Long-Term Humidifi (WET) Price Prediction

2025-12-22

Long-term Humidifi (WET) price predictions have become an increasingly popular topic among crypto investors, especially those interested in the Solana-based DeFi sector.

Humidifi comes with a liquidity and capital efficiency approach designed to address modern DeFi challenges. However, like other crypto assets, WET price movements remain subject to market volatility.

We will discuss objectively the long-term potential of the WET token, the factors that influence its value, and considerations on the best time to enter the market, so readers can make more rational and measured decisions.

What Is Humidifi (WET)?

Humidifi is a decentralized finance protocol built on the Solana network. This project focuses on liquidity optimization and improving digital asset efficiency through DeFi mechanisms designed to be simple yet functional.

By leveraging Solana’s fast transactions and low fees, Humidifi aims to create an ecosystem that is easy for new users to access while remaining relevant for experienced DeFi users.

The WET token is the core of the Humidifi ecosystem. It serves as an incentive tool, a means of protocol interaction, and a potential driver of future governance. Clear token utility is one of the key factors when assessing the long-term prospects of a crypto asset.

Some key points about Humidifi (WET) include:

- A Solana-based DeFi protocol with a liquidity focus

- WET as the primary utility token in the ecosystem

- Designed for cost efficiency and user experience

- Supports sustainable growth of the DeFi ecosystem

Humidifi’s Fundamental Value in the DeFi Ecosystem

Humidifi’s fundamental value lies in its ability to simplify access to DeFi services. If user adoption increases and token utility continues to expand, WET may develop natural demand that supports its long-term value.

Read Also: Crypto Trading Strategies for Beginners: Don’t Do This!

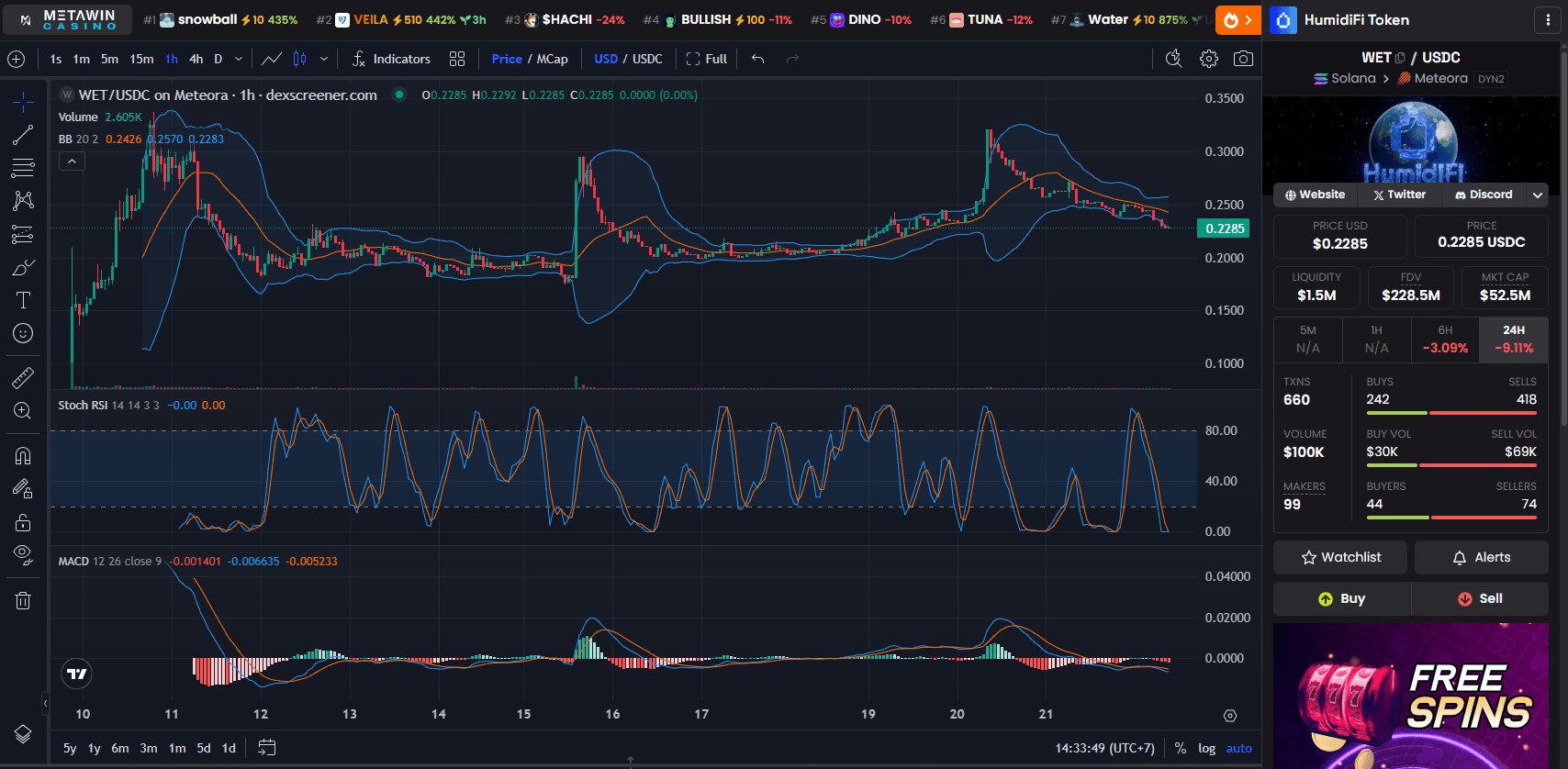

Long-Term Price Prediction for the WET Token

Long-term WET token price predictions depend heavily on a combination of fundamental factors and overall market conditions. Fundamentally, the growth of the Humidifi ecosystem, the number of active users, and successful product development are key determinants.

The higher the activity within the protocol, the greater the likelihood of sustained token demand.

In a moderate growth scenario, WET’s price tends to move more steadily as user adoption increases. In an optimistic scenario, rising interest in Solana DeFi and the rollout of new features may drive gradual price appreciation.

However, in a conservative scenario, the price may remain flat if adoption is slow or the crypto market is in a consolidation phase.

Some key factors influencing long-term WET price predictions include:

- Consistency in development and the project roadmap

- User growth and transaction volume

- Global crypto market conditions

- Investor sentiment toward the Solana DeFi sector

Risks to Consider

Despite its potential, WET still carries risks. Price volatility, intense competition in the DeFi sector, and reliance on the team’s execution are factors that should be closely considered.

Long-term investors should monitor the project’s progress regularly and avoid relying solely on short-term price movements.

Read Also: 7 Effective Ways to Trade Crypto for Beginners, Complete with Tips and Tricks

When Is the WET Token Worth Buying?

Determining when the WET token is worth buying requires a disciplined approach. Long-term investors typically consider price consolidation phases as relatively safer accumulation areas.

In addition, the period after product updates are released or token utility is enhanced often attracts market attention.

A gradual buying strategy can also help reduce risk from price fluctuations. This approach allows investors to enter the market without having to precisely guess the lowest price point.

Some considerations before buying the WET token include:

- Overall crypto market conditions

- The latest developments in the Humidifi ecosystem

- Long-term or mid-term investment goals

- Personal risk management readiness

A Rational Approach for Investors

A rational approach means understanding that no prediction is certain. Combining fundamental analysis, market sentiment, and risk management is key to capturing WET’s long-term opportunities.

Conclusion

Humidifi (WET) offers a Solana-based DeFi concept with a focus on liquidity and efficiency. Long-term Humidifi price predictions are heavily influenced by user adoption, token utility, and overall crypto market conditions.

While it has growth potential, WET still carries risks that must be well understood. A measured, information-based investment approach will help investors make wiser decisions.

To start trading or safely monitor crypto asset movements, you can explore the full features on Bittime Exchange. Don’t miss the latest crypto insights and educational content on Bittime Blog.

FAQ

What is Humidifi (WET)?

Humidifi is a Solana-based DeFi protocol focused on liquidity and digital asset efficiency.

Is WET suitable for long-term investment?

WET has long-term potential if the ecosystem grows, but risk analysis is still necessary.

What factors affect the price of WET?

WET’s price is influenced by token utility, user adoption, and overall crypto market conditions.

Is the WET price stable?

WET’s price is volatile and can change along with market sentiment.

Where can I monitor WET’s development?

WET’s progress can be tracked through exchange platforms and trusted crypto information channels.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.