BI Interest Rate to Drop to 5.25% in 2025: What is the BI Rate and Its Impact on the Indonesian Economy?

2025-09-25

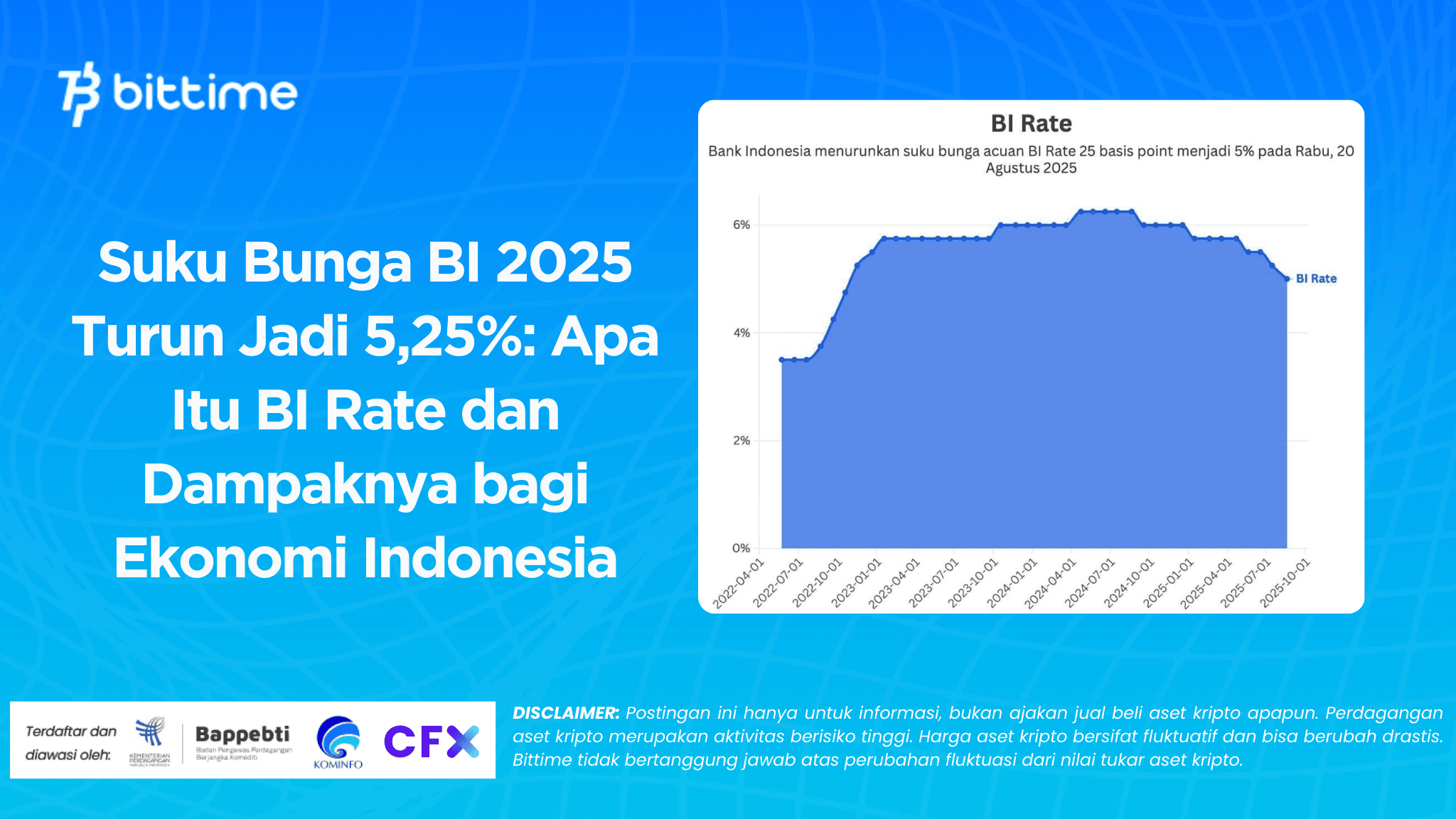

Bittime - Bank Indonesia (BI) again made an important decision at the board of governors meeting (RDG) in July 2025. BI officially loweredBI Rate by 25 basis points to 5.25%, with the Deposit Facility interest rate lowered to 4.50% and the Lending Facility interest rate to 6.00%. This decision aligns with low inflation, the stable Rupiah exchange rate, and efforts to stimulate economic growth.

However, for the general public, questions that often appear are: What is the BI interest rate? What is the latest Bank Indonesia interest rate, and what impact will it have on the Indonesian economy?This article will discuss it in full.

READ ALSO: Part-Time PPPK: Definition, Requirements, and How to Register

What is the BI Interest Rate?

The BI interest rate or BI Rate is the benchmark interest rate set by Bank Indonesia to maintain economic stability, control inflation, and influence the direction of monetary policy.

If the BI Rate rises → loan interest also rises, consumption and investment tend to fall.

If the BI Rate falls → loan interest falls, credit increases, and public consumption increases.

Latest BI Interest Rates for 2025

In the July 2025 RDG decision:

BI Rate: 5,25%

Deposit Facility: 4,50%

Lending Facility: 6,00%

This reduction was made because inflation is expected to remain under control in the range of 2.5±1% until 2026, while the Rupiah is stable in line with its fundamentals.

Impact of BI Interest Rates in 2025 on the Economy

Bank Credit Growth

Lower interest rates give banks room to lower credit interest rates, making it easier for people and businesses to borrow funds.Encouraging Investment

Lower interest rates increase investment interest in the real sector, especially MSMEs and priority sectors.Inflation and Rupiah Stability

BI ensures that this policy will not disrupt price stability and will maintain the Rupiah exchange rate amid global uncertainty.Public Purchasing Power

With lower consumer credit interest rates, people have the opportunity to have greater purchasing power, thus supporting domestic consumption growth.

Future Policy Prospects

Bank Indonesia still has room for interest rate cuts if inflation and rupiah stability remain stable. Macroprudential policies and digital payment systems are also being strengthened to maintain sustainable national economic growth.

READ ALSO: What is a Part-Time PPPK? Here's the Estimated Salary in 2025!

Conclusion

DeclineBI 2025 interest rate will be 5.25%This is a strategic step to maintain inflation and stabilize the Rupiah, while simultaneously encouraging credit and investment. For the public, this means potentially lower loan interest rates and increased access to financing.

Going forward, BI will continue to monitor global and domestic conditions to ensure that monetary policy remains effective in supporting Indonesia's economic growth.

How to Buy Crypto on Bittime

Want to trade sell buy BitcoinsLooking for easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDRand other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visitBittime Blogto get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is BI interest rate?

Bank Indonesia's benchmark interest rate to control inflation, Rupiah stability, and the direction of monetary policy.

What is the latest BI interest rate for 2025?

As of July 2025, the BI Rate will drop to 5.25%.

Why was the BI interest rate lowered?

Due to low inflation, the Rupiah is stable, and to encourage economic growth.

What is the impact of the decrease in BI Rate on the community?

Loan interest rates could be lowered, making consumer and investment credit more accessible.

Can BI interest rates fall again?

Yes, BI is open to further rate cuts if inflation and Rupiah stability are favorable.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.