What is the IHSG? Learn about its functions, how to calculate it, and its role!

2025-10-16

Bittime - If you're stepping into Indonesia's capital markets, you've likely heard the term IHSG many times. But do you really understand its meaning and role in investing?

The Composite Stock Price Index (IHSG) is the main benchmark for understanding the condition of the national stock market.

In this article we will cover the definition of IHSG, how it is calculated, related terms, its functions & influences, and how investors can use it in their strategies.

Definition and History of IHSG

IHSG stands for Indeks Harga Saham Gabungan, an index that reflects the overall performance of stocks listed on the Indonesia Stock Exchange (BEI).

Also known as the IDX Composite in English, IHSG was first introduced on April 1, 1983, with its base value set on August 10, 1982, covering 13 companies.

Its purpose is to provide a general picture of stock price movements in Indonesia so investors can see whether the market is in an uptrend, downtrend, or stable phase.

Read Also: IHSG Today: Current IHSG Price and Potential Market Moves

How IHSG Is Calculated & Its Composition

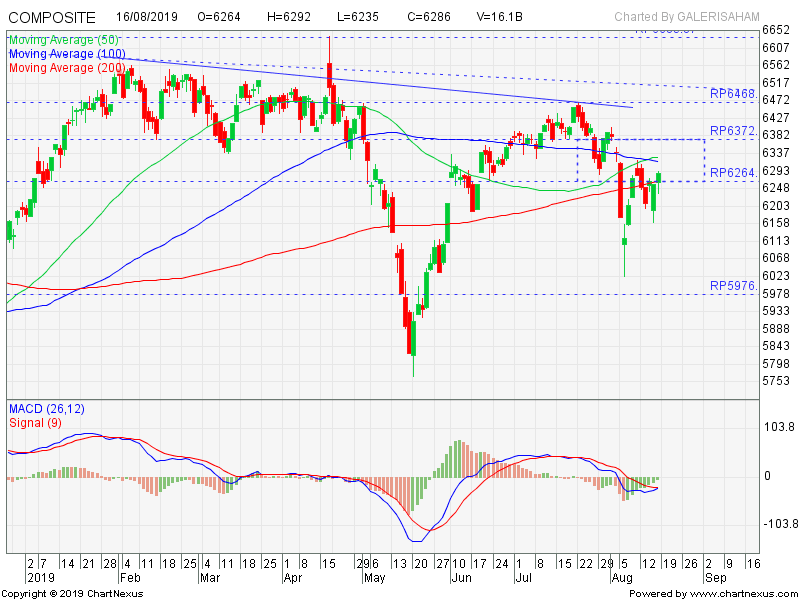

IHSG is calculated using a market capitalization method (market-cap weighted), not a simple average.

Stocks with larger market capitalizations have a greater impact on index movements than smaller-cap stocks.

Technically speaking:

- Each stock is multiplied by share price × number of outstanding shares to obtain market capitalization.

- The total market capitalization of all stocks is divided by a constant (the divisor) which is adjusted so the index is easy to read and track.

- The IHSG value is updated in real-time during trading hours.

Its composition includes all stocks listed on the BEI — both those on the main board and the development board.

Important Terms Related to IHSG

Understanding these terms can help you analyze the market:

- Bullish / Bearish: Uptrend vs downtrend.

- Volatility: Dynamic price fluctuations.

- Support & Resistance: Price levels where the index often stops falling (support) or rising (resistance).

- Capital Gain / Loss: Profit or loss from the difference between buy and sell prices.

- Portfolio: A collection of stocks owned by an investor.

- Liquidity: Ease of buying/selling stocks without significant slippage.

- Bubble: An unsustainably large price increase prone to bursting.

- Cut Loss / Hold: Strategy to sell when at a loss or hold for potential recovery.

These terms often appear when discussing IHSG charts or market news.

Read Also: IHSG Analysis: Predictions, Stock Recommendations, and Investment Opportunities 2025

Functions & Roles of IHSG for Investors

National Stock Market Barometer

IHSG serves as a gauge of whether the stock market is optimistic or pessimistic. When IHSG rises, most stocks tend to strengthen, and vice versa.

Portfolio Performance Benchmark

Investors can compare their portfolio performance against IHSG — to see whether their portfolio outperforms or lags the market trend.

Economic Indicator & Market Sentiment

IHSG movements also reflect investor confidence in Indonesia's economy — foreign capital flows, monetary policy, and macro data affect this index.

Guideline for Investment Strategy

Investors use IHSG positions (rising, falling, sideways) to decide when to buy, sell, or hold stocks.

Factors That Affect IHSG Movements

IHSG does not move by itself — many factors drive the index dynamics:

- Macro economic conditions: growth, inflation, interest rates.

- Foreign capital flows: inflows/outflows of foreign investment affect liquidity.

- Issuer performance / financial reports: sectors like banking and consumer goods have strong influence.

- Government policy & regulation: taxes, import tariffs, stimulus policies.

- Global sentiment & world stock markets: global markets can be “contagious”.

- Liquidity & trading volume: when volume is large, moves are stronger.

According to DJPB Kemenkeu, a decline in IHSG can erode investor confidence in Indonesia's economy.

Read Also: IHSG Prediction After Purbaya Effect & FOMC The Fed: Rally or Plunge?

Conclusion

IHSG is the main index that reflects the overall condition of Indonesia's stock market. As a market barometer, portfolio benchmark, and economic indicator, IHSG plays a crucial role for investors.

However, it should not be the sole reference — individual stock analysis and macro context remain important so investment decisions are better informed and not solely dependent on the index.

How to Buy Crypto on Bittime

Want to trade or sell buy Bitcoin and invest in crypto easily? Bittime is ready to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start with registration and identity verification, then make a minimum deposit of Rp10,000. After that, you can immediately buy your favorite digital assets!

Check the rates BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to see real-time crypto market trends on Bittime.

Also visit Bittime Blog for interesting updates and educational information about the crypto world. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your knowledge in the crypto space.

FAQ

What is IHSG and why is it important?

IHSG is the Composite Stock Price Index — an indicator of the performance of all BEI-listed stocks. It is important as a market barometer and an investment performance benchmark.

How is IHSG calculated?

It is calculated based on the market capitalization of stocks listed on the BEI, then converted into an index using a divisor to make it easy to interpret.

Can IHSG predict the future of stocks?

Not directly. IHSG only reflects current market conditions — forecasting still requires fundamental and technical analysis of individual stocks.

Should my portfolio always follow IHSG?

Not necessarily. Some investors choose portfolios that aim to outperform the market or focus on specific sectors that look more promising than the average.

Where can I view real-time IHSG charts?

You can view it on the official BEI / IDX website, financial platforms like Investing.com, or local broker apps.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.