Crypto Market Crash 2025: Bitcoin, Ethereum & Altcoin Going Down

2025-10-14

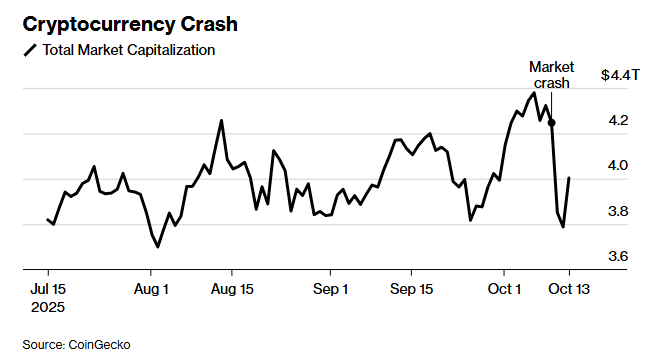

Bittime - Recently, the crypto market experienced a severe shock. Within hours, the values of Bitcoin, Ethereum, and various altcoins plunged drastically — wiping billions of dollars off the market.

This event not only shocked novice investors, but also served as a reminder that high volatility is an intrinsic characteristic of digital asset markets.

In this article, we will discuss the causes of the crisis, its impact on different types of crypto assets, how the market reacted after the crash, and strategies to cope during difficult times in the crypto market.

Triggers & Causes of the Crypto Market Crash

1. Geopolitics & Global Policy

Market cracks are often triggered by major news such as trade policies, tariffs, or global sanctions.

Recently, the announcement of a 100% tariff on Chinese technology exports sparked panic in global markets and pressured risk asset sentiment.

2. Liquidations & Excessive Leverage

The crypto market is known for high leveraged trading. When prices fall, automated liquidations trigger a cascade of forced sells and can create “short squeezes,” driving prices down further.

That is why the crypto market capitalization briefly corrected by more than US$19 billion in a short period.

3. Liquidity Drain & Domino Effect

In weak market conditions, buyers withdraw while sellers are forced to liquidate. With little demand, even small sell orders can significantly move prices.

Bloomberg reported that the altcoin index once fell as much as 40% within minutes during the recent crash.

Read Also: 5 Altcoins Targeted by Whales in October 2025 — Ready to Pump?

Impact on Bitcoin, Ethereum & Altcoins

Bitcoin (BTC)

Bitcoin fell from highs around $123,000 to below $105,000 before partially rebounding.

Recovery brought it back to about ~$114,000 after major liquidations eased, but the market remained fragile.

Read Also : Bitcoin Price Today | BTC/IDR Price

Ethereum (ETH)

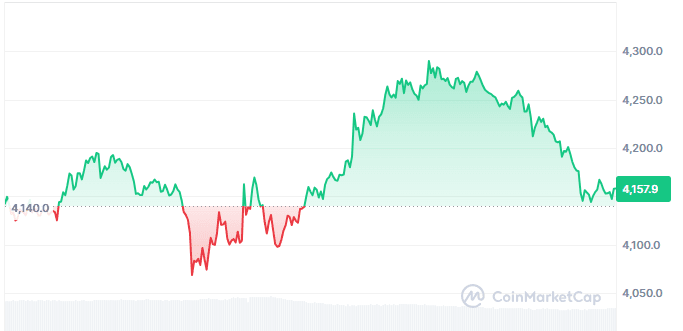

Ethereum dropped roughly 10–12%, hitting lows around the $3,800s before rebounding to about ~$4,100.

Read Also: Ethereum Price Today | ETH/IDR Price

Altcoins – Biggest Losses

Some altcoins felt even greater pressure:

- SOL, ADA, and other alts plunged by about 20–30% or more in a single session.

- The altcoin index even “blew off,” dropping nearly 40% in a short time.

- Small-cap tokens and DeFi projects are vulnerable to full liquidity drains and more extreme liquidity loss.

Market Reaction & Temporary Recovery

After the sharp decline, the market began to show partial recovery.

- BTC and ETH started climbing back to the $114,000+ and $4,100+ areas, respectively.

- Open interest and basis indicators suggested that some of the liquidated longs tried to re-enter the market.

- However, analysts warned that this rally was fragile and could correct again if macro pressure remained high.

Read Also: Crypto Crash: Tips for Facing a Market Collapse — Do These 5 Things!

Survival Strategies During a Crash

Below are strategies that can help cope with a crypto market downturn:

- Avoid using large leverage during periods of high volatility

- Use stop loss & take profit to limit losses

- Diversify assets – don’t put all capital into a single coin

- Protect base capital first – don’t chase rebounds with large amounts of capital

- Monitor global news & policy since external factors can trigger new waves

- Consider hedging such as put options or stablecoins

Conclusion

The recent crypto crash is a stark reminder that digital asset markets can be highly unpredictable and risky.

Although Bitcoin and Ethereum are often considered “relative safe havens,” they remain vulnerable in extreme market scenarios. Altcoins have once again proven to be the most sensitive components to market pressure and liquidity stress.

A near-term recovery may occur, but be prepared for further corrections. Disciplined strategy, strict risk management, and psychological readiness are crucial.

For long-term investors, preserving capital during crash phases can be key to taking advantage of the next market upswing.

How to Buy Crypto on Bittime

Want to trade or sell buy Bitcoin and invest in crypto easily? Bittime is ready to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the rates BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to see today's crypto market trends in real time on Bittime.

Also visit Bittime Blog for various interesting updates and educational information about the crypto world. Find trusted articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your knowledge in the crypto space.

FAQ

What was the main cause of the recent crypto market crash?

Geopolitical turmoil (US-China tariffs), forced liquidations of high-leverage positions, and low liquidity conditions.

Did this crash affect all altcoins?

Yes, most altcoins dropped deeper than Bitcoin due to thinner liquidity and higher leverage.

Has the market recovered?

Partially — there has been a rebound, but the rally remains fragile because macroeconomic pressure has not yet eased.

How can I protect capital during a crash?

Use stop loss, avoid high leverage, and move part of your holdings into stablecoins or safer assets.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.