What is the TAC Protocol? Now Available on Bittime

2025-11-28

Bittime - TAC Protocol emerged as a project connecting Ethereum applications to the TON and Telegram ecosystems. The TAC coin and the technology underlying its protocol are frequently mentioned in discussions about cross-platform chain integration.

For readers asking “what is TAC Protocol” or curious about the news of its listing on Bittime, this article provides a summary of the facts, technical features, and practical implications.

The opening paragraph aims to provide immediate context for key keywords like TAC Protocol and TAC coin, while also positioning the listing news as a relevant development for domestic users.

What is TAC Protocol — Brief Functions and Architecture

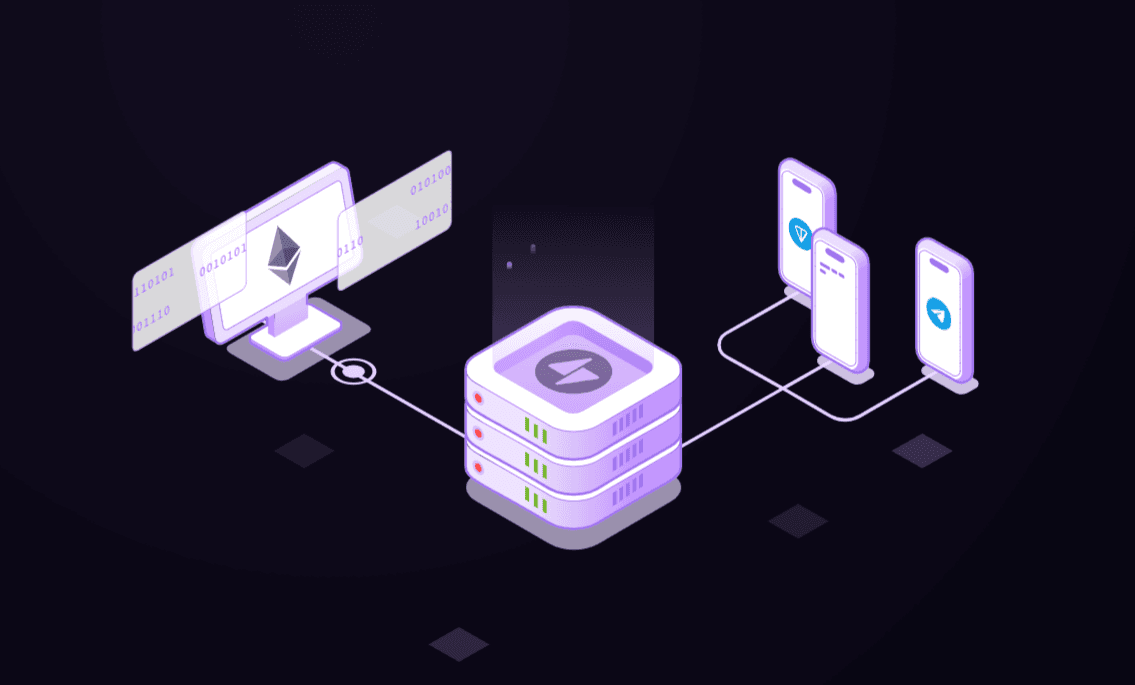

TAC Protocol is an EVM compatible blockchain designed to bridge the Ethereum ecosystem with TON and Telegram.

The architecture emphasizes deterministic cross-chain communication and a seamless user experience on the TON side, with off-chain batching and on-chain consensus mechanisms to execute contract operations.

The project's primary technical goal is to make it easier for Ethereum-based dApps to interact with Telegram users at scale without rewriting contract logic. The result is expected to accelerate the adoption of affordable and accessible on-chain financial services from a user-friendly perspective.

TAC Token — Role, Supply, and Tokenomics

The TAC token serves as gas for the TAC EVM layer, a staking tool for network security, and a governance token that grants voting rights to stakers.

According to official materials, the initial supply was minted during the Token Generation Event, and the allocation includes ecosystem, team, investor incentives, and liquidity allocation.

Tokenomics details: initial supply of 10 billion TAC, inflation policy designed to support validator rewards (inflation is projected to be in the range of 3–5 percent under certain conditions), and a multi-year vesting schedule for team and investor allocations.

This combination of token roles and distribution schemes determines how supply and demand pressures can change with network activity.

These statements and technical figures should be monitored regularly as unlocks and distributions can impact market liquidity.

Connectivity with TON and Telegram — Why It Matters

One of TAC Protocol's key claims is direct access to Telegram's large user base through integration with TON. This strategy allows EVM dApps to provide a lightweight interface and a familiar user experience to Telegram's millions of users.

In practical terms, that means the often convoluted Web3 user onboarding process — from wallet installation to gas funding — can be simplified through mini apps or in-app integrations.

If adoption takes off, key metrics to track include cross-chain volume, transactions originating from Telegram miniapps, and how quickly TAC tokens are used as gas or incentives within the ecosystem. Real adoption will be a key driver of the token's utility value in the market.

Roadmap, Launch, and Impact of Listing on Bittime

The official TAC roadmap features gradual development phases—Ignite, Flame, and Radiance—that prepare the protocol from testnet to mainnet and optimize the TON-Adapter integration.

Token and mainnet launches along the roadmap are typically key milestones that drive liquidity and market activity. TAC's presence on local exchanges like Bittime, if confirmed, would facilitate access for Indonesian users and could increase domestic trading volume.

However, it's also important to remember: listing increases short-term visibility and liquidity, while fundamental parameters such as token utility, dApp activity, and unlock schedules still determine medium- to long-term performance. Monitor Bittime's official announcement for trading pair details and listing schedule.

How to Access and Save TAC Once Listed on Bittime

Once TAC is officially listed on Bittime, the general steps to acquire tokens are to create an account, complete KYC verification, and then deposit Rupiah or a supported crypto asset to exchange for TAC.

After purchasing, storage options include storing in an exchange wallet for easy trading or moving tokens to a personal wallet compatible with the TAC EVM Layer for full control over private keys.

Don't forget to enable two-factor authentication and verify your withdrawal address to reduce the risk of unauthorized access.

Save your offline wallet recovery phrase and note any network upgrade schedules that may affect migration or token swap steps. (Check Bittime's official guide for specific procedures.)

Conclusion

TAC Protocol is a technical effort to bring the Ethereum ecosystem closer to Telegram's user base through integration with TON.

The TAC token acts as a gas, staking, and governance vote, while its tokenomics reflect a combination of ecosystem allocation, vesting, and inflation policies to support network security.

A presence on local exchanges like Bittime makes it easier for Indonesian users to access the platform, but long-term performance will depend on actual adoption, supply management, and the protocol's technical stability. Actively monitoring official announcements and on-chain metrics remains key for those interested in getting involved.

FAQ

What is the main function of the TAC token?

The TAC token acts as a gas token for the TAC EVM Layer, a staking instrument for network security, and a governance token that grants voting rights to stakers.

What is the total supply of TAC?

The initial supply stated in the official documentation is 10 billion TAC during the Token Generation Event, with an inflation mechanism designed to support validator and staking rewards. Details of the distribution and vesting schedule can be found in the official tokenomics document.

Will TAC be used directly in Telegram?

The strategy is to provide access to EVM dApps through Telegram mini apps with a simplified user experience, so that TAC can become part of the economy in those apps depending on adoption and technical integration.

How can I buy TAC in Indonesia?

If TAC is listed on Bittime, purchases are typically made through a Bittime account with KYC verification, a deposit of Rupiah or crypto, and then an exchange for a TAC pair. After purchasing, consider transferring the tokens to a personal wallet if your goal is long-term.

What are the biggest risks associated with TAC?

Key risks include supply pressure due to token unlocks, potential technical issues with cross-chain bridging, and competition from similar solutions. It is highly recommended to review the tokenomics documentation and on-chain activity before making a purchase.

How to Buy Crypto on Bittime

Want to trade sell buy BitcoinLooking for easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDRand other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visitBittime Blogto get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.