Why Does the IHSG Fluctuate? Here Are the Driving Factors

2025-10-16

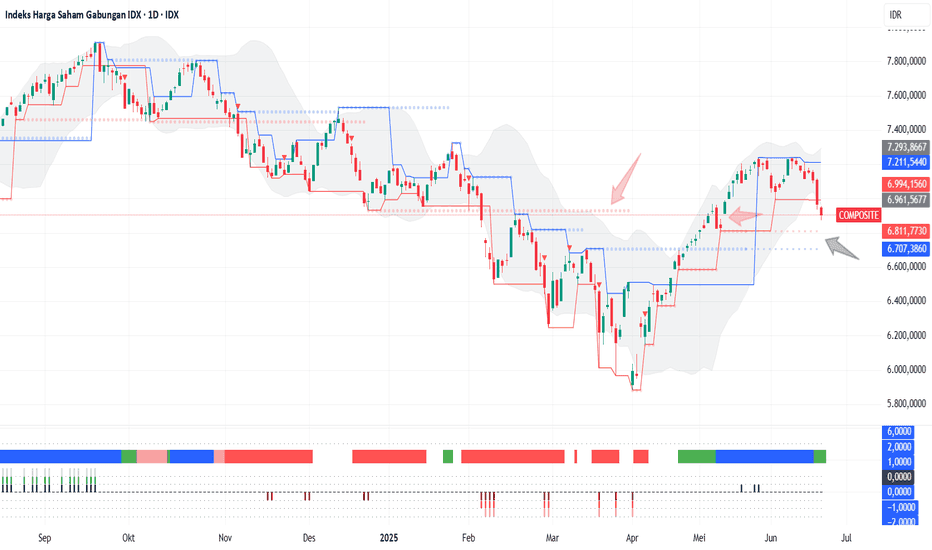

Bittime - IHSG (Composite Stock Price Index) serves as a main indicator of the Indonesian stock market.

Its movements are closely watched by investors, analysts, and market participants because they reflect the overall health of the capital market.

However, IHSG can sometimes jump sharply one day and then fall significantly the next — what exactly causes this?

This article provides a comprehensive review of the internal and external factors that drive IHSG’s ups and downs so you can better understand and prepare more effective investment strategies.

Main Factors Driving IHSG

Market Sentiment & Investor Behavior

Collective investor sentiment plays a major role — positive news (such as supportive regulation or strong economic data) triggers optimism and buying activity.

Conversely, negative news (recession, global crisis, political issues) sparks fear and mass selling — which can pull IHSG down.

Macroeconomic Conditions & Government Policy

Variables such as inflation, Bank Indonesia’s policy rate, the rupiah-to-dollar exchange rate, and economic growth (GDP) have tangible effects on IHSG.

Studies indicate that a weakening rupiah, high inflation, or rising interest rates can put downward pressure on the index.

Fiscal and regulatory policy are also crucial — for example, taxation rules, governance of foreign investment, or export restrictions.

If the government introduces measures perceived as harmful to capital markets, investors may shrink back and withdraw their funds.

Company Performance & Financial Reports

IHSG aggregates many stocks. If many large companies (blue chips) report weak performance — falling profits, rising costs, ballooning debt — their share prices decline and drag IHSG down.

Conversely, strong performance by major companies can drive the index upward.

Foreign Capital Flows

Foreign investors play an important role in the Indonesian market. When they buy (capital inflow), IHSG tends to rise due to added liquidity. When they pull funds out (capital outflow), the market faces strong pressure.

Trading Volume & Liquidity

Low volume makes the market susceptible to large trades (buy or sell). If volume is high, the market is more stable against individual shocks.

Global Factors & International Linkages

The Indonesian market does not escape global influence: U.S. Fed policy, global market sentiment, worldwide crises, and the economies of major countries all matter.

When global markets fall, investors may “flee” from emerging markets, including Indonesia. Research also finds that global indices such as the DJIA can explain fluctuations in IHSG.

Domestic Political & Social Issues

Political instability, cabinet reshuffles, large protests, or social conflicts can undermine investor confidence at home and abroad, triggering stock sell-offs.

Also read: IHSG Explained: How to Read the Data and Its History

Interaction Between Factors & Their Impact

The factors above often act together and reinforce one another. For example:

- Rupiah weakness + high inflation + foreign selling can form a negative spiral that accelerates IHSG decline.

- Conversely, controlled inflation + economic growth + foreign inflows + good corporate performance can push IHSG higher. [turn0search4]

- Sometimes global sentiment triggers local reactions even when domestic fundamentals are relatively stable.

The overview above explains why IHSG can move quickly and unpredictably — macro, micro, and psychological factors all interact.

Also read: IHSG Today: Current Price and Potential Market Moves

How to Understand & Manage IHSG Fluctuations

- Use a combination of fundamental & technical analysis before deciding to buy or sell stocks.

- Monitor Bank Indonesia policies, economic data, exchange rates, and foreign capital flows.

- Avoid emotion-driven decisions; set stop-loss levels and profit targets.

- Diversify your portfolio so risk is spread — don’t put all investments into one sector.

- Adopt a long-term mindset: fluctuations are part of the stock market; successful investors typically withstand short-term volatility.

Also read: IHSG Analysis: Forecasts, Stock Recommendations, and Investment Opportunities 2025

Conclusion

IHSG’s rises and falls do not happen randomly. Multiple factors — from sentiment to macro policy, corporate performance, foreign flows, and global dynamics — jointly determine the index’s direction.

By understanding these factors and formulating the right strategies, you can be better prepared to face the market’s dynamic waves.

How to Buy Crypto on Bittime

Want to trade or buy buy Bitcoin and invest in crypto easily? Bittime is ready to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start by registering and verifying your identity, then deposit a minimum of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check exchange rates BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to see real-time market trends on Bittime.

Also visit Bittime Blog for various interesting updates and educational information about crypto. Find trusted articles on Web3, blockchain technology, and investment tips designed to enrich your knowledge in the crypto world.

FAQ

What are the main causes of a sharp IHSG drop?

Sharp declines are typically triggered by a combination of foreign selling, rupiah weakness, high inflation, and negative global or domestic sentiment.

Does IHSG reflect all stocks?

Yes, IHSG includes all stocks listed on the IDX — so it provides an aggregate view of the market.

Which global factors most affect IHSG?

U.S. interest rate policy, global crises, and foreign market sentiment — when global markets weaken, funds can flow out of Indonesia.

Will IHSG always rise in the long term?

Not necessarily — although there may be a long-term upward trend, periods of correction or decline can occur at any time.

How should beginner investors handle IHSG volatility?

Focus on company fundamentals, avoid being swept up by hype, use risk management (stop-loss), and keep a long-term perspective.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.