Why Bitcoin Crashed: BTC Price Analysis and Prediction

2025-01-11

Bittime - Bitcoin recently experienced a sharp decline after breaking through the psychological mark of $100,000, which was previously considered the peak of optimism among investors. However, the happiness of market players did not last long. Bitcoin failed to maintain its price above $100,000, and in just under three days, the price of the world's most famous cryptocurrency crashed to hit $92,500. This decline certainly raises various questions about market stability and whether Bitcoin is able to continue its upward trend.

Deleveraging and Its Impact on Bitcoin Prices

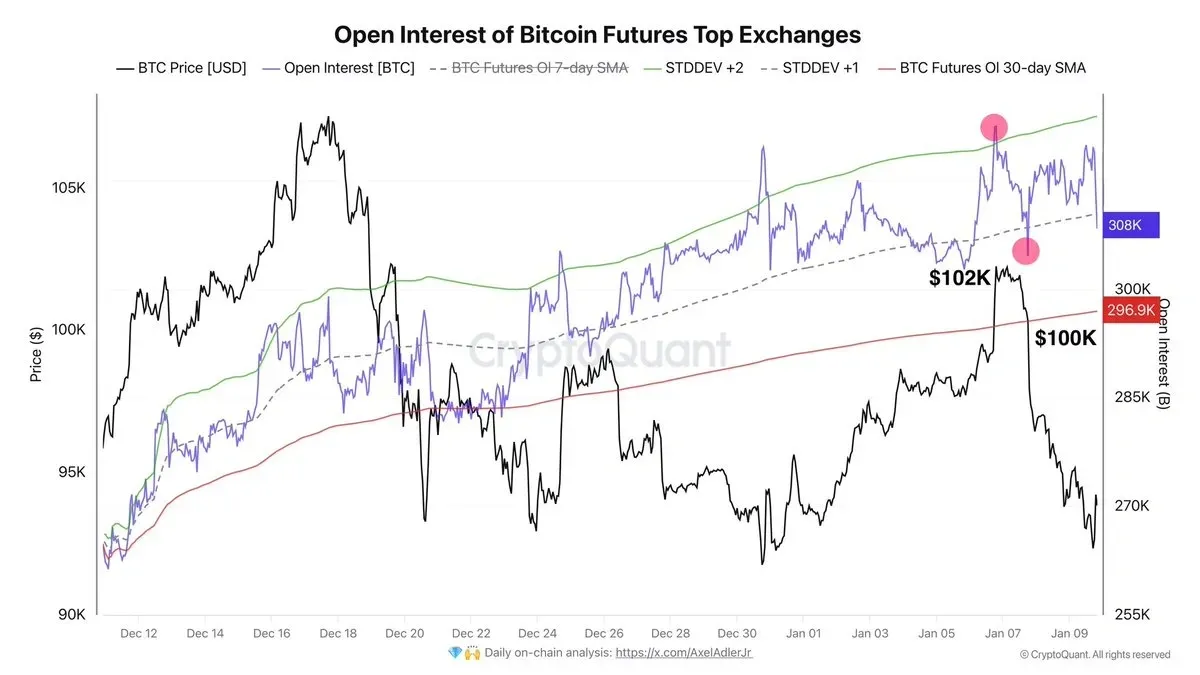

According to Axel Adler, a leading analyst from CryptoQuant, this decline is inseparable from a phenomenon called "deleveraging". On January 6 to 7, 2025, there was a large liquidation wave that caused the price of Bitcoin to drop drastically from $102,000 to $100,000.

Many investors are trapped in over-leveraged positions, and when prices start to move down, they are forced to sell their assets to cover losses. This created huge selling pressure and pushed Bitcoin's price further down until it hit a low of $92,500.

Read also: XRP Price Prediction to Increase in 2025, Here's the Reason!

Bitcoin Searches for Support: Is There Hope for Recovery?

Even though the situation looks bleak, Bitcoin is not completely sinking into ruin. In the last few hours, Bitcoin managed to find support around $92,500 and recovered slightly, climbing back to around $95,000. This gives a little hope to those who are still optimistic that BTC will be able to recover.

However, despite this recovery, many investors are still worried and wondering whether this is just a "dead cat bounce" or whether there really is potential for further upside.

Read also: Virtuals Protocol: VIRTUAL Token Price Analysis and Prediction in 2025, Can it Reach $12?

Adler also noted that despite a slight price improvement, the drop in open interest of 9,000 BTC shows that the market has not completely stabilized. This declining open interest indicates that despite a short-term recovery, the pressure in the market is still considerable, and there is no guarantee that Bitcoin will immediately resume its strong bullish trend.

Technical Challenge: Can Bitcoin Continue Its Rise?

On the technical side, Bitcoin is currently trading around $95,000, which means BTC price is just slightly below other important levels, such as the 200-hour Exponential Moving Average (EMA) which is at $96,200. These levels are very important for determining the direction of the next price movement. If Bitcoin can stay above this level and retest the $98,000 and $100,000 prices, there is a high possibility for the price to continue rising and reach another all-time high.

However, if Bitcoin fails to maintain prices above $95,000, the market could face greater bearish pressure, potentially causing BTC to plunge deeper into the consolidation zone or even test lower demand levels. Currently, we can say that the Bitcoin market is at a crucial point that requires price resilience and consistency.

Bitcoin Price Prediction

These uncertain market conditions mean that many investors, both those who have been involved for a long time and those who have just entered, must be careful. Every step and price movement in the next few days will largely determine whether Bitcoin is able to maintain positive momentum or is trapped in a deeper correction.

For those of you who are following Bitcoin movements, it is important to keep following market developments closely. Although there is potential for recovery, high volatility and market uncertainty can make price movements very volatile. So, always be alert and make sure you are ready to face all possibilities that could happen.

FAQ Bitcoin crash

What is a Bitcoin crash?

A Bitcoin crash refers to a sharp decline in the price of Bitcoin over a short period. It can happen due to factors like regulatory changes, market sentiment shifts, or global economic events affecting supply and demand.

What are the main causes of a Bitcoin crash?

A Bitcoin crash can be triggered by various factors, such as government policy announcements that limit Bitcoin use, large movements by institutional investors (whales), global economic instability, or technical issues in the Bitcoin network.

Does a Bitcoin crash mean Bitcoin will disappear?

Not necessarily. While Bitcoin's price can experience significant drops, it has shown resilience and the ability to recover from past crashes. However, its price remains volatile and unpredictable.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with CoFTRA, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Cek course BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your knowledge in the world of crypto.

Reference

Newsbtc, Bitcoin Faces Major Deleveraging – Analyst Explains Price Crash Below $100K, accessed January 11, 2025.

Author: MF

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.