Bitcoin (BTC) Price Prediction January 20, 2026

2026-01-19

Bittime - Bitcoin's price is back in the spotlight today after sharp movements in the past 24 hours. Based on trading data, BTC/IDR on Bittime Bitcoin is trading at around Rp1.56 billion with selling pressure still being felt ahead of January 20, 2026.

This price change has made market participants more cautious, especially after Bitcoin failed to maintain its daily high above Rp1.61 billion.

In the context of today's Bitcoin price prediction, January 20th, the market isn't in a panic phase, but it's clearly losing its short-term upward momentum. This article reviews the current Bitcoin price, combining market data, technical analysis from the 4-hour chart, and the BTC movement scenario for trading on January 20, 2026. Buy Bitcoin on Bitrue easily here.

Key Points

• Bitcoin price today is around IDR 1.56 billion with moderate selling pressure

• BTC failed to hold above the resistance of Rp1.60 billion

• Technical indicators point to a weakening consolidation phase

• Short-term support will determine Bitcoin's future direction.

Today's Bitcoin Price in the IDR Market

According to Bittime data, BTC/IDR was recorded at around Rp1,568,139,836, with a daily decline of around 2.5 percent. In the past 24 hours, Bitcoin reached a high of Rp1.617 billion before reversing course and dropping to a low of Rp1.558 billion. This range indicates still quite active volatility, although not as extreme as the previous rally phase.

Daily trading volume was recorded at around 23.99 BTC, equivalent to over Rp38 billion. This figure was relatively stable, but a spike in volume at the end of the session occurred when the price weakened. This pattern is often interpreted as a sign that some market participants are opting to secure profits after a brief rally a few days earlier.

In the context of today's Bitcoin price, the IDR market tends to follow the global movement of Bitcoin, which is entering a lull. There's no evidence of extreme liquidation pressure, but aggressive buying interest hasn't consistently returned.

Harga BTC ke USDTvia Market Bittime

Bitcoin Technical Analysis Based on 4-Hour Chart

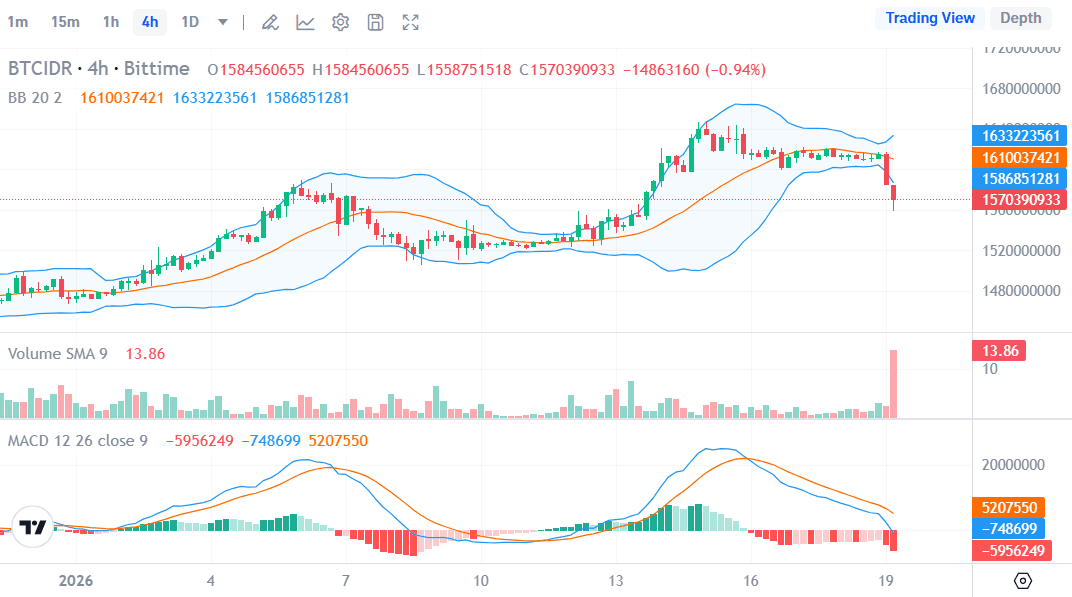

On the 4-hour chart, Bitcoin is seen moving within Bollinger Bands, which are beginning to narrow after a sharp expansion in the middle of the month. The price is currently below the middle line of the Bollinger Bands, indicating that short-term bearish pressure remains dominant.

The latest drop also brought BTC closer to the lower band area, a zone that often triggers technical reactions.

The moving average line shows the price starting to fall below the intermediate moving average, confirming the loss of bullish momentum. Meanwhile, the MACD indicator shows a widening red histogram, with the MACD line below the signal line. This indicates that selling pressure has not yet fully subsided.

The increased volume during the formation of the red candle reinforces the narrative that this weakness is more than just noise. However, no aggressive breakdown structure is yet apparent. As long as Bitcoin can hold above the psychological support of Rp1.55 billion, a consolidation scenario remains more relevant than a major trend reversal.

Read Also:Timothy Ronald's Case Is Trending, Here's What You Need to Know

Bitcoin Price Prediction January 20, 2026

Entering trading on January 20, 2026, the Bitcoin price prediction for today, January 20, is likely to move in two main scenarios. The first scenario is a weakening consolidation in the range of IDR 1.55 billion to IDR 1.59 billion. Under this condition, the market awaits new catalysts before determining its next direction.

The second scenario is a technical rebound if Bitcoin manages to hold strong in the Rp1.55 billion support area. Buying from this area could potentially push the price back to test the Rp1.59 billion to Rp1.60 billion resistance. However, without a significant increase in buying volume, the chances of a breakout remain limited.

Conversely, if selling pressure persists and the Rp1.55 billion support level is breached, Bitcoin risks falling towards the Rp1.52 billion area, which serves as further support. For short-term traders, a conservative approach with strict risk management is a rational choice amidst an uncertain market structure.

Read Also:Venezuela Has $1,000 Trillion in Bitcoin Reserves: Potential Impact on the Global Crypto Market

Conclusion

Bitcoin's price is currently showing a cooling phase after a brief rally. Based on technical analysis and BTC/IDR trading data, the Bitcoin price prediction for January 20, 2026, points to consolidation with a tendency to weaken as long as key support levels remain unconvincingly tested.

The market hasn't yet signaled a strong reversal, but it hasn't entered an aggressive bearish phase either. In such conditions, disciplined reading of support and resistance levels becomes more important than speculating on extreme directions.

Bitcoin is still moving healthily in the medium-term structure, although short-term upside room appears limited.

Read Also:2026 Gold Installment Simulation: Example Calculations & Tips Before You Start

FAQ

Does the price of Bitcoin still have the potential to rise today?

There is still a chance for a technical rebound if Bitcoin can stay above the Rp1.55 billion support area and buying volume increases again.

What is Bitcoin's current closest support?

The nearest support is around Rp1.55 billion, with further support at Rp1.52 billion if selling pressure continues.

Are these conditions suitable for buying Bitcoin?

Current market conditions are more suited to experienced traders who understand risk management, not aggressive entries without confirmation.

What are the main factors influencing BTC movement today?

Technical factors, short-term profit-taking, and a lack of new catalysts are the main drivers of Bitcoin's current price movement.

How to Buy Crypto on Bittime?

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.