What is a Contrarian? Understanding, How it Works, and Its Benefits

2025-09-26

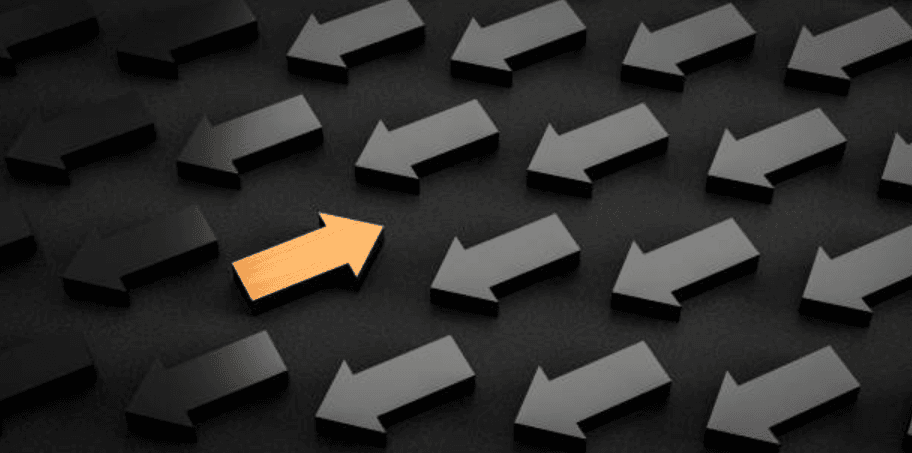

Bittime - There are many perspectives an investor can choose from. Some people like to follow the market's general trend, buying when prices rise and selling when prices fall. However, there is also an approach that challenges this habit: the contrarian approach.

Contrarianism is a style of thinking that is contrary to the majority, where an investor dares to make different decisions when most people do the opposite.

This approach may sound unusual, even contradicting simple market logic. But in fact, many major investors have successfully amassed wealth this way.

Names like Warren Buffett and Lo Kheng Hong are often associated with contrarian strategies. They boldly buy stocks when the market is in panic, then sell them when the crowd is optimistic.

The Definition of Contrarian Is

Contrarianism is an investment strategy that encourages investors to take a different perspective from market consensus. While the majority is selling out of fear, contrarians see an opportunity to buy.

Conversely, when many people are eager to buy, contrarians may choose to sell. This principle is known as the phrase "be fearful when others are greedy, and be greedy when others are fearful."

This strategy is based on the belief that markets aren't always rational. Stock prices are often influenced by emotions, psychology, and short-term trends. Therefore, there's a chance that market prices won't reflect fair value.

Read also: Trending Altcoins in Indonesia Right Now: Keep an Eye on the Rising Crypto!

How Contrarian Strategy Works

A contrarian doesn't simply go against the grain. They typically conduct in-depth research to identify stocks or assets that are undervalued or overvalued.

Panic buying: When stock prices fall due to negative sentiment, contrarians see the possibility that the market is overreacting.

Selling during euphoria: When prices spike sharply due to trends or news, contrarians may choose to exit early before prices correct.

Independent thinking: The essence of a contrarian strategy is not to get carried away, but to stick to logical analysis and strong data.

Read also: OJK Supervises Crypto in Indonesia: Impact of Regulatory Transitions and Their Implications

Benefits of Being a Contrarian Investor

Using a contrarian strategy can provide several advantages, including:

Greater chance: markets are often inefficient, so contrarians can find more profitable prices.

Reducing the effects of emotions: By thinking differently, contrarians don't get caught up in market fear or euphoria.

Long term yield potential: Many contrarians invest patiently, waiting for assets to return to their fair value.

However, this strategy isn't risk-free. It requires a great deal of patience, as results may take years to become apparent. Furthermore, there's an opportunity cost, as focusing on a single asset can cause contrarians to miss out on gains elsewhere.

Read also: Indonesia's Budget Deficit: Addressing Economic Challenges in 2025

Real-Life Examples of Contrarian Investors

Warren Buffett and Lo Kheng Hong are prime examples of contrarian investors. Buffett is known for his principle of buying shares in good companies at bargain prices, while Lo Kheng Hong often says that "treasure lies in the stock market."

They both managed to prove that thinking contrary to the majority can yield huge profits if done with discipline.

How to Buy Crypto on Bittime

Want to trade, sell, buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What strategy is contrarian?

Contrarianism is an investment strategy that takes decisions contrary to the market majority, for example buying when many people are selling.

What are the advantages of being a contrarian?

The advantage is being able to buy assets at a low price, sell at a high price, and not being easily caught up in market emotions.

Is contrarian strategy suitable for beginners?

It's possible, as long as you're willing to learn and have patience. However, this strategy requires extensive research and a long period of patience, so it's not suitable for everyone.

Is contrarianism the same as value investing?

Not the same, but similar. Both emphasize the importance of finding fair value, but contrarians focus more on moments of market panic or over-optimism.

What are the risks of being a contrarian?

The risk is that it takes a long time to see results, and there is the possibility of incorrect analysis which could result in greater losses.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.