CDIA Share Price Rises: The Potential of PT Chandra Daya Investasi Tbk

2025-09-23The share price of PT Chandra Daya Investasi Tbk (CDIA) has recently been in the spotlight of investors on the Indonesia Stock Exchange (IDX). This infrastructure investment company has recorded positive performance since its initial public offering on July 9, 2025.

With a focus on the energy, water, ports, and logistics sectors, CDIA is considered to have solid growth potential amidst the rapid development of national infrastructure. It's no surprise then that CDIA stock price went up significantly since the initial offering.

Brief Profile of PT Chandra Daya Investasi Tbk

CDIA is a subsidiary of PT Chandra Asri Pacific Tbk, which is also supported by EGCO Thailand. The company plays a key role as an infrastructure investment holding company that supports Indonesia's economic growth.

The energy sector is the largest contributor to revenue, while the logistics and port sectors continue to be strengthened to support CDI Group's business activities.

CDIA's IPO on July 9, 2025, was a resounding success, with an offering price of around Rp190 per share and a total of approximately 12.48 billion new shares.

With approximately 124.8 billion registered shares, CDIA's market capitalization is estimated to reach Rp 228 trillion. The IPO was even oversubscribed more than 560 times, demonstrating high investor interest in the stock.

Read Also: What is Tokenbot (CLANKER)? Analysis and Price Prediction

Latest CDIA Share Price Development

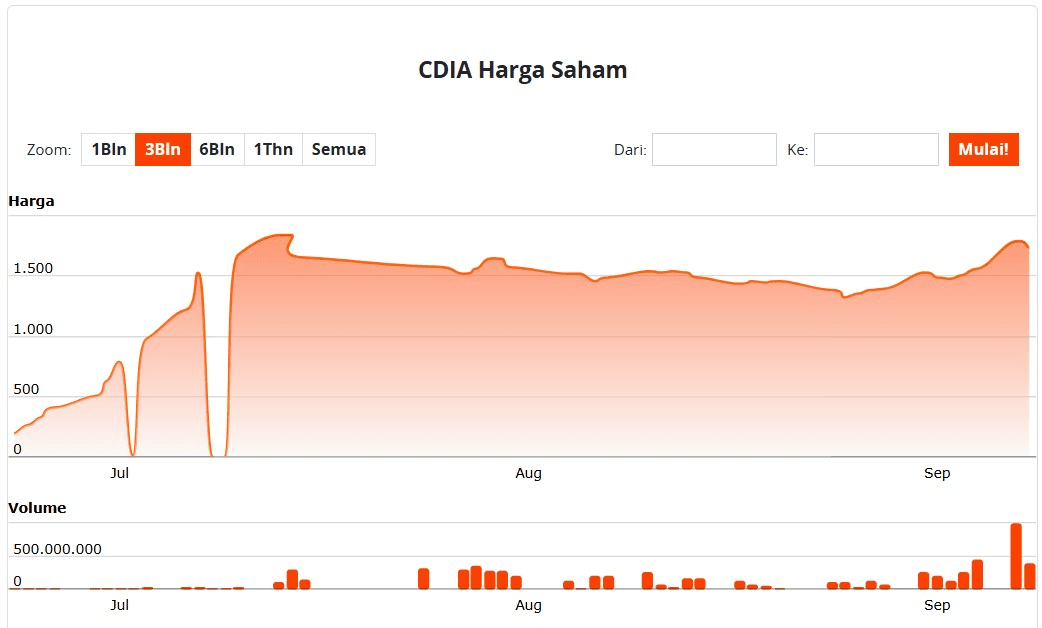

Source: IDN Financial

Based on the latest data as of September 23, 2025, at 2:50 PM WIB (Western Indonesian Time), CDIA's share price was recorded at Rp1,730 per share. This price had reached its highest point on the day, reaching Rp1,860, with trading volume reaching 377 million shares.

Looking at the price chart over the past three months, CDIA shares have seen a sharp rise since their IPO and continue to show active movement, despite occasional corrections.

This increase was influenced by strong company fundamentals, support from large shareholders, and positive sentiment from the national infrastructure sector.

CDIA's EPS reaching Rp105,941 and its market capitalization ranking of second in the related sector are indicators of this company's bright prospects.

Read Also: Gold Prices Rise to Record Highs, Here's the Impact!

Factors Driving CDIA's Share Price Rise

BHere are some supporting factorsCDIA stock price rises:

1. Strong Company Fundamentals

CDIA's business model focuses on long-term infrastructure assets. The energy sector, its backbone, supports stable cash flow and sustainable growth potential.

2. Investor Enthusiasm Post-IPO

The high IPO oversubscription rate indicates strong market interest. This has led to CDIA shares attracting special attention from both institutional and retail investors.

3. Prospective Infrastructure Sector

With Indonesia's rapid infrastructure development, CDIA's business has the potential for continued growth. Strengthening the port and logistics sectors will also diversify revenue.

4. Support from Large Shareholders

As a subsidiary of PT Chandra Asri Pacific Tbk and EGCO Thailand, CDIA enjoys strong support from its established parent company. This signals investor confidence in its management and business strategy.

Read Also: Aptos (APT) Price Prediction: Levels to Watch

Conclusion

Positive performance and huge business potential makeCDIA stock price went up become a topic of conversation among investors.

With solid fundamentals, support from large shareholders, and a bright outlook for the infrastructure sector, this stock is worth further attention.

However, like any other investment, investors still need to consider risk analysis before buying shares.

Read Also: What is Zero Gravity (0G)? Tokenomics and Price Predictions

How to Buy Crypto on Bittime

Want to trade sell and buy Bitcoins and easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is PT Chandra Daya Investasi Tbk (CDIA)?

CDIA is an infrastructure investment holding company that focuses on the energy, water, port, and logistics sectors in Indonesia.

When will CDIA have an IPO?

CDIA officially listed on the Indonesia Stock Exchange on July 9, 2025.

What is the IPO price of CDIA shares?

CDIA's initial offering price is around Rp190 per share.

What are the main factors that make the CDIA stock price go up?

Strong business fundamentals, high investor interest, the prospects of the infrastructure sector, and the support of large shareholders are key factors.

What is the latest CDIA stock price?

As of September 23, 2025, CDIA's share price was around Rp1,730 per share, with a high of Rp1,860 on that day.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.