Cigarette Tax in Indonesia: Its Impact and Influence in a Comprehensive Discussion

2025-10-02

Tobacco Tax in Indonesia: Impact and Influence in Complete Discussion

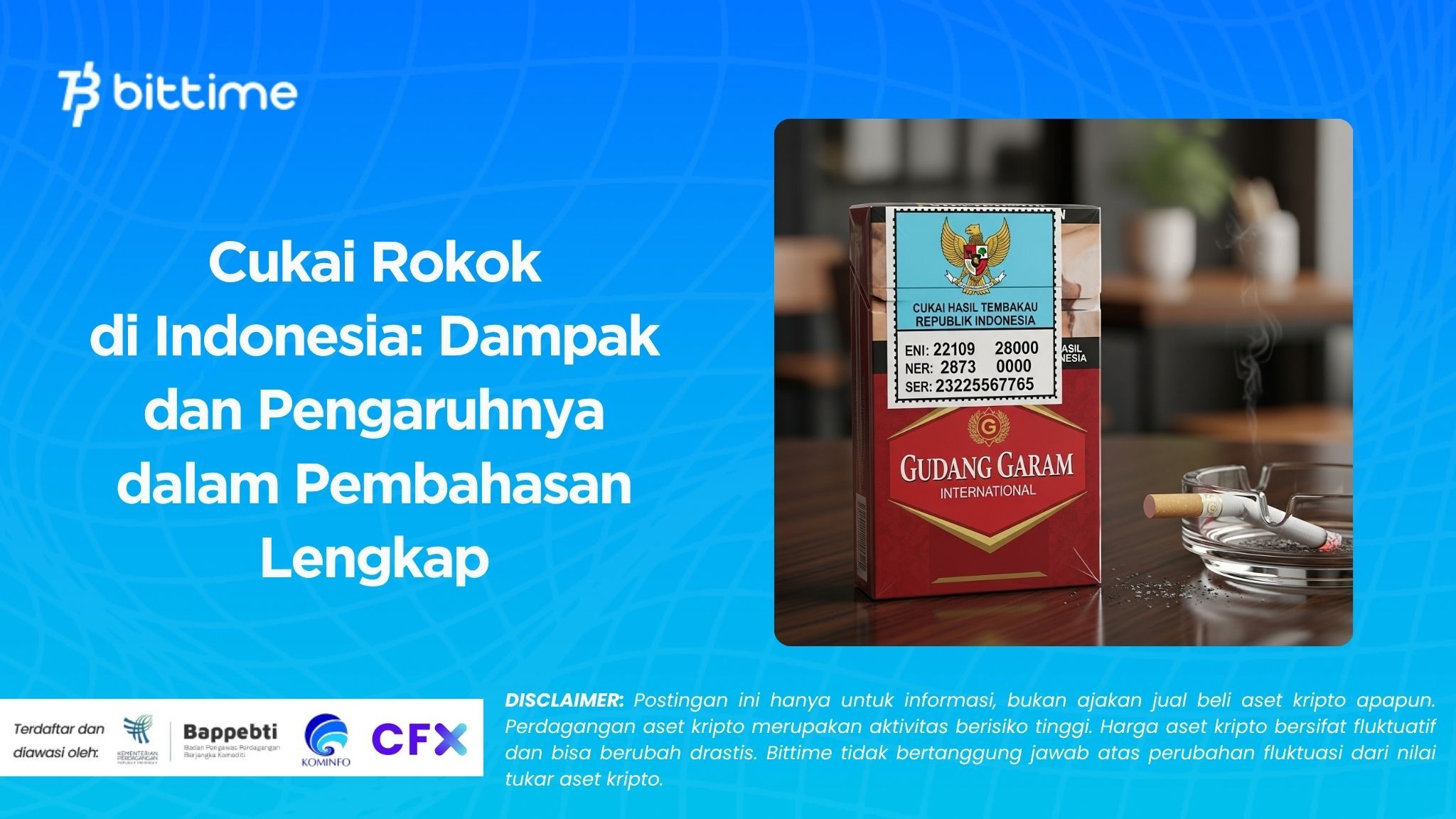

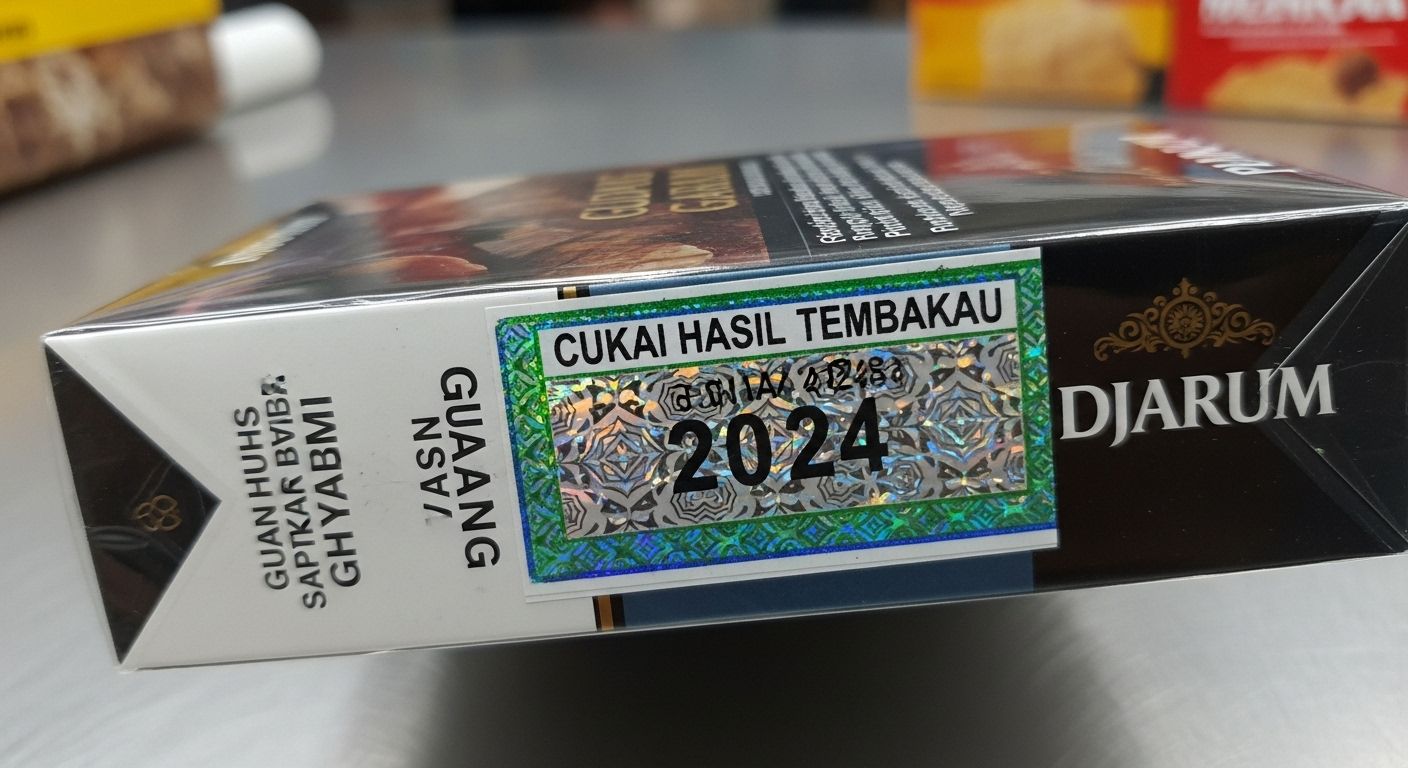

The tobacco tax in Indonesia is one of the key policies implemented by the government to regulate the selling price of cigarettes and other tobacco products. This tax is not only aimed at increasing state revenue, but also to control cigarette consumption, which has been proven harmful to health.

We will discuss in depth the tobacco tax in Indonesia, its history, rates, and its impact on society.

Also Read: How to Play Crypto: Complete Guide for Beginners

What is Tobacco Tax in Indonesia?

The tobacco tax in Indonesia is a tax imposed by the government on tobacco products such as cigarettes, cigars, and other similar products. This tax is intended to control cigarette consumption by increasing its selling price, making it harder for people, especially children and teenagers, to access cigarettes.

This tax also serves as one of the sources of state revenue, which is used to fund various government programs, including those related to health.

History of Tobacco Tax Imposition in Indonesia

The imposition of the tobacco tax in Indonesia was first regulated by the colonial Dutch government during the Dutch East Indies era through the Tabsacccijns Ordonnantie.

Over time, this tax has evolved until Indonesia gained independence and adopted a more structured tobacco tax policy through current legislation.

In the modern era, tobacco taxation has become one of the instruments to control the increasing tobacco consumption.

Types of Tobacco Taxes in Indonesia

The tobacco tax in Indonesia is differentiated based on the types of cigarettes and tobacco products sold. Below are the types of tobacco taxes applied:

1. Cigarette Tax

This tax is imposed on cigarettes, which are divided into several types, such as Machine-Crafted Clove Cigarettes (SKM), Machine-Crafted White Cigarettes (SPM), and Hand-Crafted Clove Cigarettes (SKT).

Each type of cigarette has different tax rates, depending on its classification. For example, SKM Class I has a higher tax rate compared to SKT Class III.

2. Electronic Cigarette Tax

Since 2023, the Indonesian government has also imposed taxes on electronic cigarettes. The tax for these products is categorized based on their type, such as solid e-cigarettes and liquid e-cigarettes.

The tax rate for electronic cigarettes can reach relatively high figures, depending on the size and type of product sold.

3. Other Tobacco Processed Products (HPTL) Tax

Several other tobacco products, such as molasses tobacco, snuff tobacco, and chewing tobacco, are also taxed. These products have lower tax rates compared to cigarettes, but still serve as a source of state revenue.

Reasons for Imposing Tobacco Tax

The imposition of tobacco tax in Indonesia serves various purposes, ranging from controlling cigarette consumption, improving public health, to reducing the prevalence of smoking-related diseases. Some of the main reasons for implementing tobacco taxes are:

Reduce Cigarette Consumption

By raising cigarette prices, it is hoped that people will think twice before buying cigarettes, especially teenagers and children.

Increase State Revenue

Tobacco tax contributes significantly to the state’s revenue. In 2021, total tobacco tax revenue reached more than IDR 137 Trillion.

Reduce Health Burdens

Diseases caused by cigarette consumption, such as heart and lung diseases, require significant healthcare costs. The tobacco tax is expected to lower smoking rates and reduce long-term health impacts.

Impact of Tobacco Tax on Children and Teenagers

One of the major issues facing Indonesia is the high number of young smokers. With affordable cigarette prices, children and teenagers can easily access cigarettes even though they are not of legal age to use them.

Therefore, imposing tobacco taxes in Indonesia becomes increasingly important to reduce cigarette consumption among them.

Also Read: 7 Proven Ways to Trade Crypto for Beginners, Complete with Tips and Tricks

Development of Tobacco Tax in Indonesia

The tobacco tax rates in Indonesia continue to change year by year. In line with consumption control goals, tobacco taxes have been gradually increased. For example, in 2018, the average tobacco tax rate increased by around 10.04%.

This policy aims to strike a balance between the need to control cigarette consumption and ensuring that the tobacco industry remains operational.

Simplification of Tax Categories

The Indonesian government has also implemented the simplification of cigarette tax categories since 2017. The tax categories, which originally had 12 layers in 2017, were reduced to 5 layers in 2021.

This simplification aims to streamline the tax system and reduce administrative burdens for the tobacco industry.

Conclusion

The imposition of tobacco tax in Indonesia has a dual purpose that is very important, which is to control cigarette consumption and increase state revenue.

Along with the development of policies that continue to be adjusted to market conditions and public health, tobacco taxes remain one of the important instruments that can influence many aspects of social and economic life.

This policy is also expected to reduce the prevalence of young smokers in Indonesia.

For more information about tax and tobacco policy, you can explore more news and articles at Bittime Blog. Don't forget to also try trading at Bittime Exchange!

How to Buy Crypto at Bittime

Want to trade buy buy Bitcoin and invest in crypto easily? Bittime is ready to help! As a registered crypto exchange in Indonesia by Bappebti, Bittime ensures every transaction is safe and fast.

Start by registering and verifying your identity, then deposit a minimum of IDR 10,000. After that, you can buy your favorite digital assets right away!

Check the rates for BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to check today's crypto market trends in real time at Bittime.

Also, visit Bittime Blog for various exciting updates and educational information about the world of crypto. Find trusted articles about Web3, blockchain technology, and investment tips for digital assets designed to enrich your knowledge in the crypto world.

FAQ

What is the tobacco tax in Indonesia?

The tobacco tax in Indonesia is a tax imposed by the government on tobacco products such as cigarettes to regulate prices and reduce cigarette consumption.

Why is the tobacco tax necessary?

The tobacco tax aims to control cigarette consumption, reduce health impacts, and increase state revenue.

How does the tobacco tax affect young smokers?

The tobacco tax is expected to make cigarette prices higher, making them unaffordable for children and teenagers.

Has the tobacco tax increased every year?

Yes, every year, tobacco tax rates in Indonesia increase to reduce consumption and as part of health policy.

What types of cigarettes are taxed in Indonesia?

Cigarettes taxed in Indonesia include machine-made clove cigarettes, machine-made white cigarettes, electronic cigarettes, as well as other tobacco products such as molasses tobacco and cigars.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.