STBL Price Prediction: Stablecoin Innovation with 325% Surge

2025-09-17

Bittime - In the last 24 hours, the priceSTBLsurged more than 325%, far outperforming the overall crypto market.

This surge was triggered by the launch of new products, achievementsall-time high (ATH), and increasing speculation along with the altcoin season trend.

However, behind the hype, it is important to understand the fundamental factors and risks that influence the potential future price of STBL.

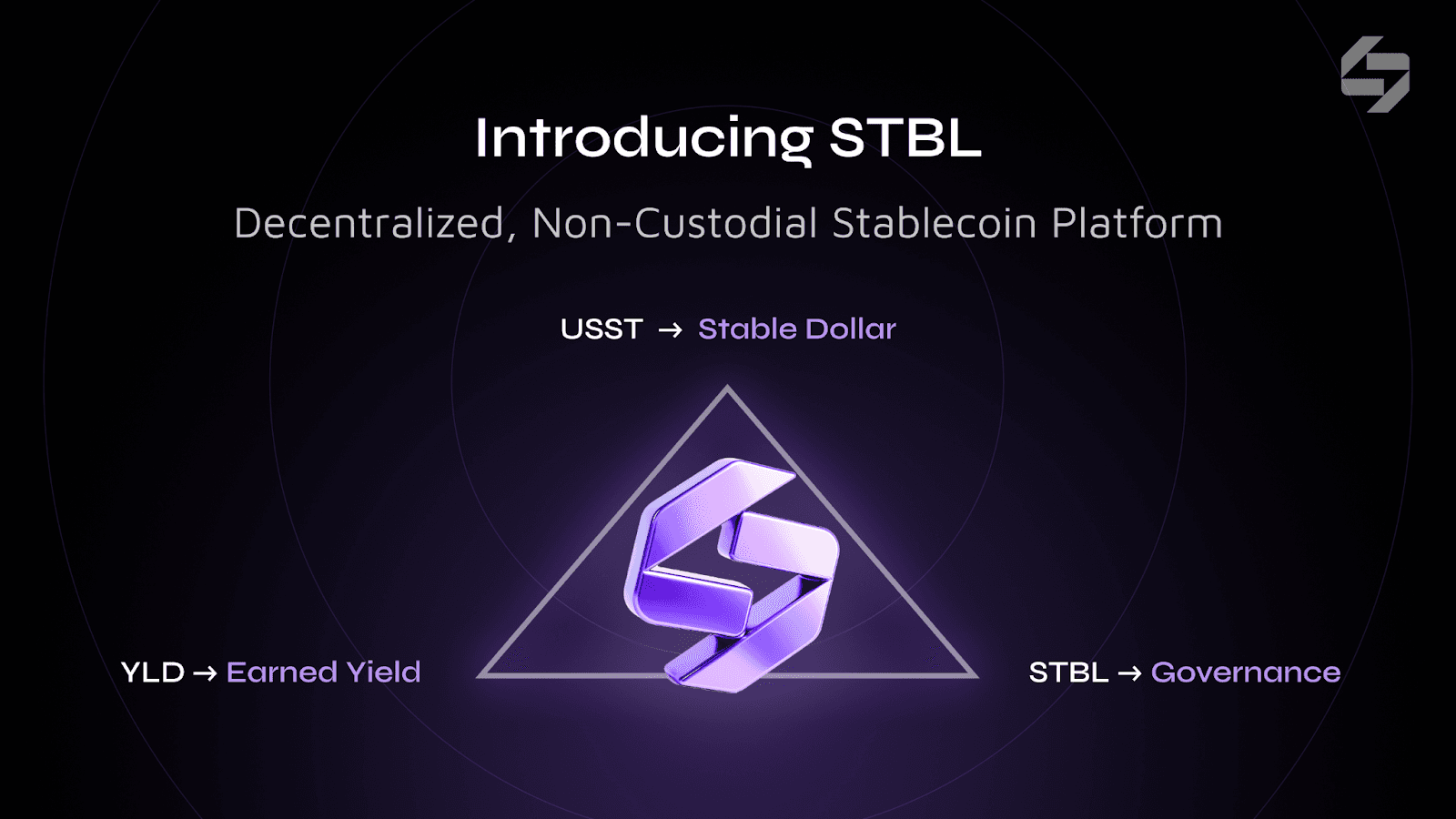

New Product Hype: Three-Token Stablecoin Model

The launch of a three-token stablecoin model led by Tether CEO,Reeve Collins, became the main trigger for market euphoria. This model divides the token's functions into:

- $USST as a token for daily transactions

- YLD NFT as a yield-generating token

- STBL as a protocol governance token

With this design, STBL acts directly as a token that benefits from ecosystem adoption. If DeFi users embrace this separation of utility and yield, demand for STBL could increase significantly.

Price implications: Bullish potential in the medium term, especially if the launched beta dApp can demonstrate user growth and collateral security.

Read Also: What Is the STBL Token? An RWA Stablecoin with Yield and Governance

FOMO ATH: The Rise That Attracts Traders

On September 16, STBL scored an ATH in $0,185, up 26.7% from its previous price of around $0.146. This surge triggered a trading volume of $378 million, a surge of more than 15,000% compared to the previous day.

However, technical indicators show conditionsoverboughtwith an RSI of 94 on the 7-hour timeframe. A 7.2% drop in the last hour also signals a potential correction.

Price implications: Post-ATH FOMO could create a short-term rally, but high volatility and profit-taking risk reversing the trend.

Read Also: What Is Token Base? An Exploration of Tokenomics & Its Role in the Base Ecosystem

Altcoin Season Tailwinds

The STBL surge also occurred amidst a trendAltcoin Season Indexwhich has risen 51% in the past month.

High-beta altcoins like STBL tend to benefit in these conditions as investors seek opportunities with higher potential returns.

However, altseasons typically don't last long. If momentum slows, tokens with immature fundamentals can quickly lose liquidity support.

Price implications: STBL has the potential to follow the broader altcoin trend, but the sustainability of the rally depends on real integration and adoption, not just market sentiment.

RWA Innovation and Regulatory Challenges

STBL is also positioned as part of the narrativeReal World Asset (RWA), backed by real-world asset-based collateral.

This adds credibility, but also opens up the risk of regulatory oversight, particularly from the SEC and other financial regulators.

If regulations are positive, they can increase institutional participation. Conversely, strict regulations can limit collateral options and hinder the growth of the STBL ecosystem.

Read Also: What is CUDIS Token? Roadmap, Allocation, and Price Prediction

Future STBL Price Prediction

- Short Term (1–3 months): $0.12 – $0.20 range, with high volatility due to post-ATH speculation.

- Medium Term (2025): If the adoption of the three-token model is successful, the price has the potential to reach $0.25 – $0.35.

- Risk: If the hype dies down without real adoption, the price could correct back down to below $0.10.

Conclusion

STBL combines stablecoin innovation with altcoin season hype, making it one of the most watched tokens today.

However, a 325% rally in a single day clearly carries the risk of extreme volatility. The long-term price success of STBL is highly uncertain.depends on USST adoption, DeFi integration, And regulatory responsetowards the proposed RWA model.

Investors should monitor key metrics such as dApp user growth, collateral ratios, and quarterly protocol revenue reports before making a decision.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is STBL?

STBL is the governance token of Tether's CEO-led three-token stablecoin ecosystem, designed to separate transaction and yield functions.

Why did STBL price rise 325% in a day?

The surge occurred due to new product launches, ATH achievements, and the boost in altcoin season sentiment.

Is STBL safe for long term investment?

It's too early to say for sure. STBL promises innovation, but also carries regulatory risks and high volatility.

What is the predicted price of STBL at the end of 2025?

If adoption increases, the price could reach $0.25–$0.35. However, if the hype subsides, the price could fall back below $0.10.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.