Bitcoin Bull Run 2026? CryptoQuant Reveals the NUPL Signal from Long-Term Holders

2026-02-17

The crypto market has been buzzing about the Bitcoin bull run of 2026 after a downturn phase and price action that tends to be anything but “relaxed.” Many people are asking: when will the Bitcoin bull run truly start again?

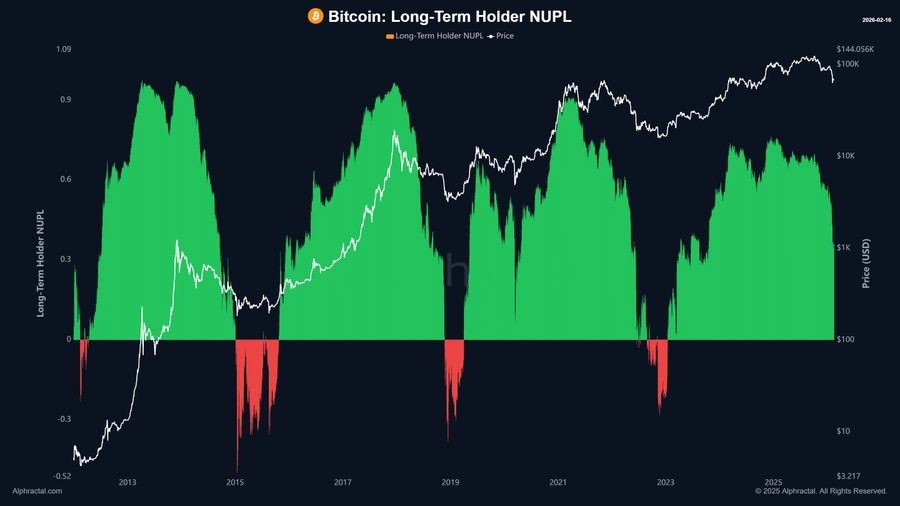

Now, one answer that’s often used to keep expectations in check is on-chain analysis. Here, CryptoQuant highlights an indicator called the Long-Term Holder NUPL, which is considered useful for reading whether the market is nearing a point where selling pressure is running out—or not.

The takeaway is simple: don’t guess—use data. By understanding this CryptoQuant indicator, you can build a calmer plan for managing risk, whether today’s Bitcoin price is rising, falling, or moving sideways.

Key Takeaways

- The Long-Term Holder NUPL signal helps identify when selling pressure starts to “run out.”

- Bitcoin bull runs often emerge after psychologically tough phases, when many long-term holders have felt uncomfortable.

- Bitcoin forecasts for 2026 are healthier when built as scenarios, not a single number.

What Is the Long-Term Holder NUPL and Why Does It Matter?

NUPL stands for Net Unrealized Profit or Loss. The “long-term holder” version focuses on the investor group that is usually the most patient. In Bitcoin analysis, this metric is often used to see whether most long-term holders are sitting in unrealized profit or unrealized loss.

When NUPL is still high, it means many holders are still comfortable in profit. When NUPL drops sharply, the market is usually being stress-tested.

What makes this topic interesting is how practical it is. Instead of being driven by emotion, you can treat NUPL as a “thermometer” for market sentiment.

It’s not a magic tool, but it can help you decide whether your strategy should be aggressive, neutral, or more defensive. In fragile market moments, understanding data like this can reduce impulsive decisions.

Read also: Crypto Trading Strategies for Beginners: Don’t Do This!

How to Read CryptoQuant’s NUPL Signal

- The green zone generally indicates long-term holders are still comfortable in profit.

- A zone near zero signals the market is starting to enter a sensitive phase.

- Negative zones are often associated with capitulation phases, when selling pressure can be near its peak.

- Confirmation is still needed—for example, by checking price and volume reactions after a zone change.

Read also: 7 Effective Ways to Trade Crypto for Beginners, Complete with Tips and Tricks

When Could a Bitcoin Bull Run Happen According to This Signal?

The question “when will the Bitcoin bull run happen?” is a favorite—but the answer is better framed as a set of scenarios. If you follow the CryptoQuant approach (on-chain indicators), major bull runs are usually more likely to appear after the market has passed through a phase where long-term holders start to lose comfort.

The logic is that when the market has “washed out” weak hands, space opens up for a new trend.

However, one thing must be remembered: on-chain indicators are tools, not calendars. You still need to consider other context such as global liquidity, macro sentiment, and how the market reacts to key technical levels.

So, a Bitcoin price forecast for 2026 should be built from multiple angles, not a single signal alone.

Practical Scenarios for a 2026 Bitcoin Forecast

- Conservative scenario: the market recovers slowly, focusing on a higher-low structure and improving capital inflows.

- Moderate scenario: NUPL improves after a tough phase, then price forms a steadier uptrend.

- Aggressive scenario: euphoria returns quickly, but the risk is higher because volatility expands.

- Whatever the scenario, a 2026 Bitcoin price target is safer when written as a range, not a single number.

Read also: Join the Bittime Futures Public Beta Waitlist and Get Trial Funds Rewards up to 1500 USDT

How to Use On-Chain Analysis Without Getting a Headache

A lot of people like data, but end up confused. The trick: simplify the steps. Start with one indicator (for example, NUPL), then compare it with price action.

If today’s Bitcoin price is moving sideways, NUPL can help assess whether it’s a reasonable accumulation phase or simply a pause before another drop. If price rises quickly, NUPL can help gauge whether the market is starting to “overheat.”

To keep it light, you can treat on-chain data as a “decision filter,” not the only decision-maker. In other words, on-chain provides context, while entries and exits should still be guided by risk management.

With this approach, on-chain analysis feels more human and doesn’t wear you out with information overload.

Beginner-Friendly Quick Checklist

- Set your timeframe: daily for the big direction, 4-hour for tighter timing.

- Check NUPL: is it rising, falling, or flat?

- Match it with the trend: is price forming an uptrend or downtrend structure?

- Choose a plan: buy in stages, wait for confirmation, or focus on protecting capital.

Conclusion

The Bitcoin Bull Run 2026 discussion becomes more reasonable when you use data like the Long-Term Holder NUPL from CryptoQuant. It helps turn big questions like “when is the Bitcoin bull run?” into an executable plan—complete with 2026 Bitcoin forecast scenarios and risk controls.

If you want to practice directly with a structured strategy, monitor market movements and manage positions with discipline.

Let’s explore trading opportunities with easy-to-use market features on Bittime Exchange. For daily updates, insights, and light reading on crypto news, also stop by Bittime Blog.

FAQ

What Is the Bitcoin Bull Run 2026?

It’s a term for a projected major uptrend expected around 2026, typically marked by strong upward momentum and rising market interest.

When does the Bitcoin bull run begin?

There is no exact date. Many traders wait for a combination of on-chain signals, price trends, and improving market sentiment.

What is the function of the CryptoQuant NUPL indicator?

NUPL helps assess whether long-term holders are mostly in profit or starting to feel pressure, providing context about the market phase.

Are Bitcoin price predictions for 2026 always accurate?

No. Predictions are scenarios, not certainties. It’s safer to use a 2026 Bitcoin price target range and proper risk management.

What should you do when today’s Bitcoin price is volatile?

Use a reasonable position size, set risk limits, and avoid impulsive decisions. On-chain data can be used as additional context.

How to Buy Crypto on Bittime?

Want to trade and easily buy/sell Bitcoin and invest in crypto with ease? Bittime is ready to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rates for BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to see today’s crypto market trends in real time on Bittime.

In addition, visit the Bittime Blog to get various interesting updates and educational information about the crypto world. Find trusted articles about Web3, blockchain technology, and digital-asset investing tips designed to expand your knowledge of the crypto space.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.