XRP Price Predictions Ahead of the GXRP ETF: Long-Term Analysis!

2025-11-24

The launch of GRAYSCALE’S SPOT XRP ETF (ETF GXRP) is getting closer, and the crypto market, especially XRP, appears likely to experience significant price movements. The ETF will provide easier access for traditional and institutional investors to invest in XRP without having to buy the token directly.

However, with the many factors that influence the market, what is the price outlook for XRP after the launch of the GXRP ETF? This article will discuss XRP price predictions, the advantages and disadvantages of the GXRP ETF, and what the market can expect.

What Is ETF GXRP?

GRAYSCALE’S SPOT XRP ETF (ETF GXRP) is an investment product that allows investors to gain exposure to XRP without having to buy and hold the token directly.

It provides access for traditional and institutional investors to invest in XRP through exchange-traded shares whose value follows XRP’s price movements.

The ETF offers convenience and security for those who want to be involved in the crypto market without having to worry about managing digital wallets.

Read Also: 7 Effective Ways to Trade Crypto for Beginners, Complete with Tips and Tricks

How the GXRP ETF Works

The GXRP ETF works in a way that is similar to other ETFs. Grayscale, as the manager of this ETF, buys and holds XRP as the underlying asset, and investors buy shares in the ETF that are traded on the stock exchange. In this way, investors can benefit from XRP price movements without having to own the token directly.

A major advantage of this product is that investors can access the XRP market through an instrument that is more familiar to them, namely shares, which are easier to administer and protected by stock market regulations.

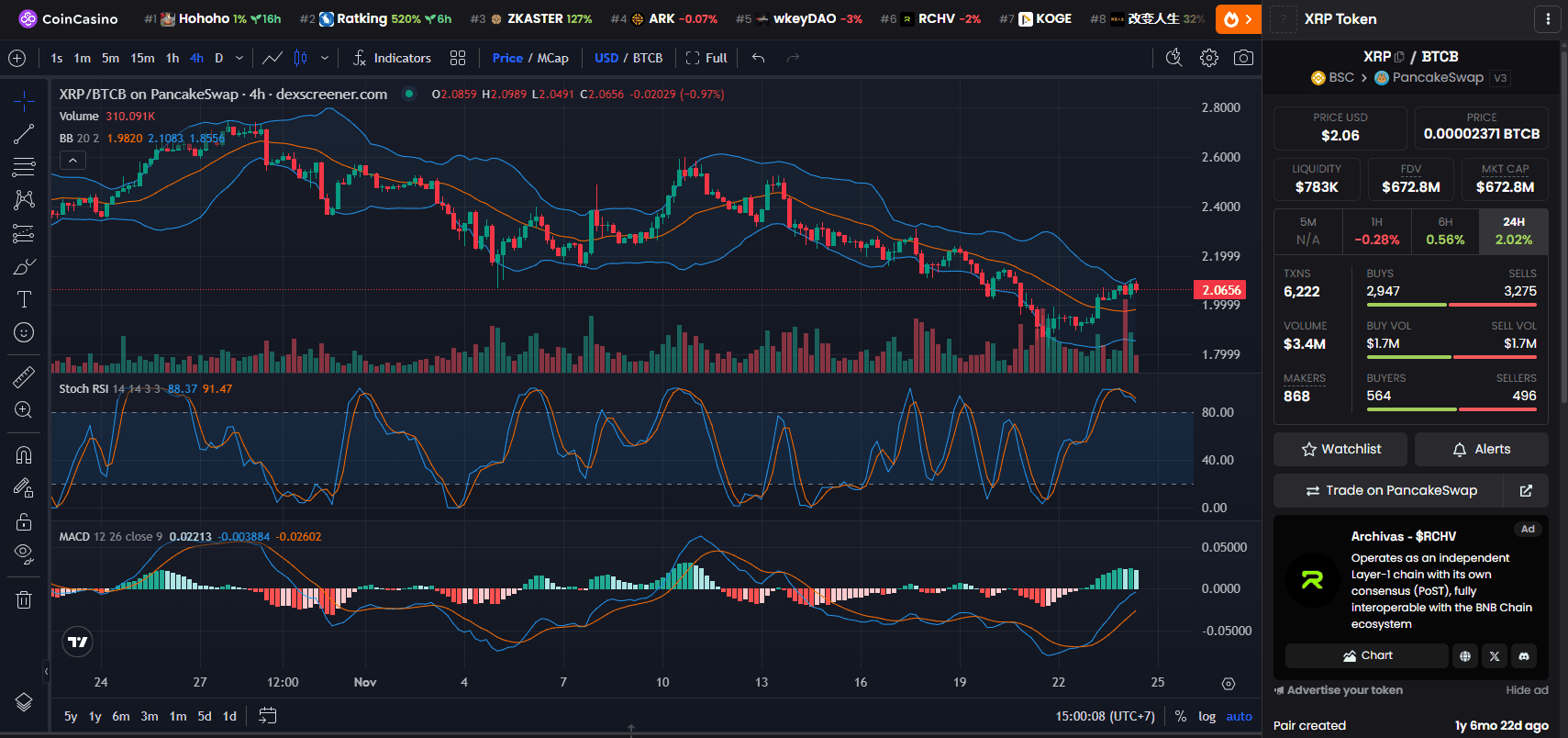

XRP Price Prediction after the GXRP ETF

The launch of the GXRP ETF is expected to trigger a significant increase in liquidity in the XRP market.

Based on the latest price charts, there is a tendency for XRP’s price to rise in line with the ETF launch, with some analysts predicting that XRP could double in price. The following are some factors that could influence XRP’s price after the ETF goes live:

- Rising Demand: With the GXRP ETF, more investors, especially institutional ones, are likely to be interested in investing in XRP. This could increase demand and push prices higher.

- Higher Liquidity: The GXRP ETF is expected to boost liquidity in the XRP market, enabling faster and more efficient trading.

- Greater Volatility: As often happens with ETF launches, XRP’s price volatility could increase. “Buy the rumor, sell the news” behavior is common in the crypto market and can cause sharp price spikes or drops after the ETF launches.

- Institutional Investor Interest: With easier access, institutional investors can enter the XRP market, which may have a long-term impact on XRP’s price.

Pros and Cons of the GXRP ETF

As with all investment instruments, the GXRP ETF has both advantages and disadvantages. Here are some points to consider before investing:

Pros:

- Easier Access: Provides easy access for traditional and institutional investors to invest in XRP without having to buy the token directly.

- Increased Liquidity: The ETF can increase liquidity in the XRP market, making trading easier and potentially supporting higher prices.

- Security: Reduces the risks of storing crypto because custody is handled by Grayscale.

Cons:

- Volatility: Despite offering convenience, XRP’s price can still be highly volatile, especially after the ETF launch.

- Management Fees: ETFs typically charge management fees, which can affect potential long-term returns.

- Market Risk: Sharp price fluctuations can occur after the ETF launch, with the possibility of sell-offs as investors take profit.

Conclusion

The launch of GRAYSCALE’S SPOT XRP ETF (ETF GXRP) is expected to have a major impact on the XRP market, with the potential for significant price increases driven by higher liquidity and stronger investor interest.

However, price volatility and other risk factors must always be taken into account. The XRP market will continue to move dynamically, and this ETF launch could become an important turning point.

If you are interested in investing or want to learn more about the crypto market, visit Bittime Exchange to start trading or read the latest news on Bittime Blog.

How to Buy Crypto on Bittime

Want to trade Bitcoin and invest in crypto easily? Bittime is ready to help. As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start by registering and verifying your identity, then make a minimum deposit of Rp10,000. After that, you can immediately buy your favorite digital assets!

Check the BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to see today’s crypto market trends in real time on Bittime.

In addition, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find reliable articles on Web3, blockchain technology, and digital asset investment tips designed to broaden your knowledge of crypto.

FAQ

What is XRP?

XRP is a cryptocurrency used in the Ripple network, which is designed to facilitate fast and low-cost cross-border payments. XRP aims to provide a solution to the problems of international transactions with low fees and fast settlement times.

What is the GXRP ETF?

The GXRP ETF is an Exchange Traded Fund (ETF) that allows investors to gain exposure to XRP without having to buy XRP tokens directly. It provides convenience for traditional and institutional investors to invest in XRP through a more familiar instrument such as shares.

What affects XRP’s price?

XRP’s price is influenced by several factors, including adoption of the Ripple network by financial institutions, regulatory decisions related to XRP, and the launch of new products such as the GXRP ETF that open wider access for investors.

Will XRP’s price rise after the launch of the GXRP ETF?

Based on market analysis, many expect that the launch of the GXRP ETF could push XRP’s price higher by opening access for institutional investors. However, market volatility remains a key risk after the launch.

What are the risks after the launch of the GXRP ETF?

The main risks after the launch of the GXRP ETF are high price volatility and the potential for “buy the rumor, sell the news” behavior, which often occurs when a new product is launched. This can lead to sharp price fluctuations in a short period of time.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.