Dropee Question of The Day: Answer January 12, 2026, Update!

2026-01-12

Bittime - Daily activity on Dropee returned on January 12, 2026. Users who regularly open the app since morning are immediately greeted with a short question that seems simple, but still requires precision. Dropee QuestionToday we're talking about financial terms, a topic that frequently appears in Dropee's educational quizzes.

For many users, taking daily quizzes is more than just a routine. There's a drive to maintain consistency, accumulate points, and, of course, ensure accuracy. That's why keywords are so important.jawaban Dropee Question of the Dayalmost always sought after every change of day.

The January 12, 2026, edition feels fairly straightforward. There are no complicated technical terms, but the questions require an understanding of concepts frequently encountered in company financial reports.

This is where some users can still be misled if they read too quickly without understanding the context.

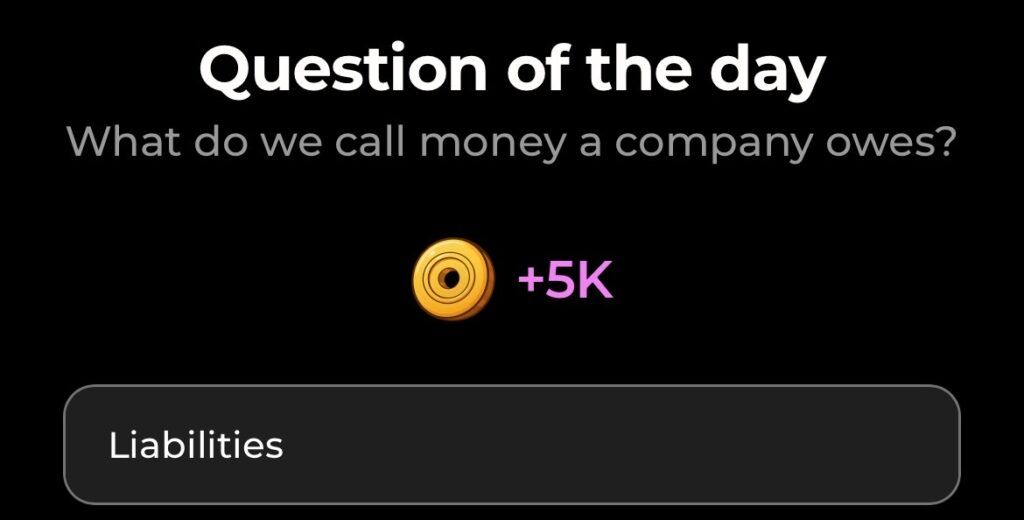

Dropee Question of the Day January 12, 2026

Referring to the circulating references,Dropee Question of the Day today reads:

What do we call money a company owes?

This question directly addresses basic accounting and finance terms. Dropee often presents questions that seem simple, but are rooted in real-world concepts frequently used in everyday business practice.

This type of questioning also aligns with previous Dropee strategies. They test not only memorization but also understanding of terms commonly encountered in financial reports, balance sheets, and business discussions.

For users accustomed to reading company reports or economic news, the context of this question is actually quite familiar. However, for those unfamiliar with financial terminology, carefully reading the answer options is key to avoiding making the wrong choice.

Read Also:Bitcoin Halving: Explanation, Impact, and Prediction of Happening in 2028

Answer Dropee Question of the Day January 12, 2026

The correct answer forDropee Question of the Day 12 January is:

Liabilities

The term "liabilities" refers to obligations or debts a company owes to other parties. These can include bank loans, trade payables, and other obligations that must be paid in the future. Therefore, this answer best describes the money a company owes.

Other possible answer options typically refer to assets or revenue, but these clearly don't fit the context of "money a company owes." By selecting liabilities, the user has answered according to the definition commonly used in accounting.

This answer has also been confirmed as the official answer based on available references. Therefore, users should feel confident when pressing the submit button on today's quiz.

Read Also:How to Buy DOGE/USDT on Bittime

Why Is This Answer Correct?

In financial reporting, liabilities are always listed as obligations, not as ownership. This means that the funds do not belong to the company outright but must be repaid according to the agreement. This is the crux of Dropee's question today.

Dropee seems to want to reinforce this basic concept with a short quiz. While simple, understanding liabilities is crucial, especially for users interested in business, investing, or financial management.

By understanding the reasoning behind the answers, users aren't just guessing, but absorbing knowledge that can be useful later. This educational approach is what keeps Dropee's quizzes relevant and doesn't feel monotonous.

Read Also:How to Buy USDT with ShopeePay

Tips for Answering Dropee Questions Every Day

To avoid making mistakes in answering Dropee Questions, there are several things to keep in mind. First, read the question slowly and understand the context. Second, relate the question to familiar, general definitions, not personal assumptions.

Third, don't rush into choosing an answer. Dropee usually gives you ample time to think. Finally, consistently taking quizzes every day helps develop a pattern of understanding, allowing you to answer similar questions more quickly.

With this approach, the chances of answering correctly will be greater and the experience of participating in Dropee Question of the Day will be more enjoyable.

Read Also:How to Buy Bitcoin with DANA on Bittime

Conclusion

Dropee Question of the Day January 12, 2026, raised a basic question about corporate finance terms. The correct answer isliabilities, which refers to money or obligations that a company must pay to other parties.

Today's question is simple, yet relevant and educational. For Dropee users, answering correctly maintains the consistency of the daily quizzes while strengthening their fundamental understanding of finance.

FAQ

What is the answer to Dropee Question of the Day January 12, 2026?

The correct answer isliabilities.

What is Dropee's question today?

The question reads:What do we call money a company owes?

Is this answer confirmed?

Yes, the answer is in accordance with the official references available.

Is Dropee Question always about finances?

Not always. Topics vary, from finance and business to general knowledge.

Do Dropee Questions have to be answered every day?

Quizzes are daily. Answering regularly helps maintain account progress and consistency.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.