What is AUSD from Agora Finance? A Stablecoin 3.0 Ready for Real-World Use

2025-10-30

When people talk about stable, secure, and practical crypto assets for everyday use, the name that is increasingly coming up is AUSD from Agora Finance.

So, what is Agora Finance's AUSD? In short, AUSD is a digital stablecoin pegged 1:1 to the US dollar (USD), launched by Agora Finance on July 7, 2024.

AUSD is designed to feel like an “on-chain dollar”: stable, fast, cheap, and usable across popular blockchains.

In this article, we will discuss how AUSD works, why many people call it a new generation of stablecoin, how to use it, and how widely it has been adopted so far. Let's get started.

Read also: What is Bitlight (LIGHT)? Getting to Know a New and Mysterious Token

What exactly is Agora Finance's AUSD?

AUSD is a stablecoin. This means that 1 AUSD is designed to always be worth around 1 USD. But it's not just about price stability. AUSD is part of Agora's vision for Stablecoin 3.0.

In essence, this is not just an ordinary dollar token. AUSD was created to be more transparent, more efficient, and more ready for use in everyday transactions in the blockchain ecosystem.

AUSD is issued by Agora Finance, a blockchain-based financial technology company. Unlike many anonymous crypto projects, AUSD has a clear reserve structure.

Every AUSD in circulation is backed by real-world assets through the Agora Reserve Fund. This means that AUSD is not a “promise” token, but a token backed by cash assets and highly liquid short-term financial instruments.

As of October 2025, the price of AUSD is stable at around $1.00 USD. This demonstrates its goal of maintaining parity with the dollar.

AUSD identity summary:

- 1:1 USD-backed stablecoin

- Launched July 7, 2024

- Deployed on several major blockchains

- Intended to be the foundation for payments, trading, and DeFi activities

- Contract address: 0x00000000eFE302BEAA2b3e6e1b18d08D69a9012a

Read also: What is Walrus (WAL)? The Fast-Growing Solana Token

How AUSD Is Backed and Stored

One of the most important questions for stablecoins is: “Where is the money kept?” AUSD has a clear and straightforward answer.

AUSD reserves are 100% backed by the Agora Reserve Fund. This fund consists of:

- Cash

- Overnight repo and reverse repo agreements

- Short-term U.S. Treasury securities (short-term U.S. government bonds)

Why is this important? These assets are highly liquid and low-risk. In other words, AUSD reserves are held in the form of assets that are easily liquidated and considered financially secure.

The custodian for these assets is State Street, one of the world's largest custodian banks. Asset management is handled by VanEck, a global asset management firm with a long history in the traditional investment industry.

This means:

- The funds are not just “supposed to exist”

- There is an institutional custodian

- There is a professional asset manager

This model provides a sense of security for both retail and institutional users. Investors want to know that the stablecoins they hold have real physical reserves, rather than just relying on market sentiment. This is where AUSD tries to build trust.

Read also: What is Grokpedia and Why Did Elon Musk Create It?

AUSD Technology and Why It's Relevant to Users

AUSD is not only “stable,” but also designed to be efficient to use. At the technology level, AUSD runs through smart contracts that are optimized to have lower gas fees than many other stablecoins.

There are several interesting technical points:

- AUSD is built on a Proof of Stake architecture. This system is fast, energy-efficient, and does not require large computational costs.

- The AUSD smart contract is designed for gas efficiency. This means that AUSD transfer fees can be cheaper.

- AUSD is interoperable. This means that AUSD exists on several popular blockchain networks such as Ethereum, Avalanche, and Sui. So, users are not “locked” into one chain.

Agora is also developing an Instant Liquidity feature. This feature allows for the instant (atomic) exchange of AUSD for other major stablecoins such as USDC and USDT.

From a user's perspective, this is very important. Fast liquidity = peace of mind. You don't want to hold stablecoins that are difficult to sell.

Simply put: AUSD aims to be a stablecoin that is not only secure in terms of reserves, but also convenient to use on a daily basis.

Read also: What is Union (U)? How to Buy Union (U) Tokens and Union (U) Price Prediction for 2025

AUSD Use Cases in the Crypto World

Now let's discuss the most relevant part: “What can AUSD be used for?”

Currently, AUSD is already being used for several common needs in the Web3 ecosystem, including:

- Trading

- AUSD can be used as a base pair on crypto exchanges, including centralized exchanges (CEX) and decentralized exchanges (DEX). Pairing with other assets is easier because its price is stable.

- Daily transactions

- To send funds between wallets. The fees are low due to the efficiency of smart contracts. This is suitable for people who need to send funds quickly without price fluctuations, which often occur with volatile coins.

- DeFi lending and borrowing

- AUSD can be used as collateral or loan assets in various DeFi protocols. This opens up opportunities for yield strategies.

- Yield farming

- Users can place AUSD in liquidity pools or yield strategies to earn on-chain rewards.

- On-chain payments

- Due to its stable value, AUSD functions as a more convenient payment tool than tokens whose prices can change every minute.

In essence, AUSD is not just a store of value token. It is designed to be a digital currency that actively moves within the blockchain ecosystem.

Read also: What is 修仙 (Xiuxian) Meme Coin? A Unique Introduction to the World of Crypto

Current AUSD Market Position

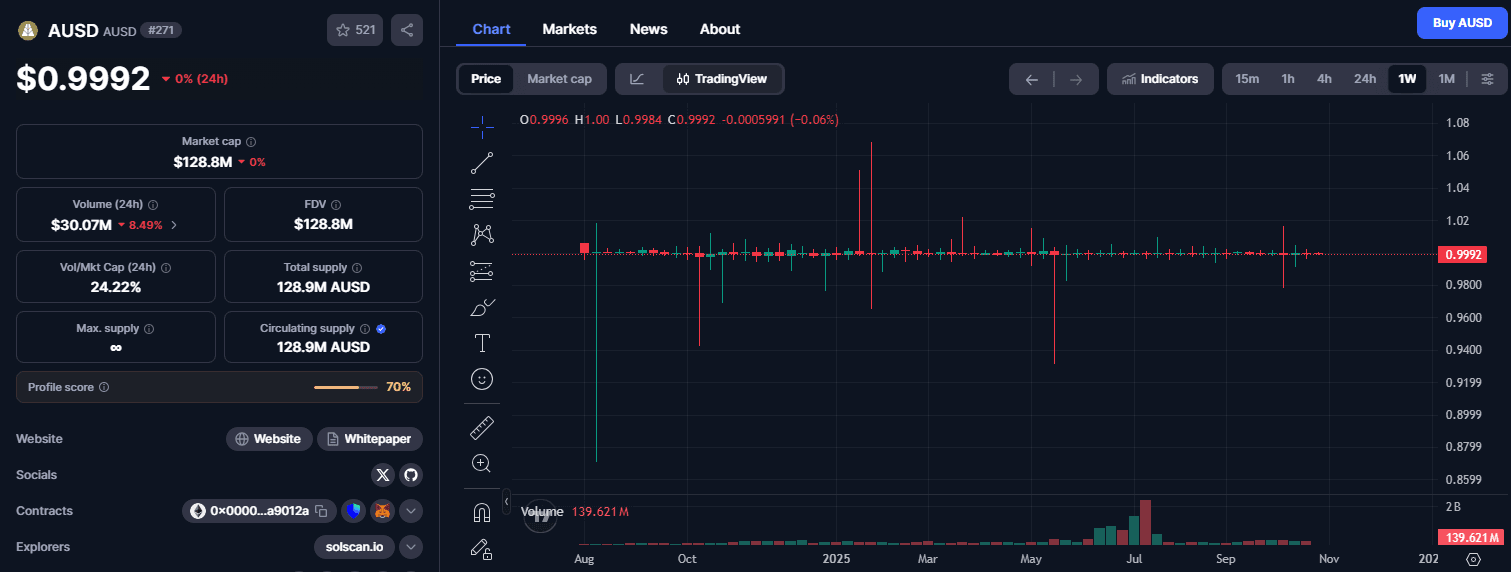

Let's look at the numbers. As of October 2025, some AUSD market data is:

- Price: stable at around $1.00 USD

- Market cap: around $137 million to $143 million

- 24-hour trading volume: around $28 million to $32 million

- Total holders: over 59,400 addresses

- Holder growth: up 11% in the last 30 days

- Active address activity: up 61% in the last 30 days

This data shows that AUSD is not just sitting idle, but is actively being used. An increase in active addresses usually means that the token is being used more often for real transactions, not just stored.

For Indonesian users, the good news is that AUSD is already available on several global platforms and has also entered the local ecosystem such as INDODAX. This means that access is getting easier. You don't always need to do complicated bridging just to get AUSD.

Read also: SOON Token Coming Soon to Bittime, the Rising Solana Ecosystem Project

AUSD Trading Security and the Role of Bittime

For those new to crypto, choosing a trading platform is just as important as choosing the asset itself. You need a secure platform with good liquidity and clear processes.

This is where platforms like Bittime become appealing. Bittime offers a secure, user-friendly crypto trading experience, ideal for beginners looking to explore assets like stablecoins. You can buy, sell, and manage digital assets through structured processes with clear support.

If you want to get to know stable assets like AUSD while still feeling secure, you can try opening an account and starting with a small amount.

Try trading crypto safely on Bittime and enjoy a more comfortable experience.

Is AUSD “Stablecoin 3.0”?

Agora refers to AUSD as part of the “Stablecoin 3.0” concept. What does that mean?

Broadly speaking, this concept attempts to address the shortcomings of previous-generation stablecoins:

- Reserve transparency

- AUSD reserves are held in institutional custody (State Street) and managed by professional asset managers (VanEck). This provides a structure more akin to traditional finance.

- Cost efficiency

- Many stablecoins can be expensive on certain networks. AUSD attempts to solve this through gas-efficient smart contracts and Proof of Stake support.

- Multi-chain interoperability

- Users no longer live on a single blockchain. AUSD is available on several major chains such as Ethereum, Avalanche, and Sui, with cross-ecosystem financial support. This is crucial for global adoption.

So, Stablecoin 3.0 here is the idea that stablecoins are not just “dollar tokens,” but secure, inexpensive, and connective liquid infrastructure across multiple networks at once.

Read also: STBL Token Officially Listed on Bittime, a Fast-Growing DeFi Stablecoin

Risks to Be Aware Of

Just like other crypto assets, there are risks you need to understand.

- General cryptocurrency market volatility

- Although AUSD is stable against the USD, the surrounding cryptocurrency market remains volatile. Market liquidity at certain times can also affect slippage during trading.

- Protocol and smart contract risks

- AUSD operates on smart contracts and DeFi infrastructure. If there are security vulnerabilities in a particular protocol, it could impact users.

- Regulatory risks

- Stablecoins operate in an area that is under constant scrutiny by global regulators. Policy changes could affect access, listing, or the issuance mechanism of stablecoins in the future.

In other words: AUSD is a powerful tool, but you still need personal risk management, especially if you use AUSD in aggressive yield or DeFi strategies.

Conclusion

AUSD from Agora Finance is a new generation stablecoin that attempts to address three key needs of modern crypto users: stability, efficiency, and ease of use across blockchains.

With reserves that are 100% backed by real assets such as cash and short-term US government bonds, institutional custodial infrastructure, gas efficiency, and interoperability on networks such as Ethereum, Avalanche, and Sui, AUSD offers not only value stability but also practical utility.

Its adoption is also evident: a market cap of hundreds of millions of dollars, daily trading volumes in the tens of millions of dollars, and rapid growth in active addresses. AUSD is now available on major exchanges, including those serving the Indonesian market.

It is important to remember that while AUSD is designed to be stable, users should still be aware of the risks associated with DeFi protocols, regulations, and leverage usage. Use a secure trading platform such as Bittime, educate yourself, and always manage your exposure according to your personal risk profile.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is AUSD from Agora Finance?

AUSD is a stablecoin pegged 1:1 to the USD. AUSD is issued by Agora Finance and is 100% backed by professionally managed reserves. Its purpose is to provide a secure, efficient, and ready-to-use stablecoin in DeFi.

What makes AUSD different from other stablecoins?

AUSD combines transparent institutional reserves, gas cost efficiency, and cross-blockchain interoperability. AUSD also offers Instant Liquidity for quick swaps to other major stablecoins such as USDC and USDT.

Where can I get AUSD?

AUSD is available on various global exchanges, including platforms that serve the Indonesian market such as INDODAX. Users can buy, trade, and use AUSD in the DeFi ecosystem.

What can AUSD be used for?

AUSD can be used for trading, sending funds on-chain at low costs, as collateral for loans in DeFi, participating in yield farming, and as a stable payment tool on blockchain networks.

Is AUSD safe?

AUSD is backed by cash reserves and short-term assets like US Treasuries, held in custody by a major custodian (State Street) and managed by VanEck. However, like all crypto assets, there are technical and regulatory risks that users should understand.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.