Today's IHSG Prices and Potential Market Movements

2025-10-06

Bittime - Today's IHSG is once again the focus of investors after the opening session showed a downward trend.

Today's IHSG price reflects market sentiment: there is pressure from foreign capital flows and external concerns, but there are also opportunities if the “driving” sectors can rebound.

Reading today's IHSG price is not limited to looking at the closing figure — what is important is the intraday dynamics, transaction volume, and the strength of leading sectors that can influence the direction until the end of the session.

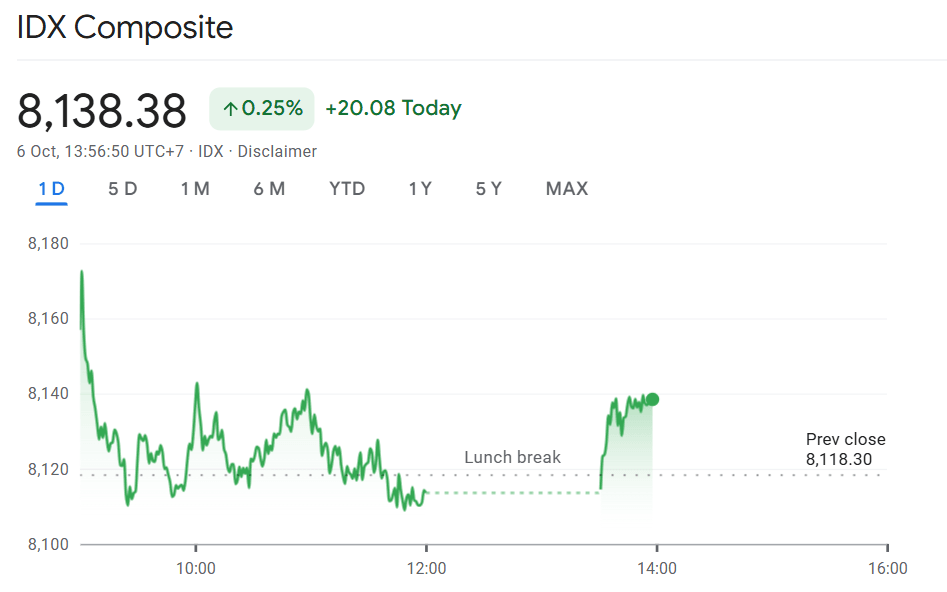

Latest Movements and IHSG Figures

The IHSG was in negative territory when the session began, with selling pressure pushing it down slightly.

Based on the latest data from market sources, the index was recorded at around 8,040 points, down from the previous close when the IHSG was at around 8,043.82 points.

A brief strengthening of a handful of leading stocks provided some relief, but it was not enough to reverse the negative trend. Moderate transaction volumes indicate that there has not been a surge in buying interest that could support a significant rebound.

Amid these conditions, the technology sector was the most resilient, posting gains even as the main index weakened.

Influencing Factors

Today's JCI price fluctuations cannot be separated from global and domestic factors. At the global level, world market sentiment, Federal Reserve interest rate policy, and geopolitical developments triggered investor reactions to risky assets.

Domestically, the outflow of foreign capital from the stock and bond markets added pressure to the index. Fiscal policy adjustments and changes in the government leadership, including the replacement of the finance minister, were also in the market spotlight due to their potential impact on economic prospects.

In addition, the performance of core sectors—such as banking, consumer, and technology—also determined whether the JCI could reduce pressure or continue its correction.

Potential Future Movements

Today's JCI price opens up opportunities for a rebound if leading sectors are able to show positive catalysts.

If buying support emerges from blue chip stocks and foreign capital flows begin to return, the index could test the resistance level in the 8,100 range.

However, if selling pressure continues and external sentiment worsens, the index could fall back to the support level in the 8,000 range.

A sideways scenario is also very likely, especially if the market is patiently waiting for macro data such as inflation, interest rates, or quarterly financial reports.

Strategy for Investors

Investors who already have positions should consider risk management strategies: use stop losses to prevent losses from widening when pressure increases. Diversifying into stocks with strong fundamentals and long-term prospects can help reduce volatility.

For novice or retail investors, it is wise not to be too aggressive on days like this—waiting for a reversal momentum or confirmation signal may be safer than forcing an entry when the market direction is unclear.

Monitoring foreign capital flows, technology sector performance, and technical indicators such as support/resistance or candlestick patterns is also very helpful in making decisions.

Conclusion

Today's JCI price reflects a balance between selling pressure and the potential for recovery in some sectors. Despite the correction, the index still has room to rebound if positive catalysts emerge.

However, risks remain, particularly from global factors and foreign capital outflows. For investors and market observers, observing intraday movements, understanding sector conditions, and maintaining strategic discipline are key to avoiding being swept up in sharp fluctuations.

FAQ

What is the IHSG price today?

Currently, the IHSG is in the 8,040 range, slightly weaker than the previous close at 8,043.82 points.

What caused the IHSG to weaken today?

The pressure came mainly from foreign selling, external concerns such as global interest rate policies, and changes in domestic fiscal policy.

Can the IHSG rebound in the next session?

It can, if leading sectors are able to drive gains and foreign investors return. However, this opportunity depends on technical signals and macro catalysts.

Which sector had the most influence?

The technology sector showed relative strength today. However, banking, consumer goods, and large industrial sectors remain the main determinants of the index's movement.

How should investors respond to a day like this?

Maintain risk management through stop losses, choose stocks with strong fundamentals, do not be too aggressive without clear signals, and monitor technical indicators and foreign capital flows.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.