Market Focus Ahead of the October 2025 FOMC Meeting

2025-10-21

All eyes are now on the Federal Reserve ahead of the Federal Open Market Committee meeting.(FOMC)on October 28–29, 2025. The interest rate decision to be announced is predicted to be a crucial moment for the direction of the global economy in the final quarter of the year.

Financial markets, including stocks, gold, and crypto assets, are bracing for potentially significant changes resulting from this decision.

Over the past few months, US economic data has shown signs of weakness in the labor and consumption sectors, while inflation remains above the 2% target.

Read Also:The FOMC Meeting Will Impact the Crypto Market: How Will Bitcoin's Price Move?

This situation puts the Fed in a difficult position: should it lower interest rates to stimulate growth, or keep them unchanged to maintain price stability?

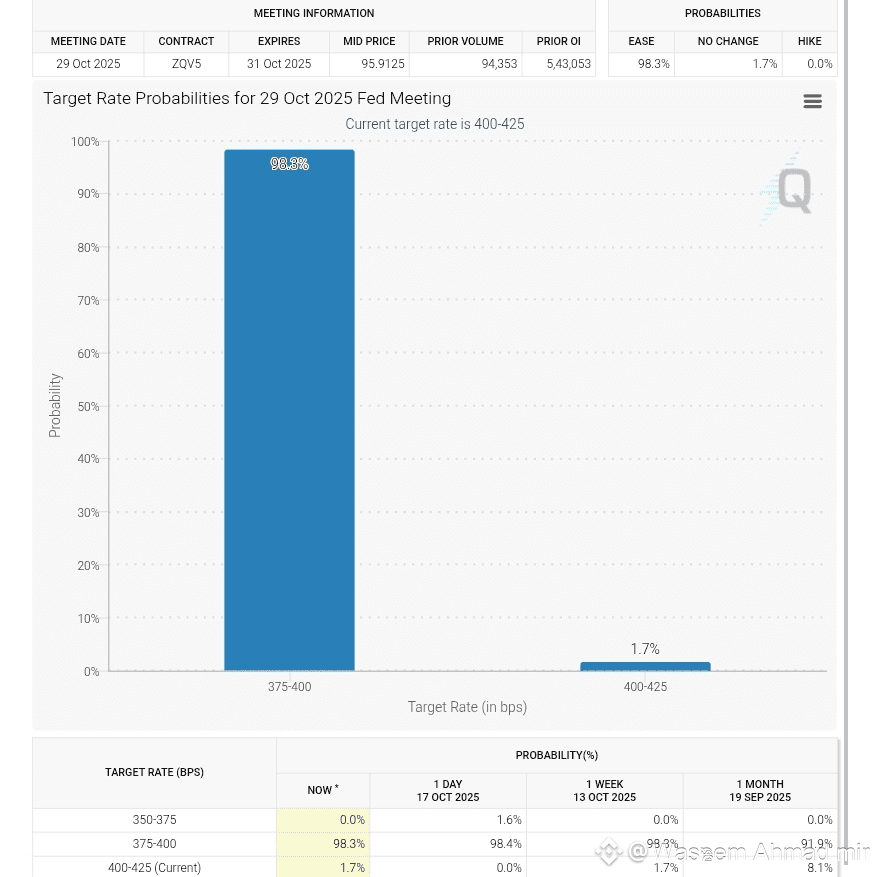

Futures markets now predict a high probability of a 25 basis point interest rate cut. However, some analysts believe the Fed could delay this move if inflation remains stubbornly persistent. This uncertainty is causing increased volatility across various asset classes, particularly in the crypto sector, which is highly sensitive to changes in monetary policy.

Potential Impact on Crypto and Gold Markets

Every Fed decision is usually a major catalyst for price movements in risk assets, including crypto. If the Fed decides to lower interest rates, global liquidity is likely to increase.

This could provide a positive boost for Bitcoin, Ethereum, and other digital assets as investors tend to look for opportunities in assets with higher potential returns.

Conversely, if the Fed chooses to hold or even raise interest rates, the crypto market could experience short-term pressure due to a strengthening US dollar and rising bond yields. In this scenario, many investors turn to safe-haven assets like gold and gold-backed tokens.PAX Gold (PAXG).

The current gold price is showing a strengthening trend, reaching the rangeUS$4.356 per PAXG, reflecting defensive sentiment in the market. This suggests that investors are shifting some of their portfolios to more stable assets ahead of the Fed's decision.

Read Also:Will the 2025 FOMC Meeting Trigger Altcoin Season and Pump the Crypto Market?

Furthermore, the correlation between crypto and gold is becoming increasingly apparent. In recent weeks, Bitcoin's price movements have tended to align with gold's, indicating that the crypto market is now also viewed as part of a diversification strategy against global economic risks.

Market Scenario After The Fed's Decision

Whatever the outcome of the FOMC meeting, its impact on the market will depend on the tone of Fed Chairman Jerome Powell's speech. If his statement signals that interest rates will continue to fall in the coming months, crypto assets are likely to experience strong positive momentum. Retail and institutional investors could become active again, driving trading volumes up.

However, if Powell signals that tight monetary policy will be maintained until inflation is truly under control, risk assets could correct. In such conditions, value-based assets like gold, stablecoins, and commodity tokens like PAX Gold could be defensive options.

Read Also:Crypto ETF 2025: Crypto Assets Potentially Approved by Regulators

For crypto traders, periods like these require careful strategy. Monitoring economic data such as inflation, unemployment, and the US dollar index can help predict future market direction. Therefore, it's crucial to stay updated and understand the macroeconomic dynamics that impact the digital market.

If you are interested in monitoring crypto assets in real-time and are looking for a platform that provides high liquidity and market education, you can join us atBittime.comThrough Bittime, you can learn, trade, and track global crypto market movements easily and transparently.

Conclusion

The Fed's rate prediction at the FOMC meeting on October 28, 2025, is a major focus for global markets. Interest rate decisions will influence the direction of the global economy, including the price movements of gold and crypto assets.

If interest rates are cut, the crypto market could experience a short-term rally. Conversely, if the Fed maintains a tighter policy, safe-haven assets like gold and PAX Gold could remain a primary choice.

Investors need to balance opportunities and risks while paying attention to global economic signals. In these uncertain times, understanding macroeconomics is key to making informed investment decisions.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is the FOMC and why is it important to the markets?

The FOMC is a committee within the Federal Reserve that sets the direction of interest rates. Its decisions have a significant impact on global financial markets.

When is the next FOMC meeting?

The next meeting is scheduled forOctober 28–29, 2025, and the market is waiting for new interest rate direction signals.

How does the Fed's decision affect crypto?

Interest rate cuts tend to support the crypto market as they increase liquidity and risk appetite.

Will gold rise if interest rates fall?

Usually yes, because low interest rates weaken the US dollar and increase the appeal of gold as a store of value.

Where can I keep up with crypto and macro market developments?

You can monitor market analysis and trade digital assets through platforms such asBittime.com.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.