Rupiah Exchange Rate Prediction against the US Dollar (USD/IDR) October 2025: Opportunities & Risks

2025-09-30

Bittime - The rupiah exchange rate against the US dollar (USD/IDR) has always been a key indicator of the Indonesian economy.

The rupiah's prospects in October 2025 are of concern to many parties—investors, importers, and even exporters and importers.

At this time, the USD/IDR exchange rate is moving aroundRp 16.700-anper dollar.

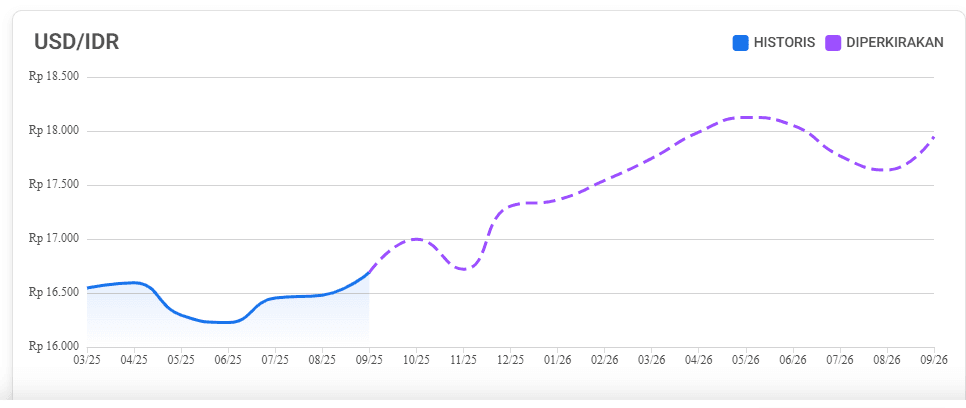

According to data from TradersUnion, the predicted USD/IDR exchange rate for October 2025 is in the range Rp. 16,602 to Rp. 17,279, with an average of around Rp. 16,941

This article will discuss the key driving factors, the predicted USD/IDR exchange rate scenario for October 2025, and the risks to watch out for.

Fundamental Factors Affecting the USD/IDR Exchange Rate

To understand exchange rate predictions, we must look at the following fundamental factors:

1. US Monetary Policy & Interest Rates

The Fed's (Federal Reserve) policy significantly determines the direction of the global dollar. If the Fed adopts a dovish stance (lowering interest rates), pressure on the dollar could ease, allowing the rupiah to strengthen.

2. Bank Indonesia Intervention & Macro Stability

Bank Indonesia has stated that it will boldly use “all instruments” to stabilize the rupiah if it comes under sharp pressure.Exchange rate policies and foreign exchange reserves are important weapons.

3. Current Account Balance & Deficit

The widening current account deficit is driving the need for foreign currency imports. Indonesia is projected to experience a significantly wider deficit in 2025 compared to 2024. This could increase selling pressure on the USD against the IDR.

4. Market Sentiment & Foreign Capital Flows

Foreign capital inflows and outflows into Indonesian financial markets (stocks and bonds) have a significant impact. If global investors view Indonesia's conditions as attractive, the rupiah could receive support.

5. Projections from Financial Institutions

Several institutions have already provided their views on the medium-term USD/IDR:

- Barclays projects the USD/IDR exchange rate will be in the range Rp. 16,600–16,900 within the horizon of one year ahead.

- Additionally, UBS and other local bankers often suggest that the Rupiah will strengthen slightly towards the end of 2025, provided the domestic economy demonstrates strong fundamentals.

- LongForecast predicts the USD/IDR exchange rate in October 2025 will be around Rp. 16,330 to Rp. 17,061, with an average of around Rp. 16,696

Read Also: Today's Gold Price, September 30, 2025: Antam, Pegadaian, PAXG & XAUT

Technical Analysis of the USD/IDR Exchange Rate

From a technical perspective, the USD/IDR exchange rate has shown a fairly consistent upward trend over the past few months.

The rupiah came under strong pressure in the middle of the year, but managed to stay above the area Rp. 16,400–Rp. 16,600 which is now a major support zone.

As long as this level remains stable, the rupiah's potential for a rebound remains open.

On the other hand, the daily chart shows a strong resistance area aroundRp. 17,200–Rp. 17,300

This level has been tested several times but has not been convincingly broken through, so the market is still waiting for a major catalyst that could push the dollar higher.

If this resistance is successfully broken, the rupiah's weakening could continue to higher levels.

Source: Traders Union

Technical indicators, such as medium-term moving averages, also show a bullish trend for USD/IDR, indicating the dollar's continued dominance.

However, the declining trading volume following the recent upswing suggests that the bullish momentum is not yet fully solidified.

Given these conditions, the technical outlook for October 2025 tends to be neutral to bullish for the US dollar.

As long as the rupiah is unable to break through the support level of Rp 16,400–Rp 16,600, the market will tend to move within a consolidation range, with the potential for dollar strengthening limited to the resistance area of Rp 17,200–Rp 17,300.

Read Also: USD to IDR: How Much is 100 Million Dollars in Rupiah?

USD/IDR Exchange Rate Prediction for October 2025

Based on a combination of fundamental and technical factors, here is the predicted scenario:

Average exchange rate prediction for October 2025:around Rp. 16,900 – Rp. 17,000

When the USD/IDR exchange rate is unstable, USDT can be a stable option. Start diversifying by buying USDT di Bittime—trusted, easy and secure platform!

Risks & Important Notes

- If the Fed surprises the market with a hawkish policy, the dollar could strengthen and put pressure on the rupiah.

- If the current account deficit worsens, demand for USD increases.

- BI's intervention could drain foreign exchange reserves if carried out aggressively.

- Global turmoil (geopolitical, financial crisis) could trigger a flight to safety to the dollar.

- Market sentiment towards Indonesia, including politics & fiscal policy, has a big influence.

Read Also: IHSG Prediction After Purbaya Effect & The Fed's FOMC: A Boom or a Crash?

Conclusion

The USD/IDR exchange rate prediction for October 2025 shows that the rupiah has the potential to be in the rangeRp. 16,800 to Rp. 17,200, with an average approachingRp. 16,900–17,000.

If global conditions are favorable and Bank Indonesia intervenes appropriately, the exchange rate could maintain stability or strengthen slightly.

However, global risks and pressure from the current account deficit could force the rupiah to weaken further.

Investors and importers are advised to closely monitor the Fed's policies, trade balance data, capital flows, and BI's actions.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

How does the bank project the USD/IDR exchange rate in October 2025?

Some projections from TradersUnion mention a range of Rp 16,602 – Rp 17,279, with an average of Rp 16,941.

What is the predicted average exchange rate?

The average exchange rate prediction for October 2025 is aroundRp. 16,900 – Rp. 17,000.

Can the Rupiah be stronger than projected?

Yes, if foreign capital flows return to a high level and BI intervenes effectively, the Rupiah could strengthen to touch the ~Rp 16,500 level.

What are the major risks to the Rupiah in October?

Key risks: Fed policy, current account deficit, capital outflows, and global volatility.

Should I hedge against USD/IDR fluctuations?

If you are an importer or your cost commitments are in USD, hedging through forwards or options can be a wise move to reduce the risk of fluctuations.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.