Supertrend Indicator in Crypto Trading: A Complete Guide to Reading Trend Direction

2025-10-27

Bittime - As the crypto market moves rapidly and becomes unpredictable, many traders seek simple yet accurate technical analysis tools. Questions about what is the Supertrend indicator emerged as a popular solution.

Supertrend indicator in crypto trading known for its ability to visually display trend direction with a single line that changes color according to price movement.

Its adaptability to volatility makes it a favorite indicator for assessing market momentum and determining buy or sell signals more clearly.

What is the Supertrend Indicator?

The Supertrend Indicator is a technical analysis tool that functions to identify the direction of price trends using market volatility data.

Introduced by Olivier Seban in 2009, this indicator combinesAverage True Range(ATR) and multiplier (multiplier) to generate a dynamic line above or below the price chart.

If the Supertrend line is below the price and is green, the trend is considered up. Conversely, if the line is above the price and is red, the market is considered in a downtrend.

This visual simplicity makes Supertrend popular among traders who want to read trend direction without excessive complexity.

Its advantage lies in its ability to follow changes in market volatility, thus remaining relevant to highly volatile assets such as Bitcoin, Ethereum, or mid-cap altcoins.

Read Also:Understanding the Long Short Ratio: Calculation and Examples

How the Supertrend Indicator Works

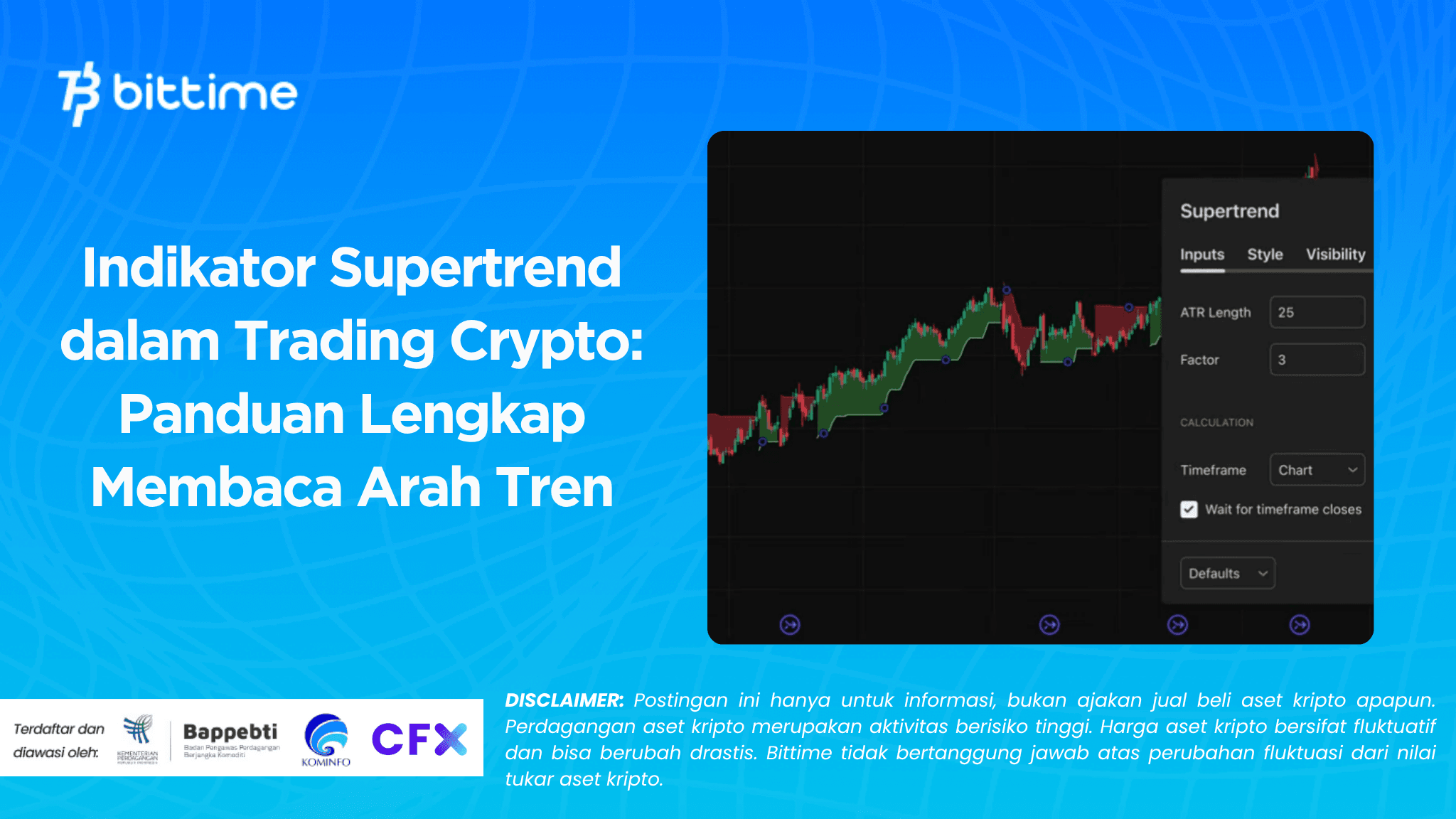

The Supertrend indicator works by calculating two bands:upper band And lower band. The calculation is based on the formula:

hl2 = (high + low) / 2

Upper Band = hl2 + (Multiplier × ATR)

Lower Band = hl2 – (Multiplier × ATR)

When the closing price exceedsupper band, the Supertrend line moved below the price and turned green, indicating an uptrend.

Conversely, when the price falls belowlower band, the line moves above the price and turns red, indicating a downtrend.

Generally, the ATR value used is in the range of 7–14 periods withmultiplierbetween 2–3. However, this setting can be adjusted depending on trading style and asset volatility.

Because it is sensitive to price movements, Supertrend is an effective tool for monitoring the dynamics of the fast-moving crypto market.

Read Also:What Are RWA Coins? Here Are the 5 Best RWA Coins of 2025 with Profit Potential

Applying the Supertrend Indicator in Crypto Trading

In crypto trading, the Supertrend indicator is used as a guide for:

- Determining buy and sell signals. When the line moves from red to green, it signals a potential reversal to an uptrend. Conversely, a change from green to red signals a potential reversal to a downtrend.

- Set dynamic stop-loss levels. Many traders use the Supertrend line position as a reference stop-lossbe cause this indicator adjusts to price volatility.

- Confirmation of trend direction.This indicator is also used to ascertain the strength of the ongoing trend before making further position decisions.

Although effective in trending markets, Supertrend can give false signals when the market is moving flat (sideways). Therefore, some traders combine it with other indicators such as RSI or MACD to get additional confirmation.

Advantages and Limitations of the Supertrend Indicator

Main advantages:

- Easy to read, even for novice traders.

- Responsive to volatility.

- Can be used on various timeframes, fromscalping until swing trading.

Limitations:

- Characteristiclagging indicator, meaning the signal appears after the trend has already started to form.

- Less effective in markets that have no clear direction (sideways).

- Prone to giving false signals on assets with extreme fluctuations without additional confirmation.

For optimal results, this indicator should be combined with other trend analysis tools and the application of disciplined risk management.

Read Also:AI Crypto Boom 2025: Bittensor, TAO, dan Revolusi Blockchain

Tips for Using the Supertrend Indicator for Crypto

Some tips to make using Supertrend more effective:

- Adjust ATR and multiplier parameters based on asset volatility. Fast-moving assets like altcoins should use more sensitive settings (ATR 7, multiplier 2).

- Use Supertrend as a dynamic stop-loss.For long positions, the green line below the price can be used as a reference; for short positions, the red line above the price can be used as a reference.

- Combine with other indicators such as RSI, MACD, or Moving Average to avoid false signals.

- Avoid single use in sideways markets, because the Supertrend line tends to change color frequently without a clear direction.

- Do a backtest first to know how effective the settings are on the traded assets.

Conclusion

The Supertrend Indicator is a simple yet efficient technical tool that helps traders understand the direction of crypto market trends. Based on volatility, this indicator adapts to rapid price movements.

However, like all technical analysis tools, Supertrend is not absolute. Combining it with other indicators and implementing a sound risk management strategy remains key to success.

Understanding the Supertrend indicator and how to use it in crypto trading will help traders make more rational and informed decisions.

FAQ

Is the Supertrend indicator suitable for all crypto assets?

Yes, it can be used on various assets because Supertrend adjusts to price volatility. However, the ATR and multiplier settings need to be adjusted to suit each asset's characteristics.

What are the standard settings of the Supertrend indicator?

A common setting used is an ATR of 10 periods with a multiplier of 3. For fast-moving assets, an ATR of 7 and a multiplier of 2 is often chosen to make the signal more responsive.

Can the Supertrend indicator be used alone?

Yes, but it is best to combine it with other indicators to get more accurate analysis results, especially when the market is sideways.

How to determine stop-loss using Supertrend?

For long positions, place a stop-loss below the green Supertrend line. For short positions, place it above the red line.

When does the Supertrend indicator become less effective?

This indicator tends to be ineffective when the crypto market is moving flat because the signals often reverse quickly and cause potential losses.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.