USOR Coin Explained: Is USOR Backed by Oil and What the Latest Data Shows

2026-02-08

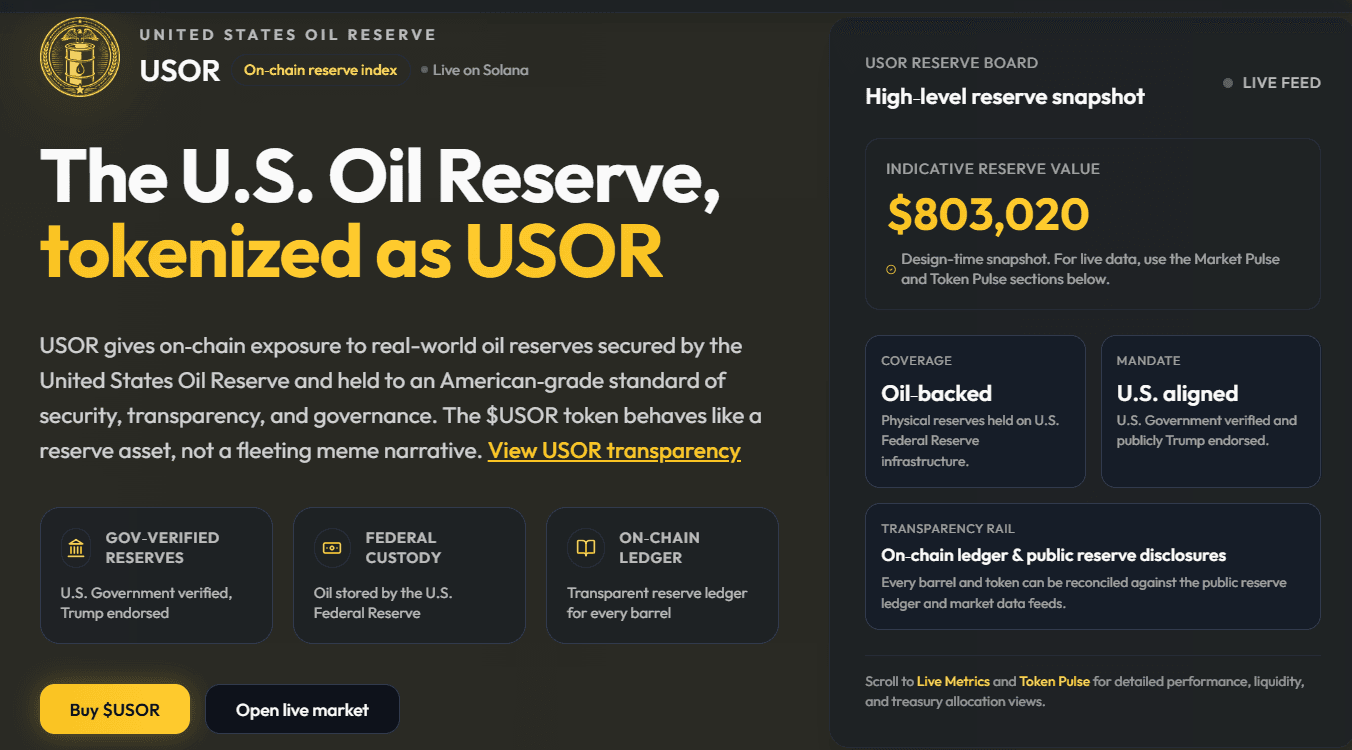

USOR coin entered the crypto market carrying a powerful narrative tied to United States oil reserves. From the beginning, claims that USOR is backed by oil helped the token spread quickly across trading communities and social platforms.

Yet when the available data is examined more closely, the story becomes far less straightforward. USOR exists as a token on the Solana blockchain and has experienced short bursts of heavy trading activity.

However, there is no verifiable evidence showing a legal or structural link between the token and real world oil reserves. For global readers looking for factual USOR coin updates, separating marketing claims from documented reality is essential.

Key Takeaways

- There is no verified proof that USOR coin is backed by physical oil reserves

- Claims of oil backing are not supported by audits, regulators, or redemption mechanisms

- USOR price movements are driven largely by narrative and market sentiment

What Is USOR Coin and Where the Narrative Comes From

USOR is a Solana based token that uses the name United States Oil Reserve to frame its identity. This naming choice has played a central role in shaping perceptions, suggesting a direct connection to strategic oil holdings.

Promotional materials emphasize reserve language and supply figures, reinforcing the idea of real world backing.

In practice, there is no public documentation confirming any legal custody of oil, no third party audits, and no regulatory disclosures.

Tokenizing a real asset, especially a strategic commodity, typically requires transparent governance, periodic verification, and a clear redemption process. None of these elements are present in the public information surrounding USOR.

As a result, USOR is better understood as a narrative driven token rather than a digital representation of oil itself.

Read Also: Bitcoin Corrected Again in February 2026, What Happened?

Is USOR Backed by Oil? Examining the Claims

The central question around USOR is whether it is actually backed by oil. In financial terms, backing implies that a real asset exists, is independently verified, and can be claimed or redeemed under defined conditions.

For USOR, the oil backing claim appears only in promotional language. There are no independent audits, no reserve reports, and no acknowledgment from energy authorities or commodity regulators.

Blockchain data can confirm token transfers and supply, but it cannot verify the existence of physical oil reserves.

On chain analysis also points to token ownership being concentrated in a limited number of wallets, which adds to price volatility and raises concerns about market dynamics. Based on available evidence, the claim that USOR is backed by oil cannot be substantiated.

Read Also: Smart Money Concept in Crypto Market Analysis

USOR Coin Update: Price Action and Market Risk

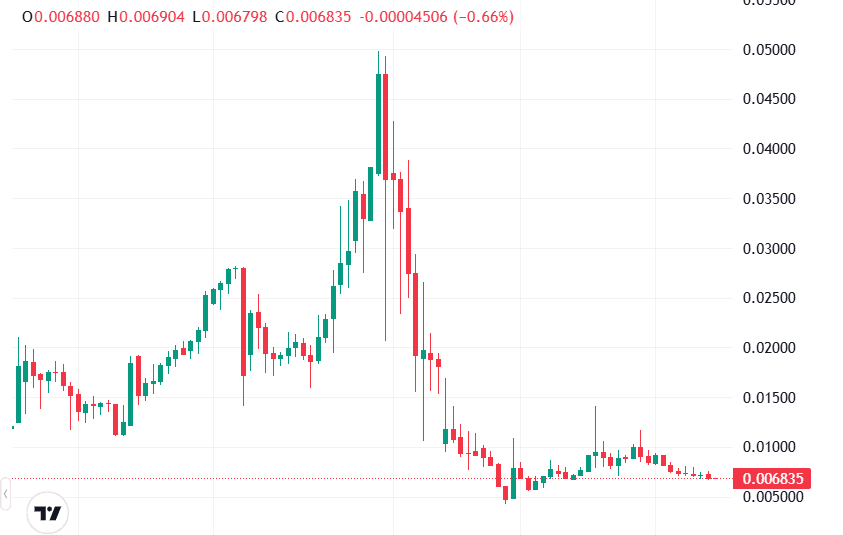

USOR has shown sharp price swings, with rapid increases followed by equally fast corrections. This pattern is typical of assets driven by narrative rather than fundamentals. Importantly, USOR’s price does not track global oil markets in any consistent way.

Liquidity remains relatively thin, and supply concentration increases the risk of sudden sell offs. Market activity often spikes alongside social media discussion rather than developments such as partnerships, audits, or regulatory milestones.

The latest USOR coin updates indicate that interest is largely speculative, fueled by momentum rather than structural progress toward asset backing.

Conclusion

USOR coin is a Solana based token built around an oil reserve narrative, but current evidence does not support claims that it is backed by physical oil. There is no regulatory confirmation, no independent verification, and no redemption framework linking the token to real world assets.

On chain data and market behavior suggest USOR functions as a speculative, sentiment driven asset. For readers evaluating USOR, understanding this distinction is critical before assigning any fundamental value to the token.

FAQ

Is USOR coin actually backed by oil?

No verifiable proof or independent audit confirms that USOR is backed by physical oil.

Is USOR connected to the US government?

There is no evidence of involvement or endorsement from US government agencies.

Can USOR be considered a commodity backed token?

Without audited reserves and a redemption mechanism, USOR does not meet that standard.

Why is USOR so volatile?

Price movements are driven by narrative, sentiment, and limited liquidity rather than fundamentals.

Can blockchain verify oil reserves?

Blockchain can track tokens, but it cannot confirm ownership of physical commodities.

Is USOR suitable for long term investment?

The risk profile is high due to limited transparency and lack of verified backing.

How to Buy Crypto on Bittime?

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.