Bitcoin Price Prediction (BTC) February 19, 2026, BTC Price Today

2026-02-18

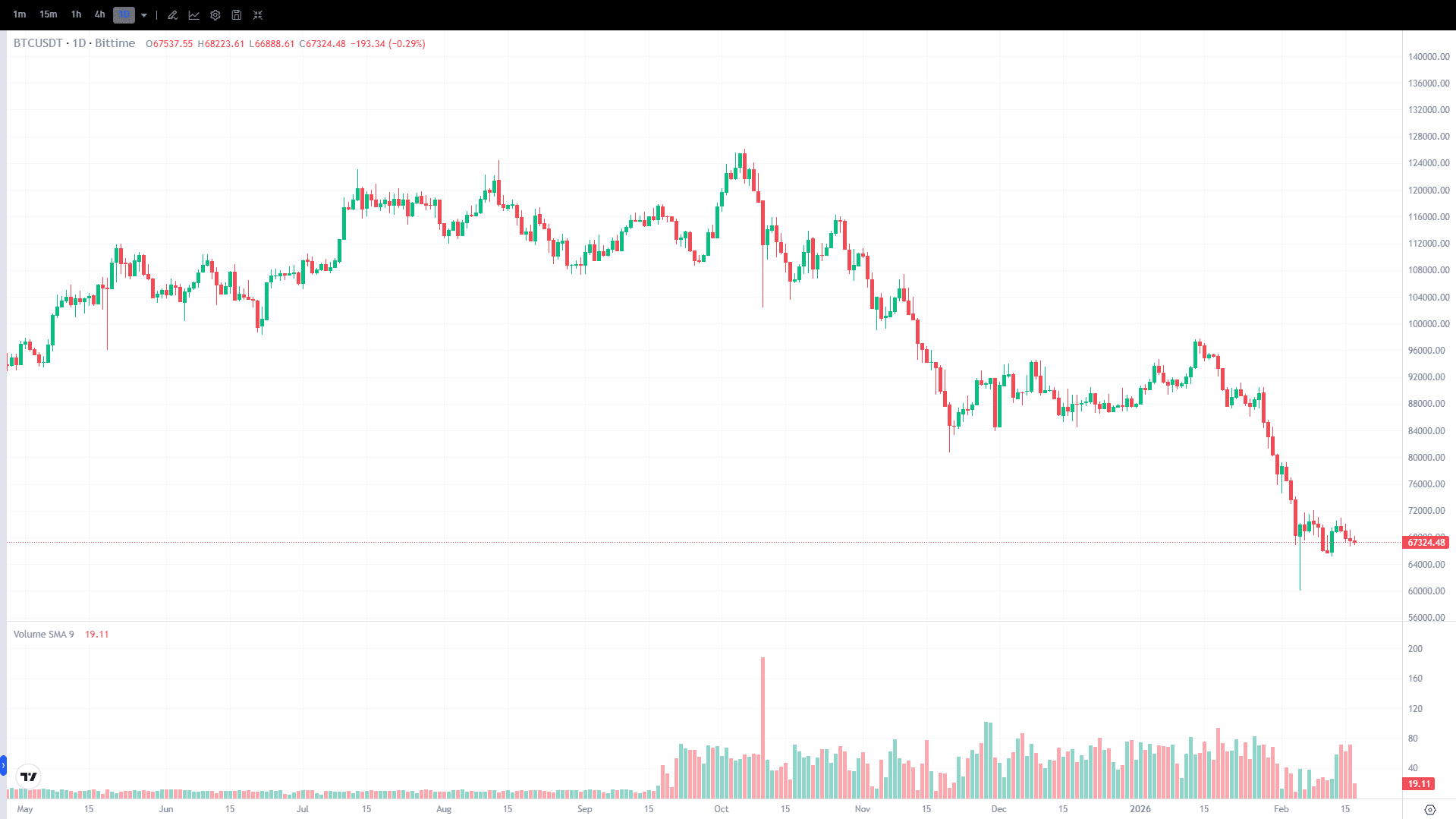

On February 18, 2026, Bitcoin (BTC) traded between $66,889 and $68,224, closing around $67,324 (down -0.29% on the daily candle). For February 19, 2026, BTC is projected to possibly rebound slightly to the $67,526-$68,267 range if the selling pressure subsides.

The crypto market remains volatile, but it is beginning to show signs of consolidation after a sharp decline in recent weeks. BTC's movement remains sensitive to global risk sentiment shifts and macroeconomic agendas.

This article provides an update for February 18, 2026, and projections for February 19, 2026, to help investors understand BTC price trends in a more structured manner.

Key Takeaways

Bitcoin's price prediction for February 19, 2026, ranges between $67,526-$68,267, with a slight increase potential if BTC holds above the daily support level.

On February 18, 2026, BTC traded between $66,889-$68,224, closing around $67,324 (daily candle -0.29%).

Important levels: support at $66,800 and resistance at $68,200-$68,500. The next movement will be heavily influenced by buying volume and macro sentiment.

Bitcoin Price Performance Today

Bitcoin Price on February 18, 2026, slightly weakened on the daily candle, with a low of $66,889 and a high of $68,224. The closing around $67,324 suggests BTC is testing a new balance area after previous selling pressure. Generally, this phase is often marked by consolidation and a struggle for support-resistance levels before determining the next trend direction.

BTC Price to USDT via Bittime Market

As long as BTC does not lose the $66,800 area, there is a potential for a technical rebound towards the nearest resistance. However, if selling volume increases again, BTC could retest further support levels.

Historical Bitcoin Price Movement

Historically, Bitcoin is known to move in cycles: strong rallies, sharp corrections, and then consolidation before a new trend forms. In recent months, BTC has tended to form a series of lower highs and lower lows on the daily timeframe, indicating that selling pressure is still dominant, although it is slowing down.

During such phases, price movements are often sensitive to macro sentiment and major news. Therefore, investors tend to focus on key technical levels and volume confirmation.

Read also: How to Buy Bitcoin (BTC)

Bitcoin Price Analysis for Today, February 18, 2026

From a daily technical perspective, BTC is still in a consolidation zone with a neutral RSI tendency (around 40–50). This indicates that the selling pressure has not fully dissipated, but a rebound remains possible if buyers enter at support levels.

The nearest resistance is at $68,200, with a psychological area of $68,500. If this level is broken with strong volume, BTC could continue its short-term recovery.

Meanwhile, support at $66,800 is a crucial level. A drop below this area could trigger a retest of further support levels (such as $66,000–$65,500) before forming a new rebound.

Factors Influencing Bitcoin Price

BTC's movement is generally influenced by a combination of factors: global market sentiment (risk-on/risk-off), interest rate policies and central bank statements, institutional fund flows, and regulatory dynamics. During volatile periods, changes in macro narratives can accelerate price movements, both up and down.

Moreover, U.S. economic data releases and comments from Federal Reserve officials often impact the DXY and bond yields, which in turn affect risk assets like crypto.

Potential Scenarios

Bullish Scenario: BTC strengthens and breaks through $68,200-$68,500 on February 19, 2026, if buyers enter with strong volume. In this scenario, the next target could potentially move towards $69,000 as the next resistance.

Bearish Scenario: BTC drops below $66,800 if selling pressure becomes dominant again. The $66,000–$65,500 area becomes a candidate for further support. Risk management such as stop-loss remains important to apply.

Bitcoin Price Prediction for February 19, 2026

On February 19, 2026, Bitcoin is projected to move in the range of $67,526-$68,267. This projection assumes that BTC can hold the $66,800 support and begin testing the nearest resistance around $68,200.

However, the crypto market volatility remains high. Therefore, investors are advised to monitor volume movements, price responses at key levels, and global economic news in real-time.

Conclusion

Bitcoin's price on February 19, 2026, is predicted to be in the range of $67,526-$68,267 with a focus on $66,800 support and $68,200-$68,500 resistance. If the support holds, the short-term rebound potential increases. However, if the support is breached, the potential for further decline remains open.

Note: The predictions are indicative and not investment advice. Always do your own research and use risk management.

How to Buy Crypto on Bittime?

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.