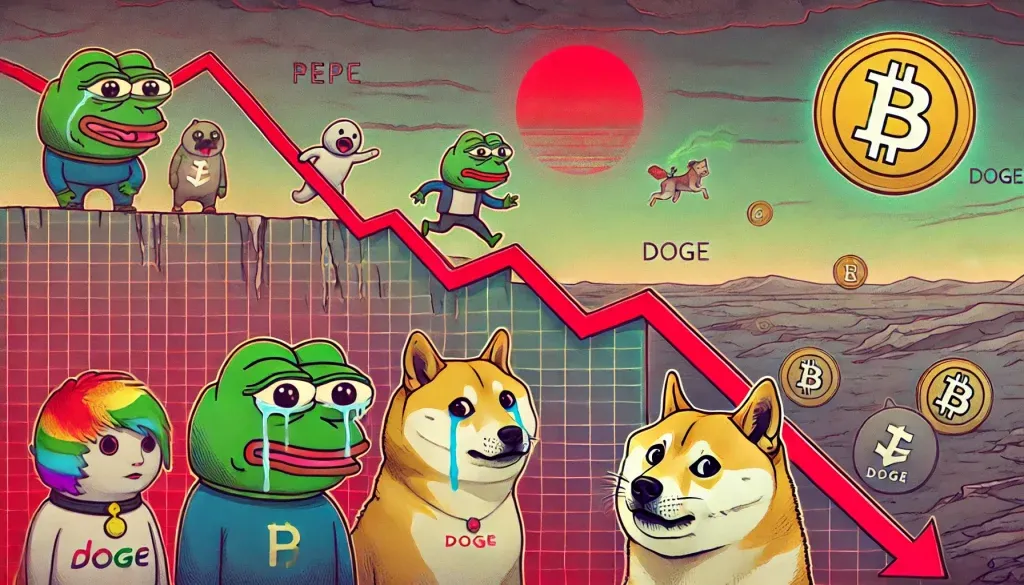

Why Have Meme Coin Prices Fallen This Month?

2025-11-17

If you look at the meme coin chart this month, almost all of the colors are red. Many holders are asking, “Why have meme coin prices fallen this month?” Even though a few weeks ago the atmosphere was festive, the timeline was full of memes, and prices were soaring.

This decline did not happen suddenly. It appeared when the global crypto market was fearful. Bitcoin fell from the $100,000 range, causing the Fear and Greed Index to drop into the extreme fear zone, with the total crypto market losing about five to six percent of its value in a week.

Amidst this pressure, meme coins such as PEPE were also hit hard. One report mentioned that PEPE fell by almost twenty percent in a week when market sentiment deteriorated and liquidity thinned.

Read also: List of the Best Meme Coin Wallets 2025 that Degen Must Have

Meme coins are also affected by the fearful crypto market sentiment

Before blaming the project or community, we need to look at the big picture of the crypto market.

Some important things that happened this month:

- Bitcoin failed to stay above $100,000 and fell to the $94,000 to $96,000 range, its lowest level since May.

- The Crypto Fear and Greed Index fell to around ten to fifteen, which is categorized as extreme fear.

- The total value of the crypto market fell more than five percent in a week, led by declines in Bitcoin and Ethereum.

- Analysts report that the market still lacks liquidity after the October crash, making price movements highly volatile.

In such conditions, investors tend to reduce risk. The assets most likely to be reduced are usually:

- Highly volatile assets.

- Assets that lack strong use cases.

- Assets that rose the fastest during the euphoria.

Meme coins meet all of these criteria. It's no surprise that when the market turned fearful, meme coins fell deeper than major coins.

Even for major meme coins like PEPE, analysis points to a technical break in the upward trend and selling pressure from some large holders as the market shifts into cautious mode.

So, one of the simplest answers to the question “Why did meme coin prices drop this month?” is because the crypto market as a whole is fearful, and meme coins are the assets most sensitive to this shift in sentiment.

Read also: Potential Memecoins for Q4 2025: Risks and Entry Strategies

Key Factors Why Meme Coin Prices Fell This Month

Now we get into the more specific causes. There are several interrelated factors that caused meme coins to fall quite sharply.

1 Meme coins are highly dependent on Bitcoin's movements and market sentiment

Meme coins almost always move in tandem with Bitcoin and major altcoins.

- On-chain reports show that one of the major meme coins, PEPE, has a strong correlation with Bitcoin, approaching eighty percent in some periods.

- When Bitcoin plunges sharply and the market enters a fear zone, most altcoins and meme coins also decline.

Simply put:

- Bitcoin falls → investors panic.

- Investors start selling altcoins and meme coins to save capital.

- Selling pressure arises simultaneously, while new buyers become fewer.

- Meme coin prices fall deeper because there is no strong support.

Meme coins rarely have their own narratives such as “network upgrades” or “institutional adoption.” They rely heavily on market sentiment and new money flows. When these two factors weaken, prices quickly collapse.

2 Profit Taking and Selling by Large Holders

The next factor is profit taking.

Several things can be seen in market data and reports:

- Analysts have noted a wave of profit taking by long-time holders and whales as the market began to weaken, both in Bitcoin and meme tokens.

- When meme coins rise many times over in a short period of time, it is natural for some big players to choose to lock in profits before the mood changes.

The pattern is usually like this:

- meme coins rise very quickly.

- Prices begin to stagnate, volume shrinks.

- Large holders quietly sell in large quantities.

- Prices break support, retail traders panic and sell.

In one special report on meme coins, it was mentioned that the nearly twenty percent decline in a week was also triggered by a combination of whale selling, weak new buying interest, and a market atmosphere that was already fearful from the start.

In the world of meme coins, a single large wallet selling in large quantities is enough to cause the chart to plummet, as liquidity is not as deep as that of major coins.

3 Thin Liquidity and Leverage Risk in Meme Coins

Another factor that is often overlooked is liquidity.

Some important points:

- A Coindesk report states that crypto market liquidity remains shallow after the October crash, so large orders can easily move prices.

- Meme coins are typically traded in markets with shallower order books than Bitcoin.

As a result:

- When a large sell-off wave hits, prices can be dragged down by several percent with relatively small volume.

- On some exchanges, meme coins are also traded with high leverage.

- When prices fall below a certain level, leveraged long positions are forced into liquidation.

- This liquidation adds new selling pressure and creates a chain reaction.

This is why you sometimes see meme coin candles drop sharply in a very short time. It's not just because “people are panicking,” but also because the market structure is thin and easily dragged down.

Read also: Five Memecoins on the BNB Chain Network That Are Now in the Spotlight

4 Special Factors of Memecoin Hype Community and News

Memecoins are unique because they are highly dependent on hype and community.

Some triggers for declining interest:

- Social media timelines are quiet, memes are decreasing, discussions are shifting to other trending tokens.

- No new catalysts, such as major listings, community campaigns, or public figure support.

- Emergence of newer, more popular meme coins, causing retail funds to shift.

Coindesk, in one of its articles, shows how major meme coins like Dogecoin and Shiba Inu can move in different directions when market interest shifts, while the meme sector as a whole remains under pressure from the weak crypto market.

For smaller meme coins, there are often additional risks:

- The project is overly dependent on a small team.

- If the team is inactive or communication is poor, trust can easily decline.

- Negative rumors in the community can quickly lead to massive sell-offs.

Therefore, when the euphoria subsides, the fundamental weaknesses of meme coins become apparent, and prices tend to fall back to levels close to those before the hype.

The Importance of Choosing a Secure Platform When Meme Coins Fall

Amid the volatility of meme coins, one thing that should not be overlooked is the security of where you trade.

In Indonesia, one example of a platform that prioritizes security is Bittime. Bittime is registered and supervised as a digital financial innovation organizer by the Indonesian financial authorities and was previously also listed with the crypto commodity supervisory agency.

This platform also holds international information security certifications such as ISO 27001 and ISO 27017 for data and infrastructure protection.

If you are interested in trading meme coins, it is wiser to do so on an exchange that is legal and has clear security standards. You can:

- Register an account on Bittime.

- Try buying or selling meme coins in small amounts.

- Use features such as limit orders so you don't get carried away by your emotions.

This is not an invitation to buy, but an invitation to be more aware of the risks and choose a safer place to trade.

Read also: Dogecoin, WIF, and MemeCore: Uncovering the Meme Coin Phenomenon in the 2025 Bull Market

How to Respond to the Drop in Meme Coin Prices This Month

After understanding the causes, the next important step is how to respond to the situation.

Here are some practical steps you can consider:

- Review your initial reasons for buying meme coins

- Was it just to join the hype?

- Do you have a clear plan for when to exit?

- If your initial reasons were weak, it's natural to feel panicked now.

- Check the proportion of meme coins in your portfolio

- Ideally, high-risk assets should not dominate your entire portfolio.

- If the proportion of meme coins is too large, it may be time to reconsider your allocation.

- The goal is not to guess the bottom, but to maintain your financial health.

- Avoid decisions driven solely by fear

- Don't sell or buy just because you saw a tweet or a short video.

- First, look at simple data such as market capitalization, volume, and liquidity.

- Remember that a very low Fear and Greed index means that many other people are also afraid.

- Reorganize your meme coin trading or investment plan

- Determine the loss limit you are willing to accept per position.

- Set realistic profit targets; don't always chase a hundredfold return.

- Write down your plan; don't just keep it in your head.

- Learn from this month's movements

- Observe how meme coin prices move when Bitcoin falls.

- Pay attention to the role of volume, news, and community comments.

- Use this as a lesson so that you won't be easily carried away by euphoria in the future.

Equally important, separate your living expenses from the money you use for meme coin experiments. Consider meme coins as a learning space for market psychology and risk management, not as a shortcut to getting rich.

Read also: Most Popular Memecoins in October 2025: Dogecoin Still Number 1

Conclusion Why Meme Coin Prices Fell This Month

So, why did meme coin prices fall this month?

In summary:

- The crypto market is in a phase of fear, with sentiment indices at very low levels and Bitcoin falling to its lowest price in recent months.

- In such an environment, meme coins are the primary victims due to their highly speculative nature, low liquidity, and dependence on community hype.

- Profit-taking by large holders, institutional fund outflows, and leveraged position liquidations have further accelerated the price decline.

Meme coins do not automatically “die” just because they decline for one month. However, this decline serves as a reminder that:

- The risks associated with meme coins are significantly higher than those of major coins.

- We need to be disciplined in managing our allocations and plans.

- Trading should be conducted on regulated platforms with robust security standards.

Ultimately, understanding the market context will help you stay calm when facing red charts and make more rational decisions rather than reacting to fleeting fears.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What are the main causes of the meme coin price decline this month?

The main causes are fear in the crypto market, the decline in Bitcoin prices, profit-taking by large holders, and the tendency for meme coins to have low liquidity.

Did all meme coins decline by the same percentage?

No. Some declined significantly, while others only experienced a slight correction. The magnitude of the decline depends on liquidity, market size, and the strength of community hype.

Does the decline in meme coin prices mean the projects are necessarily bad?

Not necessarily. Many meme coins are indeed highly speculative, but this month's price decline is more influenced by global market conditions and general investor psychology.

Is this a good time to buy meme coins again?

That depends on your risk profile. A price decline is no guarantee that prices will rise soon. Do your own research, allocate a small portion of your portfolio, and don't use money intended for essential needs.

How can you reduce risk when investing in meme coins?

Limit the portion of meme coins in your portfolio, use clear loss limits, choose a secure and legal exchange, and don't just rely on recommendations from social media.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.