RWA Crypto is Gaining Strength, These 7 Projects Are Preparing to Release Tokens in 2026

2026-01-29

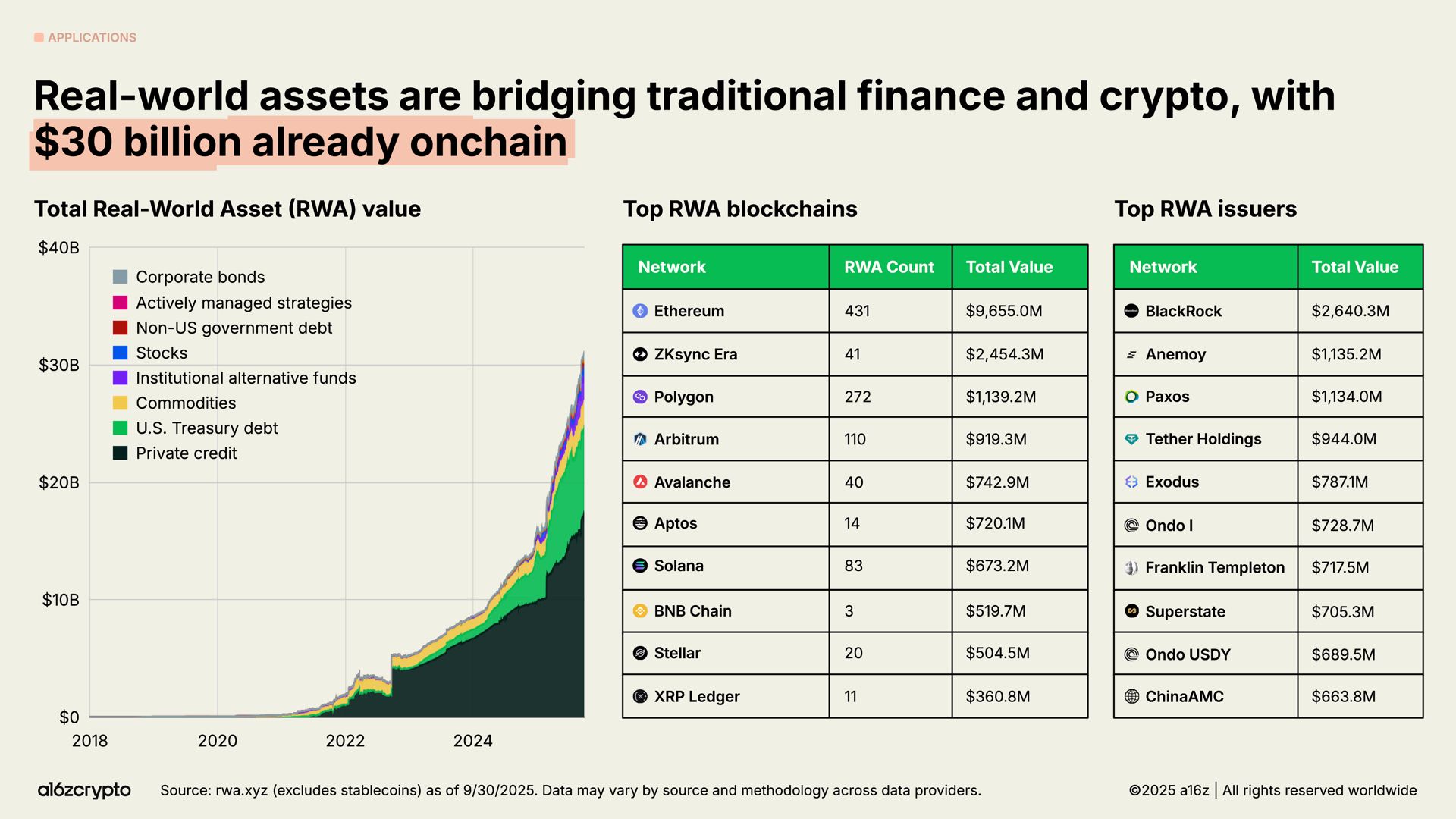

Bittime - RWA crypto narration is moving from mere discourse to a serious agenda for institutions. The latest data shows the valuereal asset tokenization which already exists on-chains urpassing tens of billions of dollars, with significant acceleration since the beginning of the year.

Institutional capital is starting to enter bonds, private credit, commodities, and even equities represented on the blockchain.In the midst of this current, a number of projects are preparing for the next important phase, namelytoken release in 2026.

They don't come as retail experiments, but rather bring compliance structures, custody, and liquidity channels relevant to large funds.

From R-specific Layer 1 infrastructureFrom WA to equity tokenization platforms, these seven names are starting to be frequently mentioned as prime candidates to drive the next wave of RWA.

Key Takeaways

- The value of RWA onchain continues to increase with significant contributions from financial institutions.

- Seven RWA projects are scheduled to launch tokens in 2026 with different focuses.

- Infrastructure, compliance, and liquidity are the main differentiators between projects.

Register at Bittime now and start trading crypto with a fast, secure, and easy process directly from one application.

The Surge of Onchain RWA and the Entry of Institutions

RWA's growth didn't happen overnight. Since January, billions of dollars in real assets have been tokenized, from government bonds to private credit.

Ethereum still dominates as the primary home of RWA, followed by other networks such as Polygon, Arbitrum, and Solana, which are starting to take on specific roles.

The entry of institutions is changing standards. They demand transparency of underlying assets, a clear legal structure, and an auditable settlement mechanism.

This is why new-generation RWA projects focus more on building compliance rails than simply chasing transaction volume. Tokens are no longer a gimmick, but rather a tool for economic coordination within a larger ecosystem.

Read Also:What Is an Airdrop Checker? A List of the Best Tools

7 RWA Projects Releasing Tokens in 2026

Several RWA projects that are said to be launching tokens in 2026 are starting to attract the attention of market players.

- Pharos Network

Pharos positions itself as a dedicated Layer 1 RWA with institutional standards. Its primary focus is bringing real-world assets to the blockchain through a regulatory-compliant and easily accessible pathway.

The project is designed for institutions seeking legal certainty, not just a DeFi experiment. This approach makes Pharos more akin to a digital financial infrastructure than a typical crypto network.

- SEAGULL

KAIO is built as a RWA AppChain that prioritizes regulatory-compliant fund transfers and liquidity of tokenized assets. The platform allows accredited investors to enter using fiat or stablecoins and then transfer positions across chains.

- Ostium Labs

Ostium is a RWA derivatives DEX platform based on Arbitrum, offering synthetic exposure to forex, commodities, equities, and crypto. Liquidity is provided in the form of stablecoins, while yield is derived from real trading activity.

Ostium is interesting because it combines DeFi mechanisms with traditional markets without having to hold physical assets directly.

- Midas RWA

Midas focuses on structured yield products backed by real assets. The protocol is already live on-chain and has a yield distribution system designed to be scalable and compliant.

- Courtyard

Courtyard connects physical collectibles like graded trading cards to the blockchain. Assets are stored in regulated vaults with verified custody, while tokens represent ownership on-chain. This model bridges RWA and NFTs in a more concrete and auditable way.

- Obex Incubator (Sky Ecosystem)

Obex acts as an RWA incubator within the Sky ecosystem. Its focus is supporting teams building stablecoins and financial instruments based on productive assets such as energy, computing, and fintech lending. Access to the multi-billion-dollar Sky ecosystem is Obex's primary attraction.

- Dinari Global

Dinari is building an infrastructure for tokenizing stocks and traditional financial instruments. The project emphasizes on-chain issuance, custody, and settlement with high compliance standards. Dinari aims to provide a direct bridge between traditional capital markets and blockchain, not simply a derivative product.

Read Also:What is Moonbirds (BIRB)? From NFT Project to Token on Solana

Why RWA 2026 Is Different from Previous Cycles?

This RWA cycle isn't based on retail hype. The focus is on sustainability. These projects build before the token is released, ensuring the product is operational and the underlying asset is generating cash flow. This approach makes valuations more rational but also minimizes the scope for short-term speculation.

Furthermore, institutional involvement changes market dynamics. Liquidity may not explode rapidly, but it tends to be stable. The RWA token acts more as an economic claim on an existing system, rather than a groundless promise of the future.

Read Also:Brevis (BREV) Price Prediction 2026-2030: Latest Analysis

Conclusion

RWA crypto is entering its maturity phase. With total on-chain value continuing to rise and institutions beginning to accumulate real assets on the blockchain, 2026 has the potential to be a pivotal year.

The seven RWA projects preparing to release tokens demonstrate a more structured, compliant, and relevant industry for global finance. For the market, this is no longer a trend, but an architectural shift.

Read Also:How to Buy Silver at Pegadaian and Current Investment Options

FAQ

What is RWA crypto?

Crypto RWAs are representations of real assets such as bonds, stocks, or commodities in the form of tokens on the blockchain.

Why are RWAs being looked at by many institutions?

Because it offers transparency, settlement efficiency, and global access to previously inaccessible assets.

When will the big RWA projects release tokens?

A number of major projects are scheduled to release tokens in 2026 after the infrastructure development phase is completed.

Is RWA suitable for short term traders?

RWA is more relevant for medium to long term strategies because of its focus on cash flow and stability.

How to Buy Crypto on Bittime?

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with CoFTRA, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.