Bioethanol Stock Outlook in Indonesia 2025: MOLI, SRSN, and TULA Shine Amidst the 10% Ethanol Program

2025-10-14

Bittime - The Indonesian government's plan to mandate a 10% ethanol blend (E10) in fuel is a major catalyst for the national bioenergy industry. This program aligns with the clean energy transition and efforts to reduce dependence on gasoline imports.

The impact?SharesShares of bioethanol issuers such as MOLI, SRSN, and TULA are currently in the capital market spotlight due to their potential to record a surge in demand and significant revenue increases from 2025 and into the next few years.

READ ALSO: Digital Investment Trends in Indonesia 2025: Opportunities and Challenges

The 10% Ethanol (E10) Program: A Game Changer for the Energy Industry

The E10 policy targets a 10% blend of ethanol with conventional gasoline. The goal is not only to reduce fuel imports but also to support Indonesia's commitment to clean energy.

In the medium to long term, E10 will create a large-scale domestic ethanol market, strengthening the position of companies already operating in this sector.

In addition, the government is preparing various fiscal incentives for bioethanol producers and the plantation sector, which supplies raw materials such as sugarcane and cassava. This step confirms that bioethanol is a key pillar of Indonesia's 2025–2030 sustainable energy policy.

MOLI: Ethanol Market Leader Ready to Harvest Demand

Source:TradingView

PT Madusari Murni Indah Tbk (MOLI) is Indonesia's largest ethanol producer, with a production capacity of 80 million liters per year. This position positions MOLI as the most prepared player to face the surge in demand from the E10 program.

Main catalyst:The implementation of E10 increases domestic ethanol demand by millions of kiloliters per year.

Strong fundamentals:Low debt-to-equity ratio (DER) and capacity expansion make MOLI superior in the long term.

Outlook:If the E10 policy is fully implemented, MOLI has the potential to record a significant increase in revenue, while strengthening its dominance in the new renewable energy sector.

Long-term investorassesses MOLI as the bioethanol stock with the healthiest fundamentals and most stable growth prospects on the stock exchange.

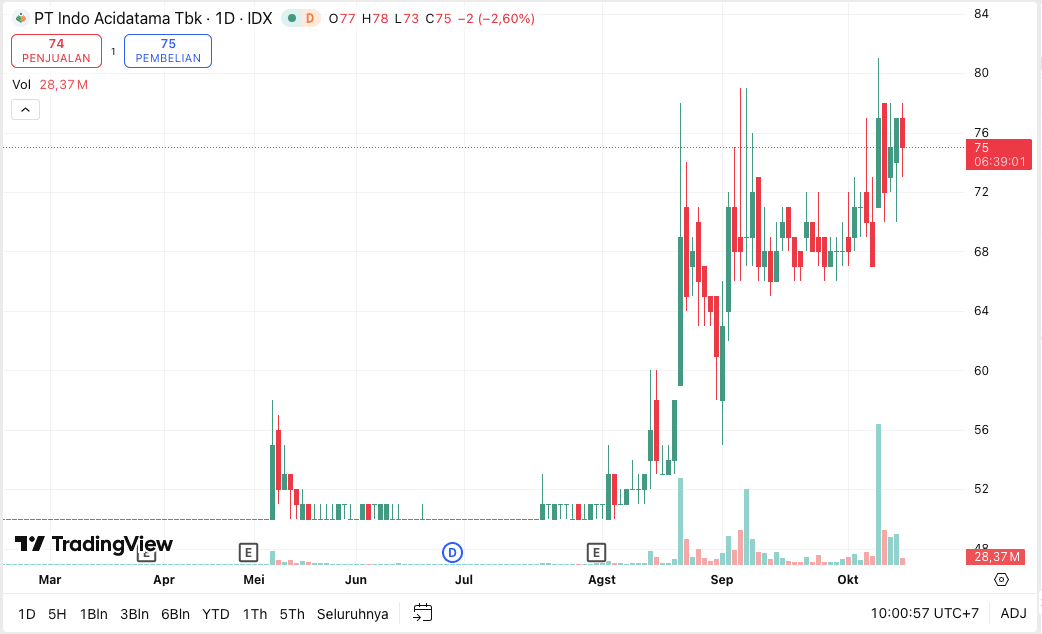

SRSN: Strong Sentiment, High Volatility

Source: TradingView

PT Indo Acidatama Tbk (SRSN) has also been in the spotlight since the government announced its plan to implement E10. While its primary focus remains on the industrial chemicals segment, such as acetic acid, SRSN has prepared a bioethanol business line that is poised for growth.

Positive catalyst:E10 opens up new domestic markets for SRSN ethanol products.

Potential risks:Stock price increases driven by regulatory sentiment are vulnerable to correction if not balanced by increases in real production capacity.

Outlook:High volatility makes SRSN attractive for short-term traders, but risky for conservative investors.

Nevertheless, E10 sentiment remains a strong driver of investor interest in this stock in 2025.

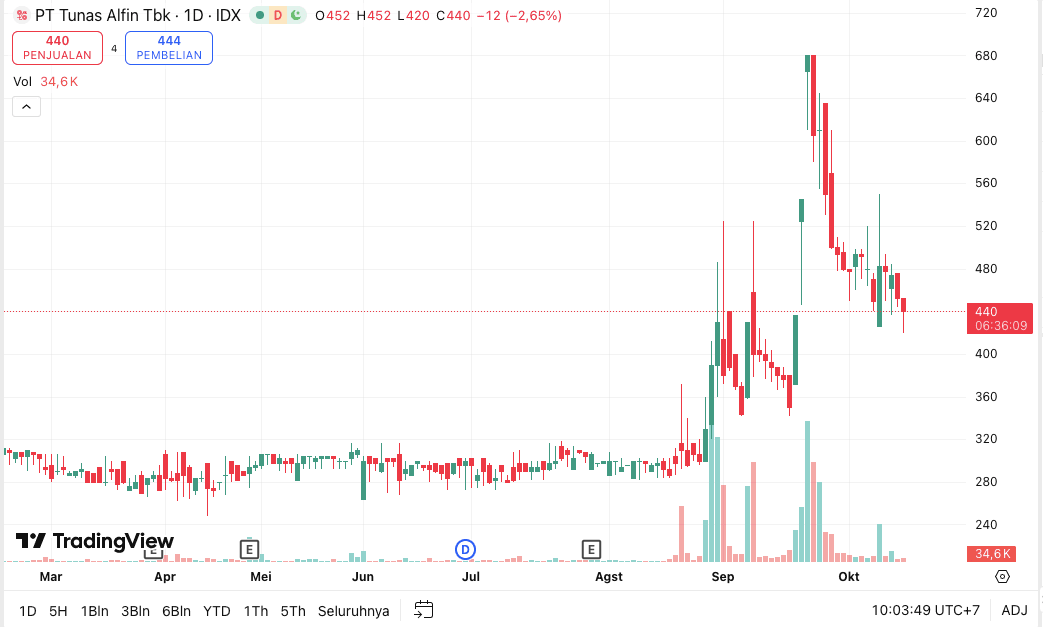

TULA and Other Bioethanol Supporting Issuers

Source:TradingView

PT Tunas Alfin Tbk (TULA), although not directly producing ethanol, has the potential to be indirectly positively impacted through the chemical supply chain and distribution.

In addition, issuers in the plantation and sugar sectors will also benefit, because molasses is the main raw material in the production of bioethanol.

The positive impact is also felt by companies in the energy distribution sector, such as gas station operators and fuel infrastructure, which will distribute E10 products to the market.

With its interconnected ecosystem, the E10 program not only promotes one sector, but has the potential to create a major multiplier effect for Indonesia's green economy.

READ ALSO: Free Float Stocks: Definition, Impact, and Rules According to the IDX

Conclusion

The prospects for bioethanol stocks in Indonesia in 2025 look bright with strong support from the 10% Ethanol (E10) policy.

LIGHTfundamentally superior as a major producer of ethanol.

SRSNoffers sentiment-based trading opportunities.

POEMand other supporting issuers can enjoy indirect impacts through the supply chain and distribution.

If the E10 program is successfully implemented according to the target in the next 2–3 years, the bioethanol sector has the potential to become a new pillar of growth in the Indonesian capital market.

How to Buy Crypto on Bittime

Want to trade sell buy BitcoinsLooking for easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDRand other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visitBittime Blogto get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is the 10% Ethanol (E10) program?

The policy of blending 10% ethanol in gasoline to reduce fuel imports and carbon emissions.

Which issuers benefit most from the E10 program?

PT Madusari Murni Indah Tbk (MOLI) and PT Indo Acidatama Tbk (SRSN) as the main ethanol producers.

What are the prospects for MOLI shares in 2025?

Very positive, due to MOLI's dominant position in the ethanol industry and the E10 policy that supports demand growth.

Is SRSN stock worth buying?

Good for short term sentiment based, but be wary of high volatility.

Is TULA also affected by the bioethanol program?

Yes, indirectly through the chemical supply chain and distribution opportunities within the E10 ecosystem.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.