Binance Holder (BNBHOLDER) Price Prediction and What You Need to Know

2025-11-17

The price prediction for Binance Holder (BNBHOLDER) has been a hot topic of conversation since this token exploded on Binance Wallet's MemeRush program in October 2025. Within minutes, the market capitalization surged by over 100 million dollars with a volume of around 80 million dollars on the BNB Chain, and dozens of wallets made millions of dollars in profits from this token.

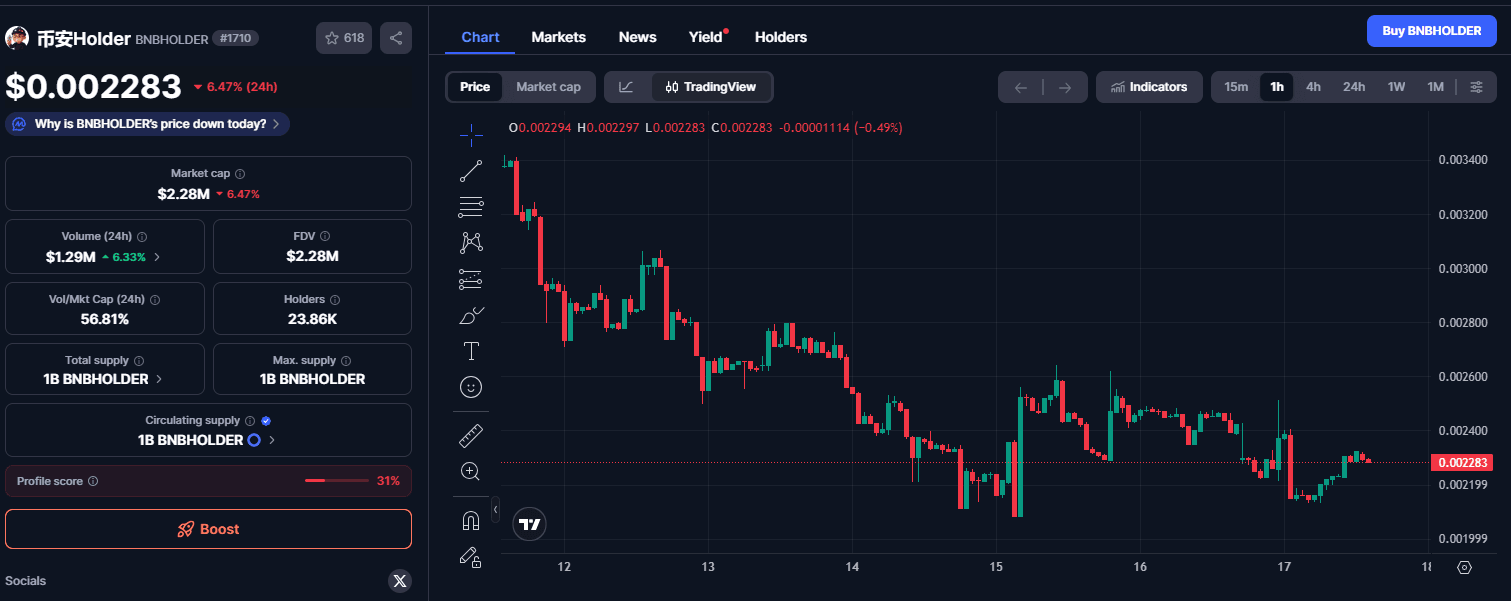

Now the situation is much calmer. The price of BinanceHolder is in the range of about $0.002 to $0.0026 per token, far below its all-time high of around $0.118 on October 9, 2025. This represents a decline of nearly 98 percent from its peak.

Read also: BabyBoomToken (BBT) Price Prediction: Latest Analysis and Outlook

Overview of Binance Holder (BNBHOLDER) and its price journey

Binance Holder is a meme coin on the BNB Smart Chain network that was born through the MemeRush campaign on Binance Wallet. This token collaborates with Four.Meme, using a bonding curve model to make the launch more transparent and equitable for the community.

The token is positioned as the “meme guardian of the BNB community” and is the first meme coin to feature as a star on the MemeRush platform.

Within the first few hours of its release on October 9, 2025, the market capitalization surged to over $100 million with a trading volume of tens of millions of dollars.

Some key facts about the early price journey of BNBHolder:

Initial surge phase

Within the first few minutes to hours, the price surged sharply as large funds from whales and retail traders entered the market. On-chain reports show that 13 wallets made profits exceeding 1 million dollars solely from trading BNBHolder in less than an hour.

Peak followed by a downturn

Data from several price aggregators show that BNBHolder's peak was around $0.118 on launch day before the price began to correct.

Long downturn and low consolidation

After the initial hype faded, the price continued to weaken, leaving only a few percent of its peak value. The latest position is around 0.002 to 0.0026 dollars per token, with a market capitalization of around 2 to 2.5 million dollars and a circulating supply of 1 billion tokens.

This picture is important for the context of price predictions. Tokens that have fallen more than 90 percent do seem “cheap,” but that does not automatically mean that a return to the peak will be easy to achieve.

In many cases with meme coins, trends like this end up becoming coins that are only active occasionally when there is a new wave of speculation.

Read also: Latest BOOST Price Prediction: Is BOOST Ready to Rise Again After Surging 28%?

Simple technical analysis of Binance Holder: trends, support, and volume

Technical analysis of Binance Holder must be honest: the price history of this token is still very short, but the patterns that emerge are very classic for meme coins.

Some key technical points:

Price trend and distance from peak

The price is currently around $0.002 to $0.0026 per token, while the highest point is around $0.118. This means a decline of about 98 percent from the peak.

The daily trend shows a gradual decline after the initial euphoria subsided, then moved sideways in the low price area. This pattern is often referred to as the “post-hype bleed” phase, where selling pressure remains while new buying interest is waning.

Support and resistance levels to watch

Looking at the current range of movement, several frequently touched price zones can be summarized as follows:

The area around $0.002 as short-term psychological support

The $0.003 to $0.004 area as near resistance

The area around $0.005 as stronger resistance related to the price after the initial euphoria phase. As long as the price remains below this resistance zone, the overall trend is still likely to be down or flat, not strongly up.

Trading volume and market dynamics

At the initial launch, the 24-hour volume reached tens of millions of dollars, even attracting widespread attention within the BNB ecosystem.

Now, the daily volume has dropped to just hundreds of thousands of dollars, according to data from several price tracking sites.

This over 90% decline in volume indicates that speculative interest has significantly diminished. The market has become thin, making price movements highly sensitive to large orders but lacking consistent activity.

Technical indicators using historical data, such as the algorithmic prediction model on CoinCodex, generally view the short-term outlook for BNB Holder as bearish to neutral.

Their predictions place the price in the coming months still in the range of a few thousand cents and not much different from current levels, with the risk of a further decline before any significant increase is possible.

Read also: Long-Term Telcoin (TEL) Price Prediction: Outlook, Fundamentals, and Market Direction 2025–2030

Fundamental analysis and community sentiment for Binance Holder

From a fundamental perspective, Binance Holder is very different from major crypto projects that have products, clear teams, and roadmaps. This token is purely in the meme coin realm.

Some fundamental points to understand:

The nature of meme coins and the role of MemeRush

币安Holder was launched as a community token within the BNB ecosystem with the main narrative of “BNB holders” and a tribute to the founder of Binance. Binance Wallet, in collaboration with Four.Meme, provides the MemeRush platform infrastructure for launching meme coins using a bonding curve model, ensuring more transparent distribution. However, this token lacks a detailed technical whitepaper or clear utility beyond speculative functions and community identity.

Supply and Token Structure

Data from several market aggregators indicates a total and maximum supply of 1 billion Binance Holder tokens. All of this supply is circulating in the market, so there is no additional inflation from new token minting. Without a specific burn mechanism or reward scheme, price movements are entirely determined by supply and demand on exchanges.

Community and Holder Distribution

Since its launch on October 9, 2025, BNBHolder has quickly accumulated over 23,000 holder addresses on the BNB network. The active community primarily emerges in the Binance Square environment and several social media groups, with the narrative that this token symbolizes loyalty to the BNB ecosystem. However, after the price fell significantly from its peak, it is understandable that many holders have become passive and are simply holding onto their losing positions.

Market sentiment and media coverage

Crypto media briefly highlighted the phenomenon of wallets profiting millions of dollars in a very short time from trading BNBHolder, while also reminding readers of the extreme risks of memecoins.

Now, coverage is more balanced and emphasizes that the potential for large gains early on is followed by the risk of sharp declines when the hype ends. There have been no major utility announcements, technical collaborations, or new product developments that could change Binance Holder's status from being just a meme token.

In short, from a fundamental perspective, it is difficult to find long-term value drivers. Its current value relies more on community sentiment and the meme coin market cycle than on cash flow, products, or a growing ecosystem.

Read also: ANYONE Price Prediction 2025: Crypto Trend Analysis and Outlook

币安Holder price prediction: short, medium, and long term

Since this is a memecoin, all predictions should be considered scenarios, not certainties. The price could suddenly spike or fall deeper if a new campaign or a major sell-off emerges.

1. Short-term prediction for about 1 week to 1 month

For the next few weeks, the main factors are technical analysis and the overall crypto market sentiment.

In summary:

Positive Scenario

If the BNB and BNB Chain markets are improving and Binance Holder volume slightly increases, the price could bounce back to the nearby resistance range of around $0.003 to $0.004. This is more of a relief rally rather than a major trend reversal.

Base Scenario

Algorithmic models like CoinCodex project prices within a narrow range and tend to point toward a moderate decline before any potential upside. In the short term, they view sentiment indicators as bearish with limited potential movement from current levels.

Negative Scenario

If the support around $0.002 fails to hold and selling volume strengthens, prices could drop to lower levels. Due to the thin market structure, downward movements can occur quickly when there is significant selling pressure.

For day traders, short ranges like this are sometimes attractive for scalping. However, the risk of slippage and spread spikes is significant, so risk management must be very strict.

2. Medium-term prediction for about 3 to 6 months

Over the course of several months, the picture will be more influenced by the crypto market cycle and whether the hype around memecoins on the BNB Chain resurfaces.

Scenario overview:

If the crypto market is sideways or weak

Without new news, 币安Holder has the potential to continue to hover in the low price area, with the risk of slowly falling to smaller levels. Medium-term investments in tokens without fundamentals usually face the problem of “dead capital” that is difficult to exit without loss.

If there is a new meme mini-season on the BNB Chain

Binance Holder's status as a MemeRush token born in the early days gives it historical value. In a state of euphoria, the community could revive old tokens as part of a nostalgic narrative. In this scenario, the price could rise several times from the bottom, although it would still be difficult to return to its previous high.

Quantitative model prediction

CoinCodex estimates place the price range of Binance Holder over the next year still in the range of a few thousand cents, with the potential to double from current levels in the best-case scenario, but still far below the $0.1 mark.

Therefore, for the medium term, the basic outlook is closer to stagnant to weak, unless a truly significant sentiment catalyst emerges.

3. Long-term predictions over 1 year

For a horizon of more than one year, meme tokens such as Binance Holder usually face two major possibilities: slowly fading from the radar or occasionally reviving when there is a new wave of speculation.

Some things to note:

Long-term prediction model

CoinCodex estimates that the potential price of Binance Holder in 2030 will still be in the range of less than a cent to a few cents, with an optimistic scenario reaching around $0.0089. To reach $0.1, their algorithm estimates a very long time frame of around 2050, while $1 is considered unrealistic in their model's horizon.

Risk of becoming a sleeping coin

Without new developments, many meme tokens end up as coins with thin liquidity and minimal activity. The price appears stable at a small number, but it is actually difficult to trade in large amounts without moving the market.

The possibility of a surprise remains but is highly speculative

In crypto history, some tokens that were once “dead” can come back to life in the next bull cycle. However, this is more like a lottery than a calculable investment. Such strategies typically only use a very small portion of the portfolio to avoid large losses.

In conclusion, long-term predictions for Binance Holder tend to be conservative. The potential for significant gains is highly dependent on uncertain external factors, while the risks are clearly high.

Read also: Uniswap (UNI) Price Prediction: The Big Impact of the UNIfication Proposal

Key risks and safer ways to speculate on Binance Holder

Before jumping in, it's wise to assess the risks clearly.

Some key risks:

No clear utility and reliance on hype

Without a real product, roadmap, or active team, the token's price is supported solely by community sentiment and meme seasons. This makes price movements highly unpredictable.

A sharp decline has already occurred, but it may not be over

The fact that the price has already fallen nearly 98 percent from its peak does not guarantee that it cannot fall further. Many tokens have fallen more than that and never recovered.

Thinning liquidity and difficult exit risks

Daily volumes that are much smaller than at the beginning mean that selling in large quantities can cause prices to fall sharply. This is important to consider if you are entering with significant capital.

Dependence on specific exchanges and BNB ecosystem sentiment

Although Binance Holders are present on several exchanges, fragmented liquidity can make it difficult to execute large orders. Additionally, if sentiment towards the BNB Chain weakens, demand for meme tokens in that ecosystem usually declines as well.

Safer trading through regulated platforms like Bittime

If you want to learn crypto trading more safely in general, using a platform that is officially registered in Indonesia is a rational step, at least one sensible decision amid meme coin speculation.

Bittime is a crypto asset exchange registered with Bappebti and monitored by Kominfo, and claims to have information security certifications such as ISO 27001 and ISO 27017.

This platform is also known as one of the largest crypto exchanges in Indonesia and provides an application with a user-friendly interface to buy, sell, and store various crypto assets.

If you want to start trading crypto gradually:

- Start with major assets such as BTC or BNB first

- Use a regulated exchange such as Bittime to learn risk management

- Then allocate a small portion of your funds for speculation in meme coins such as Binance Holder

If you're interested in trying cryptocurrency trading with rupiah on a regulated platform, you can register an account on Bittime and start with a small amount first.

Conclusion: what does the 币安Holder price prediction mean for you

The 币安Holder (BNBHOLDER) price prediction basically shows a combination of:

- Technical data that still indicates a weak trend with prices well below the peak

- Fundamentals with minimal utility and heavy reliance on community sentiment

- An algorithmic prediction model that tends to be conservative, with limited upside potential in the medium term and little chance of reaching high numbers in the near future

In the short term, the price is likely to move within a narrow range with occasional spikes. In the medium to long term, the risk of this token becoming a dormant coin is quite high unless a strong new meme cycle emerges in the BNB ecosystem.

If you want to speculate on Binance Holder, consider it a high-risk game, not a primary investment. Use funds you can afford to lose, don't go into debt, and balance it with crypto assets that have stronger fundamentals on regulated exchanges.

This is not investment advice. It is your responsibility to conduct your own research and assess your own risk tolerance. If you've read this far and still want to get in, at least do so with your eyes open.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

Is Binance Holder still worth buying now?

It is only suitable for high-risk speculation with small funds. The fundamentals are weak and the price trend is still declining.

Can the price of Binance Holder return to its peak of $0.1?

Theoretically, it is possible, but the probability is very low without significant hype and strong support from the ecosystem. Long-term prediction models are also very conservative.

What are the main factors that could drive the price up in the near future?

A surge in sentiment on the BNB Chain, a sudden increase in volume, or a large community campaign. However, all of these are uncertain.

Where should I learn to trade before getting into meme coins like this?

You can learn first on regulated exchanges in Indonesia such as Bittime with major large-cap crypto assets before touching meme coins.

Can price predictions from sites like CoinCodex be fully trusted?

No. Such models are useful as references, but they still use historical data and certain assumptions. The results cannot be used as a guarantee for the future.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.