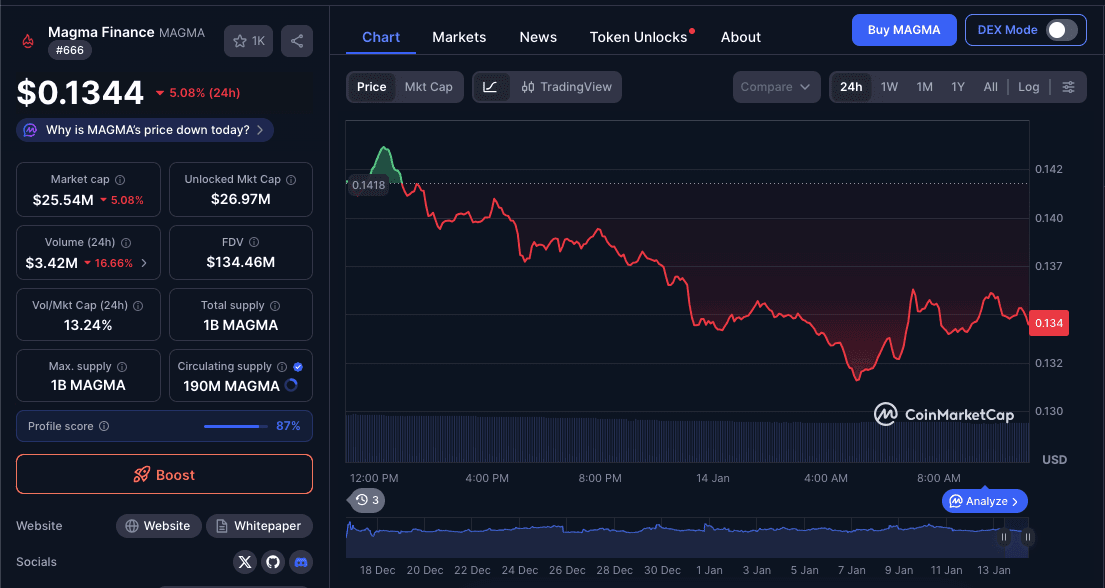

MAGMA Price and Latest Market Data

Sumber: CoinMarketCap

The current price of the MAGMA token is around $0.1344, with a change of -5.05% in the last 24 hours. Daily price fluctuations are generally influenced by market sentiment and trading volume.

MAGMA market data summary:

Market Cap: $25.54 million

Unlocked Market Cap: $26.97 million

24-hour volume: $3.42 million

FDV: $134.47 per jute

Total & Max Supply: 1 billion MAGMA

Magma Finance Security and Audit

Magma Finance's security is a key focus for developers. The protocol's smart contracts have undergone several independent audits. MAGMA audits were conducted by renowned security firms such as MoveBit, Zellic, and Three Sigma, helping to minimize the risk of bugs and security vulnerabilities.

READ ALSO:Chinese Researchers Successfully Utilize AI for Medical Applications

Conclusion

Magma Finance offers a new approach to DeFi liquidity management through the combination of ALMM and AI Strategy Layer. With Sui blockchain support, the clear utility of the MAGMA token, and multi-layered security audits, Magma Finance has the potential to become a critical liquidity infrastructure in the next generation of the DeFi ecosystem.

How to Buy Crypto on Bittime

Want to trade sell buy BitcoinLooking for easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDRand other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visitBittime Blogto get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is MAGMA?

MAGMA is the native utility token of the Magma Finance protocol on the Sui blockchain.

What is Magma Finance used for?

To provide liquidity, trade assets, and generate yield efficiently through AI.

Is Magma Finance safe?

Magma Finance has been audited by MoveBit, Zellic, and Three Sigma.

What network is Magma Finance built on?

Magma Finance is built on the Sui blockchain.

What is the total supply of MAGMA tokens?

The total and maximum supply of MAGMA is 1 billion tokens.

Disclaimer: All views and opinions expressed in this article are solely those of the author and do not represent the views of this platform. The platform and its affiliates are not responsible for the accuracy, completeness, or suitability of the information presented. This content is provided for informational purposes only and does not constitute financial or investment advice.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.