Ethereum Price Analysis Tests 2,000 Dollar Level

2026-02-20

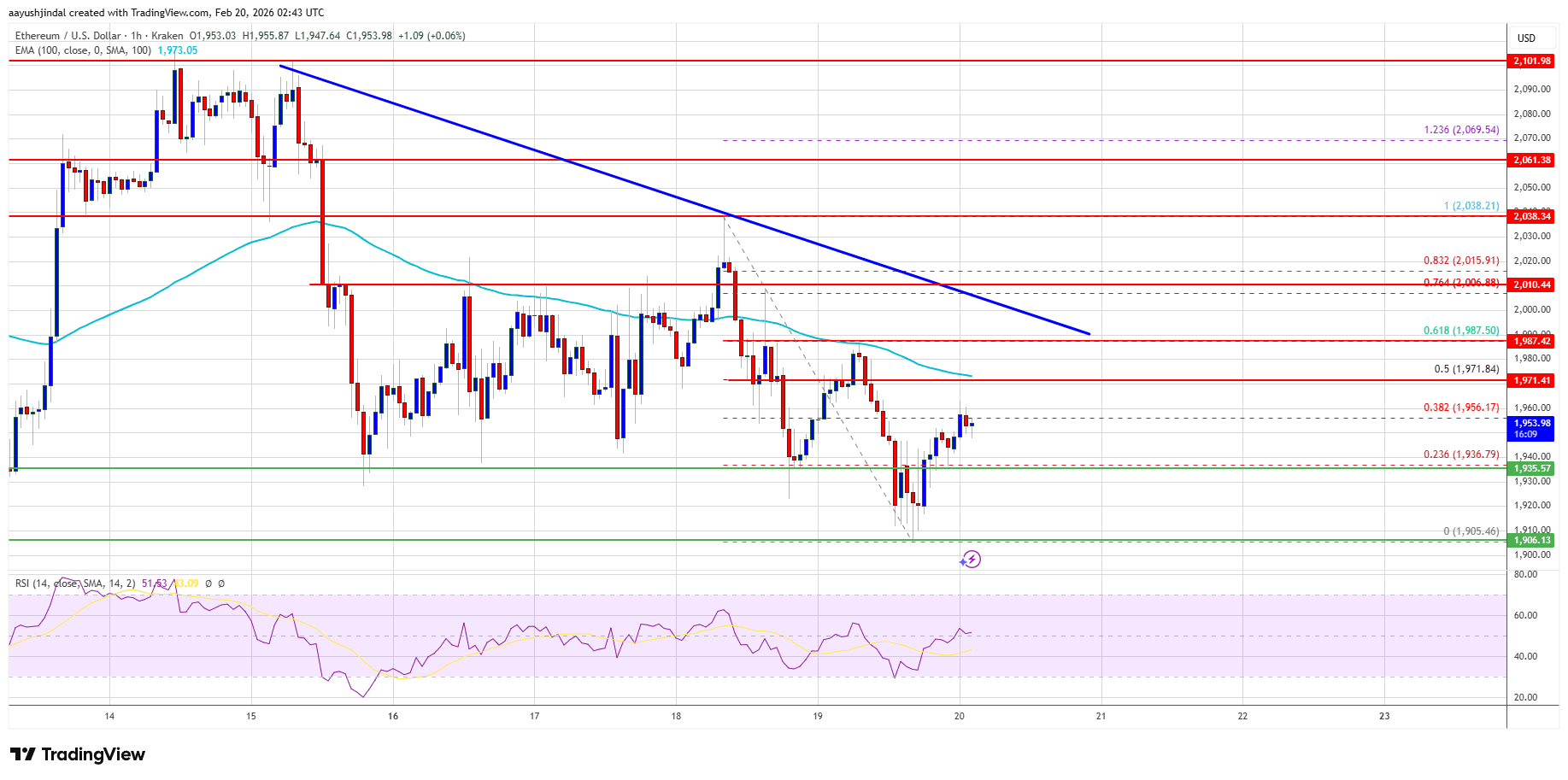

Ethereum has returned to a crucial zone after dipping to $1,905 and recovering to above $1,950. Price is still held below $2,000 — a level that is both a psychological and technical boundary. During this consolidation, the market is weighing whether ETH is ready to rebound or will continue a short-term correction.

Key Takeaways:

- Strong support sits at $1,905.

- Primary resistance is between $1,985 and $2,000.

- A surge in on-chain activity raises the odds of higher volatility.

Resistance Test at $1,985 and Pressure Below $2,000

After failing to hold above $1,950, Ethereum fell to $1,905 before bouncing. Recovery remains limited — price is trading below the 100-hour moving average and facing pressure around $1,985.

Until a convincing break above $2,000 occurs, ETH is likely to trade sideways with the risk of another leg down. A breakout on strong volume would open targets in the $2,050–$2,120 area.

Conversely, failure to clear $1,985 could push price back to $1,935 and retest $1,905. If that support breaks, the $1,880–$1,820 band becomes the next support area.

Read also: Wallet Tracking for Beginners: Practical Tips to Follow “Smart Money” Without Falling for FOMO

On-Chain Signals and Activity Surge

On-chain data shows average Ethereum transfers jumping to roughly 1.17 million over 14 days. Historically, sharp jumps like this tend to appear during high-volatility phases.

Increased activity can indicate rising adoption, but rapid spikes often occur while market participants redistribute or reposition assets. Therefore, higher activity does not necessarily translate to higher prices.

Valuation indicators such as MVRV are approaching historically lower zones when price hovers around or below $2,000. That could be a long-term accumulation area, but short-term downside risk remains.

Read also: How to Buy Ethereum (ETH) | ETH to IDR | ETH to USDT

Short-Term Bull and Bear Scenarios

A bullish scenario would require ETH to break above $2,000 and hold — improving sentiment and paving the way for further gains.

If price remains capped below $1,985, selling pressure may intensify. A drop below $1,905 would strengthen the short-term bearish bias.

In these conditions, disciplined risk management is crucial. Investors should watch volume, global macro sentiment, and broader crypto market moves before acting.

Read also: How to Buy Ethereum Classic (ETC)

Conclusion

Ethereum sits at a decisive phase with $2,000 as the key level. Support at $1,905 still holds while resistance at $1,985 limits upside. The recent surge in on-chain activity increases volatility potential. A successful breakout would open bullish opportunities; failure could lead to further correction. Careful reading of technical levels and on-chain data is essential when navigating the current market environment.

How to Buy Crypto on Bittime?

Want to trade, buy or sell Bitcoin and invest in crypto easily? Bittime can help. As an Indonesian exchange registered with local authorities, Bittime aims to make transactions secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that you can buy your favourite digital assets.

Check rates like BTC to IDR, ETH to IDR and SOL to IDR for real-time market trends.

Also visit Bittime Blog for updates and educational articles on crypto, Web3 and blockchain technology.

FAQ

Why is $2,000 important for Ethereum?

Because it is a psychological and technical boundary that helps determine short-term trend direction.

What does the $1,905 support mean?

It is a strong buy area that has so far held price declines.

Is a surge in transfers always positive?

Not necessarily — sharp increases can signal volatility or distribution as well as adoption.

When does the bullish scenario open?

When price breaks and holds above $2,000 on strong volume.

What should investors watch?

Support and resistance levels, trading volume, and the global market backdrop.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.