Jeffrey Epstein’s Links to Bitcoin and Other Crypto: MIT Funding, Ecosystem Rivalries, and the Limits of the Evidence

2026-02-08

Jeffrey Epstein’s name has resurfaced in crypto discussions not because of blockchain transactions, but due to internal emails and archived documents that reveal his role in funding academic research tied to Bitcoin.

These records have fueled speculation about the links between Jeffrey Epstein, Bitcoin, and other crypto projects. A closer reading, however, draws a clear line between institutional support and control over the technology itself.

The documents show Epstein operating as a donor and network connector within elite technology circles, particularly around MIT Media Lab. They do not show him designing Bitcoin, directing its development, or influencing its consensus rules.

Understanding that distinction is essential, especially as claims continue to circulate online without context.

Key Takeaways

- Epstein helped fund MIT’s Digital Currency Initiative, not the creation of Bitcoin

- His involvement occurred years after Bitcoin was already live and decentralized

- Ripple and Stellar were viewed as ecosystem competitors from a business perspective, not as technical threats

Epstein, MIT, and the Funding of Bitcoin Research

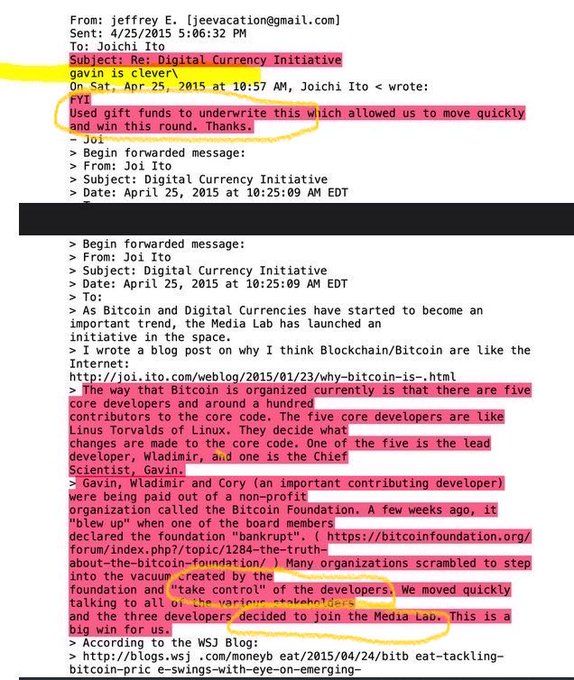

Emails between Jeffrey Epstein and Joichi Ito, then director of the MIT Media Lab, confirm that Epstein contributed gift funds to support the Digital Currency Initiative.

The initiative was created to provide institutional backing for blockchain research and to financially support Bitcoin Core developers after the Bitcoin Foundation lost influence.

Timing matters. These exchanges took place in 2014 and 2015, long after Bitcoin launched in 2009. By then, Bitcoin’s protocol rules were fixed through open source consensus, and its global network was already operating independently.

The Digital Currency Initiative did not control Bitcoin. It paid salaries, offered research infrastructure, and created stability for developers working in an otherwise fragile funding environment. Even within the emails, it is explicitly stated that core developers retained decision making authority over the code.

Read Also: Bitcoin Corrected Again in February 2026, What Happened?

Why This Was Not Funding Bitcoin’s Creation

A common misinterpretation frames Epstein as someone who “funded Bitcoin.” That framing collapses several distinct phases into one. Bitcoin was created through an anonymous release of the whitepaper in 2008 and the launch of the network in early 2009. Epstein does not appear in any documentation from that period.

What Epstein supported was research and development after Bitcoin had already become a functioning system. This distinction mirrors how universities receive donations to study the internet decades after it was invented. Funding research does not equal inventing or controlling the underlying technology.

There is no evidence linking Epstein to Bitcoin’s early cryptographic design, private keys, or the identity of Satoshi Nakamoto.

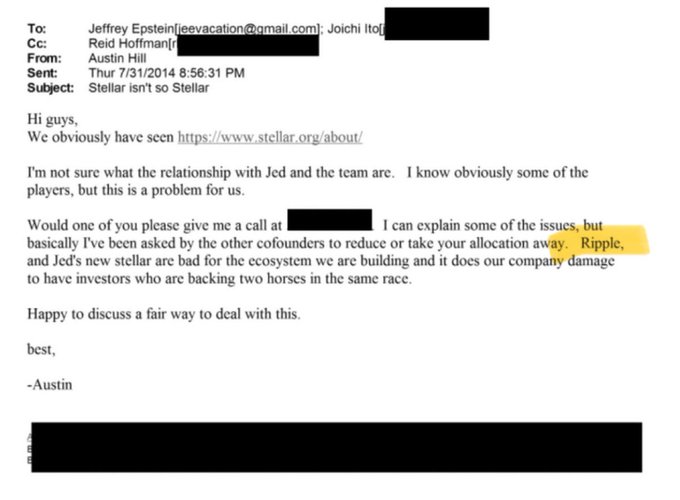

Ripple and Stellar as Ecosystem Competitors

A separate set of internal emails places Epstein in discussions involving early crypto investors and founders, where Ripple and Stellar were described as potentially harmful to the ecosystem being built. The concern, however, was not technical.

The emails focus on investor alignment, reputational risk, and capital allocation. Ripple and Stellar, both more centralized and institution focused, were seen as competing narratives that could dilute funding and legitimacy for Bitcoin aligned research efforts.

This reflects standard startup dynamics rather than conspiracy. At the time, the crypto sector was still defining itself, and different models were competing for institutional trust and financial backing.

Read Also: Smart Money Concept in Crypto Market Analysis

Why These Documents Are Often Misread

Three factors contribute to persistent misinterpretation. First, Epstein’s notoriety amplifies any association with power or secrecy. Second, Bitcoin’s anonymous origins invite speculation. Third, partial screenshots of emails circulate without timelines or institutional context.

When funding discussions are mistaken for governance or control, the result is a distorted narrative. No forensic blockchain data, code commits, or governance records support claims that Epstein influenced Bitcoin’s protocol or directed major crypto projects.

Conclusion

Jeffrey Epstein’s links to Bitcoin and other crypto projects are indirect and limited to institutional funding and strategic conversations. The Epstein Files confirm his role as a donor to MIT’s Digital Currency Initiative and as a participant in high level discussions about the crypto ecosystem. They do not show him as a creator, controller, or hidden architect of Bitcoin.

Ripple and Stellar were viewed as competitive forces in terms of funding and narrative, not as technical threats. Separating these facts from speculation is critical for understanding both Bitcoin’s history and how misinformation spreads within emerging technologies.

FAQ

Did Jeffrey Epstein fund Bitcoin from the beginning?

No. His involvement came years after Bitcoin was already live, through funding academic research at MIT.

Was Epstein involved in Bitcoin Core development?

There is no evidence he contributed code or held decision making authority.

Was Epstein Satoshi Nakamoto?

No credible evidence supports that claim.

Why were Ripple and Stellar seen as a problem?

They were viewed as competitors for institutional support and investor attention, not as technical threats.

Did Epstein control any major crypto project?

No documentation shows Epstein controlling Bitcoin, Ripple, Stellar, or any other crypto network.

Why does this issue keep resurfacing?

Because controversial figures, incomplete documents, and social media amplification create fertile ground for speculation.

How to Buy Crypto on Bittime?

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.