ANTM Shares Weaken Today to 4,610, Here's a Chart Analysis and Future Price Prediction

2026-01-27

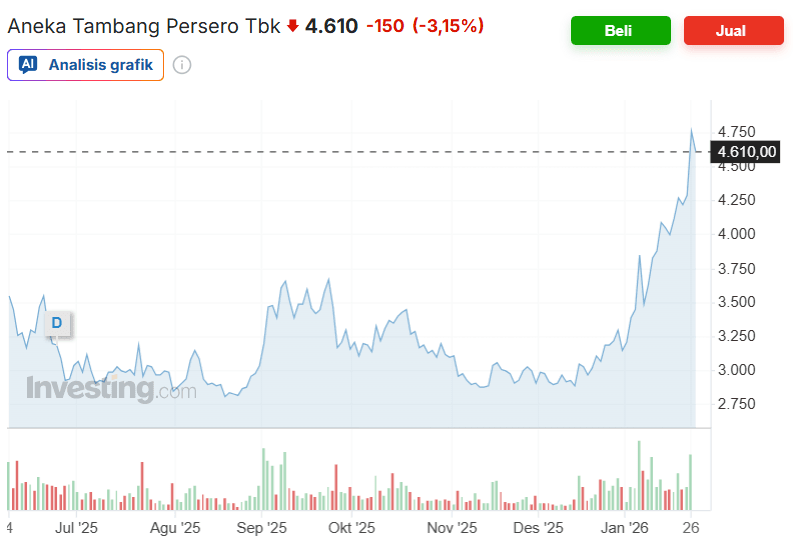

Bittime - ANTM's stock price is back in the spotlight today after Aneka Tambang Persero Tbk closed lower at 4,610. This correction follows a long rally since the end of last year, which had brought ANTM shares close to their new high.

For market players, ANTM's stock price today is not just a closing figure, but an important signal for understanding the direction of the next trend amid fluctuating global commodity prices.

As a stock based on natural resources and mineral downstreaming, ANTM shares often move in line with changes in nickel, gold, and strategic industrial policy sentiment.

The price drop in recent trading raises further questions as to whether this correction is merely a temporary pause or the beginning of a longer consolidation.

By looking at the price chart, transaction volume, and fundamental context, ANTM's stock price prediction can be read more clearly and proportionally.

Key Points

- ANTM shares closed down 3.15 percent today at 4,610 after a strong rally in recent months.

- The price chart shows the potential for a healthy correction amidst a medium-term uptrend.

- ANTM stock price predictions are influenced by commodity sentiment and the direction of investor cash flows.

Register at Bittime now and start trading crypto with a fast, secure, and easy process directly from one application.

ANTM Stock Today: Price Performance and Trading Volume

Based on the latest trading data, ANTM shares fell 150 points, or 3.15 percent, to 4,610 today. This decline occurred after the price briefly touched a high of around 4,750, before selling pressure gradually emerged.

In terms of volume, transaction activity remains relatively high, indicating that market interest has not waned despite the price correction.

This type of movement is common in stocks that have recently recorded significant increases. Short-term investors tend to realize profits, while medium-term investors begin to examine price areas deemed more attractive for accumulation.

In this context, ANTM shares remain within a healthy range today, as long as they don't breach key support areas. Data from Investing and TradingView indicate increased volatility, but this hasn't altered the overall trend structure.

Read Also:Bitcoin (BTC) Price Prediction January 28, 2026

ANTM Stock Chart Analysis Based on the Latest Chart

Looking at the ANTM price movement chart over the past few months, we see a fairly consistent upward trend from the 2,800 area to nearly 4,700.

This increase was followed by a natural correction that brought the price back to the 4,600 area. Technically, the 4,500 to 4,600 zone is now a crucial immediate support area.

As long as the price can hold above this level, the medium-term uptrend remains intact. Meanwhile, the 4,750 to 4,800 area has the potential to become the nearest resistance level, which could be tested if buying interest strengthens again.

The momentum indicators on the chart show short-term weakness, but not yet a major trend reversal. This indicates that ANTM's stock movement is more likely consolidation after a rally, rather than a drastic change in direction.

Read Also:Gold Prediction 2026: XAU Breaks $5,000, Major Banks Raise Target to $6,600

ANTM Stock Price Prediction: Sentiment and Future Prospects

ANTM's near-term share price predictions are heavily influenced by global commodity sentiment, particularly nickel and gold, as well as the direction of domestic industrial policy. As long as sentiment toward downstreaming and the energy transition remains positive, ANTM will remain attractive to investors.

In a conservative scenario, ANTM's share price has the potential to move sideways in the range of 4,500 to 4,800 while awaiting new catalysts. If selling pressure persists and support is breached, a further correction could lead the price to test lower levels.

Conversely, if buying interest re-emerges and volume increases, the opportunity for further gains remains open. The medium-term price forecast for ANTM shares remains positive, with the caveat that volatility still needs to be anticipated.

Read Also:How to Buy Silver: Where to Buy It Easily and Cheaply

Conclusion

ANTM shares closed lower today at 4,610, reflecting a correction phase following sharp gains in recent months. From a technical perspective, this movement is still considered normal and has not altered the medium-term uptrend.

The support area around 4,500 is a key point that determines the direction of the next movement.Future ANTM share price predictions will depend heavily on market sentiment, commodity price movements, and cash flow dynamics.

Read Also:Monad Airdrop: Complete Guide to Claiming MON Tokens

FAQ

What caused ANTM shares to fall today?

ANTM's share price decline today was triggered by profit-taking after a strong rally, amid market volatility and short-term pressure.

Is the ANTM stock trend still positive?

Technically, the medium-term trend remains positive as long as the price remains above the main support area.

What is the predicted price of ANTM shares in the near future?

In the near term, ANTM shares are expected to consolidate within the support and resistance range while awaiting new catalysts.

How to Buy Crypto on Bittime?

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with CoFTRA, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.