XRP Price Prediction 2026: Price Target, Bullish and Bearish Scenarios, and Support and Resistance Levels

2025-12-30

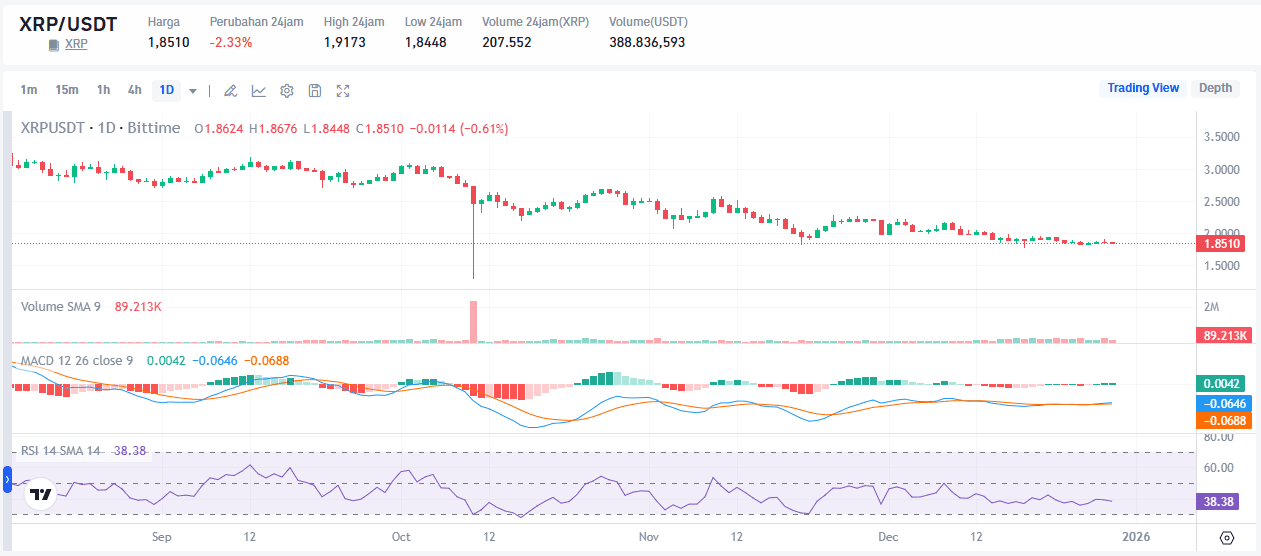

Many people are looking for XRP price predictions for 2026 because 2025 is shaping up to be a challenging year for altcoins. XRP moved aggressively at first, then weakened, and then tended to be flat. This makes 2026 feel like a decisive year. Will XRP form a more orderly uptrend in 2026, or will it continue to weaken and test lower levels?

This article discusses XRP price predictions in an easy-to-read, neutral, and technical manner. There are three main focuses: the 2026 XRP price targets from crypto experts, the bullish XRP 2026 scenario and its triggers, the bearish XRP 2026 scenario and its risks, and the XRP support and resistance levels for 2026 that you can monitor practically.

2026 XRP Price Predictions According to Global Analysts: Price Targets and Three Main Scenarios

In summary, 2026 XRP price predictions according to global analysts do not usually anticipate a sharp surge from the beginning of the year. Many analysts believe that the beginning of 2026 will be relatively calm.

Prices may fluctuate within a certain range while waiting for a truly strong trigger. For clarity, we will use three scenarios: base, bullish, and bearish.

Here are the working price targets in US dollars (USD) that are easiest to use for writing and analysis.

- Base scenario, consolidation

- Working price range: USD 2.00 to USD 2.50

- Meaning: XRP is moving within a range, with no clear direction

- Realistic target: gradual increase as long as the price stays above the USD 2.00 pivot

- Gradual bullish scenario

- Trigger level: USD 3.00

- Further target: USD 3.66 as a frequently discussed peak reference

- Meaning: if USD 3.00 is broken and held, the market begins to shift to a more bullish structure

- Defensive bearish scenario

- Vulnerable level: USD 1.81 to USD 1.79

- Further decline target: USD 1.68 then USD 1.52 to USD 1.50

- Meaning: If support breaks, the downside opens up and recovery is typically slower

To avoid feeling like empty numbers, use this simple reading method.

- If prices frequently hold above USD 2.00, market bias tends to be stable or neutral to the upside

- If prices break through USD 3.00 and hold, bullish bias begins to strengthen

- If prices fall and close below USD 1.79, defensive bias makes more sense

With a scenario-based approach, XRP price predictions become a map of levels with conditions, not just numbers.

Read also: Ripple Acquires Hidden Road for $1.25 Billion: A New Bridge Between TradFi and DeFi

XRP's Bullish Scenario for 2026 and Its Triggers: What Needs to Happen for It to Rise

XRP's bullish scenario for 2026 usually doesn't happen because of one big piece of news. More often, bullishness forms when several small things happen simultaneously. Demand improves, selling pressure eases, and then the chart forms a neater structure. So, the focus is not just “XRP rises,” but “XRP rises with structure.”

Triggers from the market and investor behavior

- More stable demand

- Stable demand makes the rise more sustainable

- The market tends to appreciate rises that are not too wild but consistent

- Selling pressure decreases

- Bullish trends are easier to form when sellers are not aggressive

- This is usually seen when corrections no longer easily break through support

- Crypto market sentiment improves

- XRP is an altcoin, so it is sensitive to risk appetite conditions

- When interest in risky assets returns, altcoins tend to rise as well

Practical bullish confirmation checklist

- Price levels

- Reclaim USD 1.90, then strengthen at USD 1.99

- Hold above USD 2.00 as a psychological pivot

- Key: break through USD 3.00 and hold for several daily closes

- Volume

- Volume increases when prices rise, not just when prices fall

- Rallies without volume often weaken quickly

- Trend structure

- Prices begin to form higher lows, then higher highs

- Corrections do not break the area that has just been broken

- Momentum and cash flow

- RSI is more often above 50 than below 50

- Cash flow indicators such as CMF or MFI do not continue to weaken when prices try to rise

Read also: Ripple Collaborates with Cippher Cash, Here's the Goal!

Bittime: A Secure Crypto Trading Platform

If you want to practice technical analysis, the trading platform is also important. Bittime emphasizes account security with features like multi-factor authentication and 2FA. If you want to start more securely, create an account on Bittime, enable 2FA, then test your strategy with small transaction sizes first.

In essence, the 2026 bullish scenario becomes more credible if XRP can stay above USD 2.00 and then break through USD 3.00. Without that, the increase is often just a short rally that is easily broken.

Read also: ZCash Vs XRP: Analysis of Features, Capitalization, and Arthur Hayes' Claims

The 2026 Bearish Scenario for XRP and Its Risks: Support Levels to Watch and Warning Signs

The 2026 bearish scenario for XRP does not mean XRP will definitely fall. It is a risk map. Bearish warning signs usually appear first through broken support levels, increased selling volume, and deteriorating trend structures.

Resistance levels to watch

- USD 1.90 as the initial recovery area

- USD 1.99 as the next test of strength

- USD 2.50 as the upper limit of the initial range

- USD 3.00 as the neutral and bullish separator

- USD 3.66 as the target area if a bullish trend is truly formed

Support levels to watch

- USD 1.81 as short-term defense

- USD 1.79 as a critical level that often triggers continued selling pressure

- USD 1.68 as continued support if a breakdown occurs

- USD 1.52 to USD 1.50 as a defensive area that is often considered the lower zone

Read also: Ripple XRP Price Prediction 2025–2030: Will XRP Reach $5 in 2025 and $26 in 2030?

How to read risks without panicking

- Use simple rules

- If the price stays above USD 2.00, the market is relatively stable

- If the price closes below USD 1.79, a defensive bias makes more sense

- Separate monitoring times

- Short term for entry and exit timing

- Medium term to see if the trend is improving or deteriorating

In this way, the 2026 XRP prediction becomes a tool for discipline, not a tool for guessing.

Conclusion

The most reasonable XRP price prediction for 2026 can be read as three scenarios. The base scenario tends toward consolidation between USD 2.00 and USD 2.50.

The bullish scenario strengthens if XRP breaks through USD 3.00 and builds a solid structure towards USD 3.66. The bearish scenario strengthens if the USD 1.81 to USD 1.79 support breaks, as this opens up room for a decline to USD 1.68 and then USD 1.52 to USD 1.50.

When writing or making decisions, use a simple technical format: define the scenario, set the levels, then wait for confirmation. This way, analyzing the XRP price in 2026 feels calmer and more reasonable.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is the most commonly used XRP price prediction for 2026 as a target?

Short answer: Many analyses use the range of $2.00 to $2.50 as the baseline scenario, then bullish if it breaks through $3.00.

What is the main trigger for the bullish XRP 2026 scenario?

Short answer: Stable demand, easing selling pressure, and technical confirmation in the form of a closing price that stays above $3.00.

What is the biggest risk to the bearish XRP 2026 scenario?

Short answer: A breakdown of support at USD 1.81 to USD 1.79, which could open the door to a decline to USD 1.68 and then USD 1.52 to USD 1.50.

What are the most important XRP support and resistance levels for 2026?

Short answer: Support at USD 1.81 and USD 1.79, resistance at USD 1.90 and USD 1.99, and the key level at USD 3.00.

What technical indicators are easy to use for analyzing XRP in 2026?

Short answer: Price levels and volume for validation, RSI for momentum, and CMF or MFI to track fund flows.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.