Bitcoin Price Prediction Q4 2025: Analysis and Prospects

2025-10-21

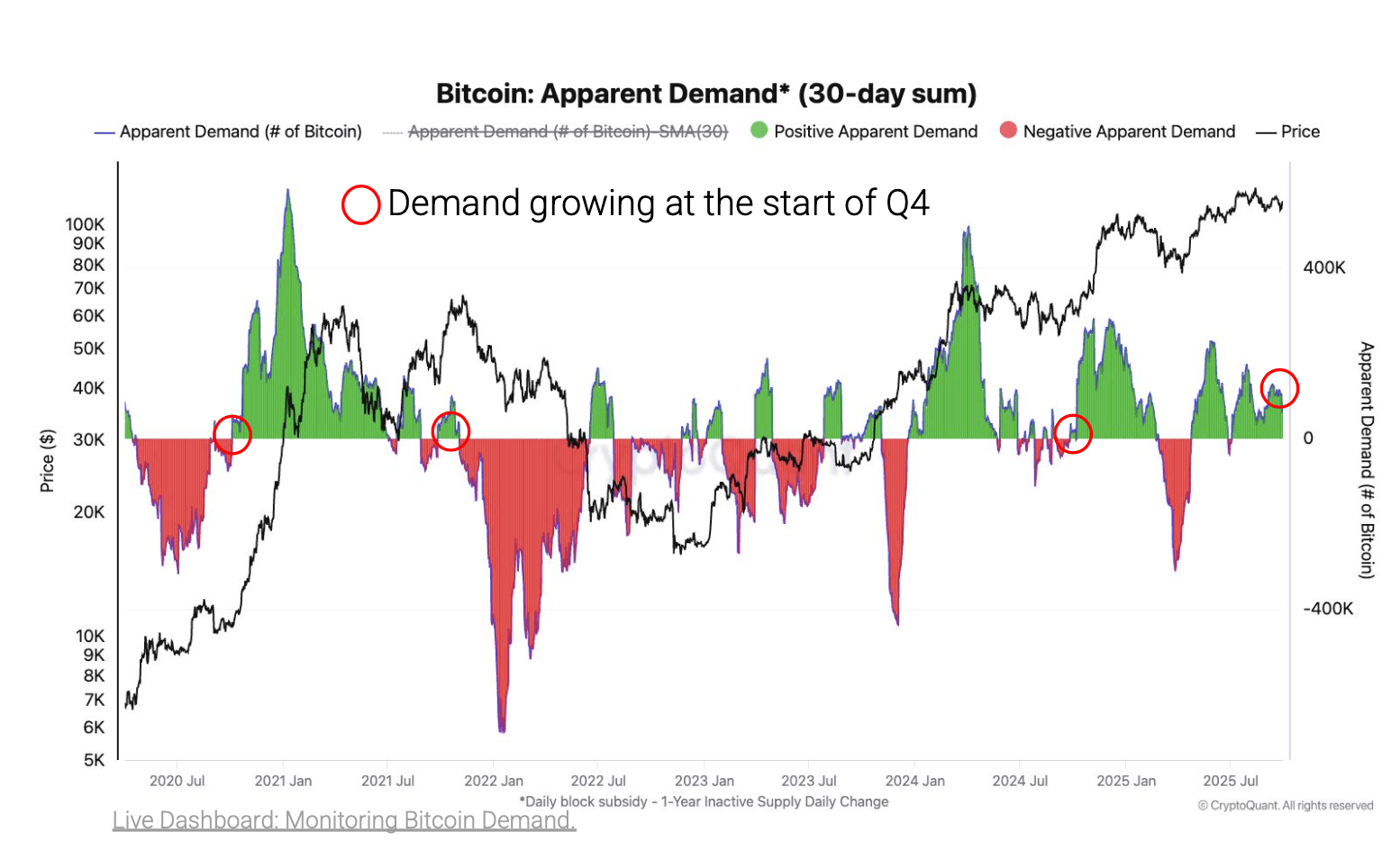

Bitcoinstarted the final quarter of 2025 with quite an impressive momentum. According to a recent report from on-chain analytics firmCryptoQuant, market conditions are showing signs of strengthening that could drive a price rally in the fourth quarter.

CryptoQuant estimates that Bitcoin price could potentially reach the range$160,000 to $200,000before the end of the year, provided demand continues to rise. Let's discuss the factors influencing this prediction and how Bitcoin's trend could develop in the coming months.

On-Chain Factors Driving Positive Predictions

CryptoQuant notes that since July 2025, demand for Bitcoin in the spot market has continued to increase at a rate of more than62,000 BTC per monthA similar pattern emerged before major rallies in the fourth quarters of 2020, 2021, and 2024.

This surge in demand shows that investor interest in Bitcoin remains very strong, especially amidst the global economic recovery and weakening confidence in traditional assets.

In addition, the activitywhalealso experienced a significant increase. CryptoQuant data shows that whale holdings are growing at an annual rate of around331.000 BTC, higher than 255,000 BTC in the last quarter of 2024. This surge indicates that large market participants continue to increase their holdings, strengthening confidence in Bitcoin's potential price increase.

Meanwhile, ETF Bitcoinlisted in the United States also recorded a 71% increase in purchases compared to the previous quarter. In Q4 2024, total purchasesETF reach 213.000 BTC, and this figure could continue with a similar trend this year. According to Julio Moreno, Head of Research at CryptoQuant, demand from financial institutions was the main driver of Bitcoin's price movement in Q4.

Read Also:17+ Recommended Bitcoin Movies, Learn Crypto the Fun Way!

From an on-chain technical perspective, Bitcoin has successfully broken through the “trader’s realized price” level of around$116.000, which marks the transition to a new bullish phase. Bitcoin is currently trading in the range$117.300, opening up the opportunity to move into the $160,000–$200,000 price range as predicted.

Crypto Market Sentiment and Liquidity on the Rise

Besides demand factors, crypto market liquidity also plays a significant role in driving price movements. CryptoQuant revealed thatlikuiditas stablecoinhas risen in recent weeks, providing additional fuel for a potential rally.

This increase in liquidity often signals that market participants have ready funds to make large purchases of crypto assets such as Bitcoin.

Index “Bitcoin Bull ScoreCryptoQuant's index also showed significant improvement. At the end of the third quarter, the index was at the level of40–50, similar to conditions before the major rally in late Q3 2024, when Bitcoin's price surged from $70,000 to $100,000. This means the market is at the beginning of a phase of optimism, though not yet fully euphoric.

Furthermore, selling pressure from traders who haven't yet realized profits has also decreased. CryptoQuant assesses that the lower level of unrealized gains indicates a decrease in the potential for short-term profit-taking. In other words, most investors are still holding their positions, indicating confidence in further price increases.

However, analysts remain cautious. Increased demand and liquidity do not necessarily guarantee a sustained rally. External factors such as global interest rate policies, macroeconomic conditions, and potential new regulations on crypto ETFs could influence Bitcoin's price direction in the near term.

Bitcoin Q4 Price Outlook: Between Optimism and Caution

Based on on-chain data and current market trends, many analysts predict the fourth quarter of 2025 could be a pivotal period for Bitcoin. CryptoQuant assesses the target$160,000 to $200,000realistic if market conditions remain supportive, especially if institutional and retail demand continues to increase.

Similar predictions also came from several large financial institutions.Standard Chartered Bank, Bitwise, and senior analystTom Lee of Fundstratexpressed a positive view on Bitcoin price movements.

Even Standard Chartered projects that the price of Bitcoin could reach$500,000 in 2028, driven by increased global investor access and reduced volatility.

Read Also:Who is Peter Todd? HBO's Alleged Creator of Bitcoin

However, investors are advised to remain cautious. Rapid rallies are often followed by sharp corrections, especially if there is a surge in selling volume from short-term traders.

For now, the market's main focus is to maintain momentum above the psychological area.$115.000–$120.000, which provides a strong basis for movement towards medium-term targets.

For those of you who want to monitor Bitcoin price movements or start investing in a safe and easy way, you can join viaBittime.comThis platform provides access to a variety of popular crypto assets as well as market analysis features to help you make smarter investment decisions.

Read Also:Money Electric The Bitcoin Mystery Movie, Synopsis and How to Watch It

Through Bittime, you can also learn to understand on-chain trends, monitor liquidity data, and evaluate risks before purchasing Bitcoin. Small steps like these can be a great start to building a long-term crypto portfolio with a well-thought-out strategy.

Conclusion

The fourth quarter of 2025 appears to be a promising period for Bitcoin. With increasing demand in the spot market, support from large institutions, and abundant stablecoin liquidity, the potential for a rally towards the $160,000–$200,000 range is wide open. However, investors should still consider the risk of price corrections and global macroeconomic factors.

Analysis from CryptoQuant and other institutions suggests that Bitcoin is at the beginning of a new bullish phase, but consistent demand growth will be key. To capitalize on this opportunity wisely, be sure to conduct your own research and use trusted platforms likeBittime.comto support your investment strategy.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is the Bitcoin price prediction for Q4 2025?

CryptoQuant estimates that Bitcoin prices could reach the $160,000–$200,000 range if demand continues to grow through the end of the year.

What factors influence the rise in Bitcoin prices?

The increase was driven by increased spot demand, accumulation by whales, and large purchases by Bitcoin ETFs in the US.

Is now a good time to buy Bitcoin?

The best time depends on your investment strategy. Many analysts view Q4 as potentially positive, but the risk of volatility remains.

Why do ETFs affect Bitcoin prices?

ETFs increase institutional investor access and increase real demand for Bitcoin in the open market.

Where can I buy Bitcoin safely in Indonesia?

You can buy and monitor Bitcoin prices on trusted local platforms such asBittime.com, which is registered and supervised by Bappebti.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.