Antam Gold Price Prediction for October 2025: Consolidation or Reaching IDR 2 Million per Gram?

2025-09-30

Bittime - Gold prices are once again in the spotlight as October 2025 approaches.

After fluctuating throughout September, many investors are wondering whether this month will be the moment Antam gold will break through the psychological level of Rp2 million per gram.

This article will discuss a flashback of global price movements, international analyst predictions, Antam gold price simulations in Indonesia, and investment strategies to consider.

September 2025 Flashback: From Euphoria to Consolidation

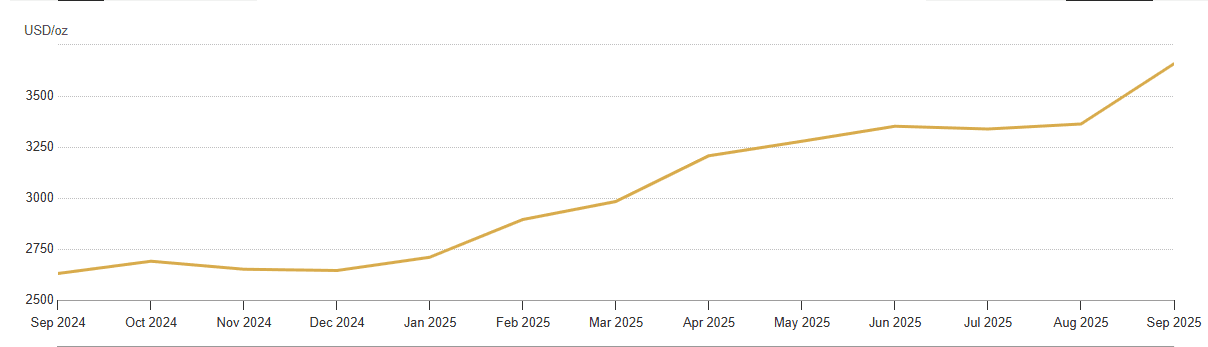

September 2025 is marked by gold price consolidation in the range of $3,300–$3,500 per troy ounce.

Although stable compared to the April spike that broke through $3,500, the market remains shrouded in uncertainty.

The US gold bullion import tariff policy, which initially sparked euphoria, has instead depressing prices after President Trump provided limited clarification. Investors who were previously optimistic have turned cautious.

This consolidation is the foundation for October, raising the question: will this phase be the foundation for a rally or the beginning of a downturn?

Read Also: Today's Gold Price, September 30, 2025: Antam, Pegadaian, PAXG & XAUT

Global Predictions October 2025

Global analysts have given mixed projections for October HSBC estimates that gold prices will be in the range $3.100–$3.600 per ounce, with an average of $3,215, indicating that price strength remains intact despite the decline from the peak.

Conversely, Goldman Sachs is more bullish, predicting prices could reach $3,700–$4,500 in an extreme scenario. Other analysts see a sideways trend around $3,480 per ounce at the start of the month.

Meanwhile, the World Gold Council (WGC) highlighted seasonal factors such as Indian demand ahead of Diwali. Although consumption had fallen to a five-year low, there was still potential for a rebound.

The WGC even sees a possible increase of 0–15% in the second half of 2025, especially if global economic conditions worsen.

Antam Gold Price Simulation in Indonesia

Local investors typically focus on the price per gram. Using a conversion of 1 troy ounce = 31.1 grams and an exchange rate of IDR 16,500/USD, the global gold price of $3,400–$3,700 per ounce is equivalent to:

- $3.400/oz ≈ Rp1.804.000/gram

- $3.700/oz ≈ Rp1.965.000/gram

Adding printing costs, VAT, and buying and selling margins, the price of Antam gold is very likely to reach IDR 2 million per gram by October 2025.

This level has important psychological significance for Indonesian investors, as it is considered emotional resistance.

Gold Technical Analysis

Technically, the gold price chart shows a consolidation phase after a strong rally in the first half of 2025 $3.300–$3.350 become a fairly solid support, while the resistance is at $3.600–$3.700.

The daily movement pattern is still above the 100-day Exponential Moving Average (EMA), indicating that the medium-term trend remains bullish.

However, weak trading volumes on the recent upswing signal potential sideways movement before any major catalysts such as the Fed's interest rate decision or geopolitical turmoil.

Given these conditions, the technical outlook for October 2025 is neutral-bullish. As long as the price remains above the $3,300 support level, the opportunity to test the $3,700 resistance level remains open.

Check today's Pax Gold (PAXG) price

Antam Gold Investor Strategy

For long-term investors, the Dollar Cost Averaging (DCA) strategy remains relevant. By purchasing regularly, regardless of daily fluctuations, timing risk can be minimized.

For short-term traders, technical levels should be monitored. If the price approaches the $3,300 support level, it could be an entry opportunity. However, if it approaches the $3,700 resistance level, caution is needed due to the potential for a false breakout.

Indonesian investors can also consider diversifying between physical Antam gold and more liquid digital gold such as PAXG or XAUT.

If you are interested in trying digital gold assets, start buying PAXG And XAUT in Bittime easily and safely.

Check Tether Gold (XAUT) price today

Conclusion

Antam's gold price prediction for October 2025 shows significant potential to reach the psychological level of IDR 2 million per gram, in line with bullish projections from several global analysts.

However, macroeconomic factors such as Fed policy, inflation, and Indian demand will remain the main determinants of price direction.

Technically, gold still has room to stabilize and strengthen, with a neutral-bullish scenario being more dominant.

For investors, strategic flexibility between DCA and short-term trading is crucial to capitalize on opportunities while managing risk.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

Will Antam gold prices reach IDR 2 million per gram in October 2025?

It is very likely possible, especially if global prices break through $3,700 per ounce and add exchange rate factors and printing costs.

What are the main factors influencing the gold price in October 2025?

The main factors include the Fed's policy, global inflation, Indian demand ahead of Diwali, and geopolitical conditions.

What strategy is suitable for investing in Antam gold?

In the long term, a DCA strategy is safer. Meanwhile, in the short term, pay attention to the technical support levels of $3,300 and $3,700.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.