The Impact of the FED Rate Cut on Bitcoin Price 2026: What to Know?

2025-12-11

Bitcoin always been the center of attention in the worldcryptocurrencydue to its volatility and enormous profit potential. However, external factors such as central bank monetary policy can significantly affect Bitcoin's price.

One of them is the policyrate cut from The FED(Federal Reserve) planned for 2026. So, how?rate cut The FED this may impact the priceBitcoin?

In this article, we will discuss in depth about impact of rate cuts The FED on Bitcoin price 2026and what investors can expect.

Will this bring benefits to Bitcoin holders, or will it create new uncertainty in the market?

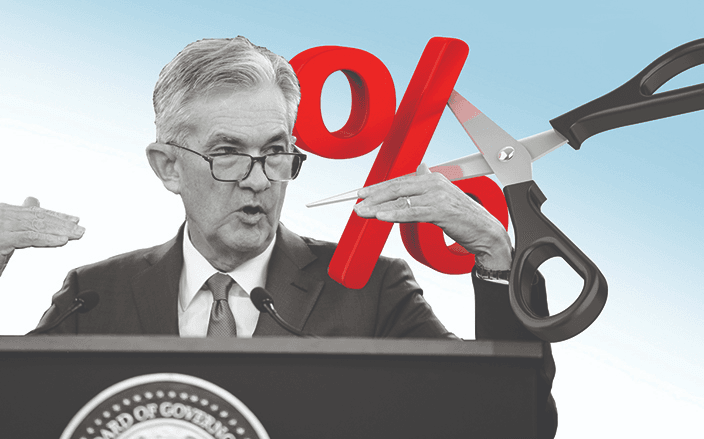

What is the FED's Rate Cut?

Before we discuss the impact, it is important to understand what a FED rate cut is. The Federal Reserve (FED) is the central bank of the United States responsible for monetary policy in the country. One of its main policies is to lower or raise the benchmark interest rate, also known as the interest rate.

A rate cut refers to a decrease in the benchmark interest rate by the FED. This decrease is usually done to encourage economic growth by making loans cheaper, encouraging consumption, and investment. However, how does this affect the cryptocurrency market, especially Bitcoin?

Read also: Fed Interest Rate Cut Drastically: The Worst Decision? Here Are the Facts!

What Impact Will This Have on Bitcoin?

- Impact on the Value of the US Dollar

The FED's rate cut will cause the US dollar to depreciate. When interest rates are lowered, the US dollar tends to weaken, which often makes Bitcoin an attractive investment alternative. Many investors are turning to Bitcoin to protect their wealth from inflation or a declining dollar exchange rate. - Bitcoin as a Hedge Asset

Bitcoin has been known as "digital gold" or digital images. When rate cut lowering the value of fiat currencies such as dollar, Bitcoin is often considered a safer place to store value, similar to how it's functioning in unstable economic conditions. Thus, a decrease in interest rates could causeBitcoin price go on. - Impact on Market Liquidity

Lower interest rates can increase liquidity in the market. With lower interest rates, more money circulates in the market, which can increase the number of investors putting their funds into the crypto market, including Bitcoin.

Read also: Fed Cuts Interest Rates by 25 Bps: What Does This Mean for the Crypto Market?

Bitcoin Price Prediction 2026 After The FED Rate Cut

If we look at historical patterns, the FED's rate cut policy is often followed by an increase in Bitcoin prices.

In 2026, predictions show that Bitcoin prices could experience a sharp increase if the benchmark interest rate is significantly cut. However, there are several factors to consider.

Factors That Influence Bitcoin Price Predictions

- Global Economic Conditions

Although rate cuts can push up the price of Bitcoin,global economic conditions will also play an important role. If the world is experiencing economic uncertainty or recession, many investors will turn toBitcoinas a safer asset. - Adoption of Blockchain Technology

In addition, wider adoption of blockchain technology will also support Bitcoin prices. If more companies and countries integrate blockchain and cryptocurrency into their systems, demand for Bitcoin will increase, strengthening its price. - Market Sentiment

Market sentiment will remain the main factor influencing Bitcoin prices. Although rate cuts may increase demand, investor sentiment toward cryptocurrencies in general also needs to be positive in order to keep prices stable or rising.

Read also: Impact of US Fed Interest Rate Cut: Will It Trigger a Bitcoin Rally?

What Should Bitcoin Investors Pay Attention To?

As a Bitcoin investor, there are several things you need to consider regarding the impact of rate cuts in 2026:

- Market Volatility: Although rate cuts may drive Bitcoin prices up, keep in mind that cryptocurrencies are still a highly volatile market. There is a possibility of sharp price fluctuations.

- Long-Term vs. Short-Term Investment: If you are a long-term investor, you will likely see the benefits of this rate cut over time. However, if you are a short-term trader, it is important to pay attention to market sentiment, which can change quickly.

- Portfolio Diversification: Diversification is very important. While Bitcoin can provide significant returns, make sure your portfolio also includes other assets to minimize risk.

Read also: When Will Bitcoin ETFs Be Released in Indonesia? Latest Update 2025

Bittime: Secure Crypto Trading Platform

If you are interested in investing in Bitcoin or trading, Bittime is a secure and reliable platform. With various features such as staking, trading, and staking rewards, Bittime gives you easy access to the world of cryptocurrency.

With a sophisticated security system and optimal user experience, Bittime is the ideal place to start your crypto investment journey.

Sign up on Bittime now and start trading Bitcoin safely and conveniently!

Conclusion: Facing the FED Rate Cut and Its Impact on Bitcoin

The FED rate cut in 2026 is predicted to have a positive impact on Bitcoin prices. This interest rate reduction could drive demand for Bitcoin as a safer investment alternative, given the potential decline in the value of the US dollar and possible increase in inflation.

With in-depth technical analysis and an understanding of other external factors, investors can make smarter decisions in the face of market changes.

However, as with all investments, it is important to always be prepared for market volatility and global economic conditions that could affect Bitcoin prices. Continue to update your knowledge and always diversify your portfolio to deal with market uncertainty.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is a FED rate cut?

A rate cut is a reduction in interest rates by the Federal Reserve (FED), which aims to stimulate economic growth by making loans cheaper.

How does a rate cut affect the price of Bitcoin?

A rate cut can weaken the US dollar and increase demand for Bitcoin as a hedge asset, which can cause the price of Bitcoin to rise.

What should Bitcoin investors consider with a rate cut?

Investors should pay attention to market volatility and potential shifts in market sentiment. Diversifying your portfolio is also crucial to reducing risk.

Will Bitcoin prices continue to rise after the rate cut?

Although the rate cut may drive Bitcoin prices up, external factors such as market sentiment and blockchain technology adoption also influence prices.

How to invest in Bitcoin after the rate cut?

To invest, you can buy Bitcoin on platforms like Bittime, which offers trading and staking with advanced security features.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.