What Is Pepon? A Complete Guide to Buying PepsiCo Tokenized Stock (PEPon)

2026-02-18

Interest in real world asset tokenization continues to grow, and Pepon has entered the conversation as a concrete example. If you are searching for what is Pepon, how PepsiCo Tokenized Stock works, or the practical steps for cara beli Pepon crypto, this guide breaks it down clearly.

Pepon, also known as PepsiCo Tokenized Stock ONDO (PEPon), represents on chain exposure to shares of PepsiCo, Inc. Instead of purchasing stock through a traditional brokerage account, investors can gain price exposure through a blockchain based token. The concept blends equity markets with crypto infrastructure, giving global participants access in a more flexible format.

This article explores how PEPon works, how it is backed, its market position, and how to buy PepsiCo Tokenized Stock through crypto exchanges.

Key Takeaways

- Pepon (PEPon) is a tokenized representation of PepsiCo stock, designed to track the real world share price.

- PEPon operates within the RWA Ondo ecosystem, backed by underlying assets held in custody.

- Buying PEPon is similar to purchasing other crypto assets, but investors must understand its structure and limitations.

What Is Pepon (PepsiCo Tokenized Stock ONDO)?

Pepon is a blockchain based token that mirrors the economic performance of PepsiCo, Inc. common stock, traded under the ticker PEP in traditional markets. It is issued within the Ondo ecosystem, which focuses on bringing real world assets into tokenized form.

Each PEPon token reflects exposure to PepsiCo shares held by a custodian. Based on available asset data, one PEPon corresponds to slightly more than one underlying PEP share, with the exact share ratio specified in the asset documentation. This structure ensures that the token’s value closely tracks the underlying stock price.

However, holding PEPon does not grant shareholder voting rights. Investors receive price exposure rather than direct legal ownership of equity. That distinction is important for those comparing it with buying PepsiCo shares through a brokerage.

In essence, Pepon sits at the intersection of equities and decentralized infrastructure, positioning itself within the broader rwa ondo category.

How Does PepsiCo Tokenized Stock Work?

The mechanism behind PEPon is relatively straightforward but carefully structured. Ondo’s model relies on custodial backing. This means the issuer holds real PepsiCo shares in custody, and token issuance corresponds to those holdings.

When demand increases, new tokens can be minted against additional shares acquired and stored. When redemptions occur, tokens can be burned. This supply management helps keep the token price aligned with the underlying stock through arbitrage opportunities.

Unlike purely speculative crypto tokens, PEPon’s valuation is anchored to a publicly traded company. Price fluctuations primarily follow PepsiCo’s market performance, although liquidity conditions and exchange spreads in crypto markets can cause minor deviations.

Trading activity may extend beyond traditional stock exchange hours, depending on the exchange listing. This feature is one reason tokenized equities attract global investors seeking flexibility.

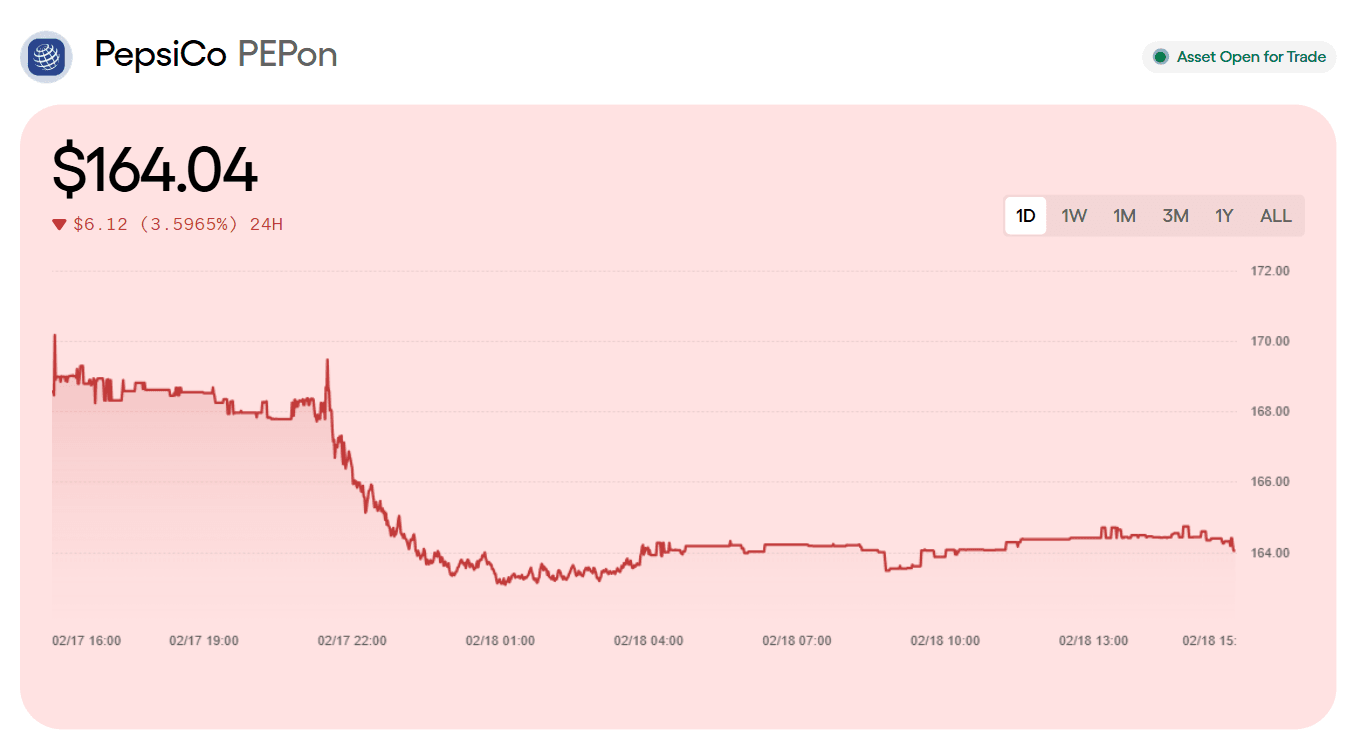

Market Overview and Current Position

As a tokenized equity, PEPon’s market metrics differ from large cap cryptocurrencies. Liquidity is typically lower than major crypto assets, but it reflects a growing niche segment within real world asset tokenization.

The price of PEPon generally tracks PepsiCo’s stock price, which historically trades in the range of high double digit to low triple digit US dollar levels. Market capitalization depends on the number of tokens issued and circulating.

For investors in Indonesia and other regions, PEPon offers exposure to a US listed multinational company without opening a US brokerage account. That accessibility is part of its appeal, especially in jurisdictions where foreign stock access can be complicated.

Still, liquidity concentration on specific exchanges means traders should check order book depth before executing larger transactions.

How to Buy Pepon Crypto on Bittime

If you are looking for cara beli PepsiCo Tokenized Stock in token form, here is a practical guide.

1. Register or Sign up on Bittime

Create and verify your account according to the exchange’s KYC requirements.

2. Fund Your Account

Deposit supported assets, commonly stablecoins such as USDT. Some exchanges also allow direct fiat deposits depending on your region.

3. Search for the Trading Pair

Locate the relevant trading pair, typically PEPON paired with USDT or another stablecoin. Review the price chart, order book, and recent trading activity.

4. Place Your Order

You can place a market order for immediate execution or a limit order if you prefer to buy at a specific price. Confirm the transaction details before submitting.

5. Store Your Tokens

After purchase, you may keep PEPon on the exchange or transfer it to a compatible self custody wallet, depending on network support and withdrawal availability. Always double check the contract address and network before transferring.

Before buying, review trading fees, withdrawal fees, and regional restrictions.

Advantages and Risks of PEPon

Advantages

One clear advantage is access. Investors can gain exposure to a major US listed company through crypto rails. Settlement is digital, and trading can be more flexible than traditional brokerage systems.

PEPon is also part of a broader trend toward tokenized real world assets, where blockchain transparency and programmability can enhance efficiency.

Risks

Liquidity risk is a primary consideration. Tokenized stocks do not always have deep order books. Regulatory frameworks for tokenized equities are still evolving and may vary by country.

Additionally, holders do not receive voting rights and may not receive cash dividends directly. Economic benefits are typically reflected in token structure rather than traditional shareholder mechanisms.

Investors should also consider counterparty risk tied to the custodian and issuer structure.

Conclusion

Pepon represents a tangible example of how real world assets are entering the blockchain ecosystem. By tokenizing PepsiCo stock, the Ondo framework offers price exposure in a digital format that is accessible to global investors.

Understanding what is Pepon, how PepsiCo Tokenized Stock operates, and the proper steps for cara beli Pepon crypto is essential before allocating capital. While the structure offers convenience and cross border accessibility, it also introduces regulatory and liquidity considerations that differ from direct stock ownership.

For investors exploring rwa ondo products, PEPon serves as a case study in how traditional equities and crypto infrastructure are increasingly intertwined.

FAQ

What is Pepon crypto?

Pepon, or PepsiCo Tokenized Stock ONDO, is a blockchain based token designed to track the price of PepsiCo, Inc. shares.

Is PEPon the same as owning PepsiCo stock?

No. PEPon provides economic exposure to the stock price but does not grant voting rights or direct shareholder status.

How can I buy PepsiCo Tokenized Stock in crypto form?

You can buy PEPon on supported crypto exchanges by depositing funds, selecting the trading pair, and placing a buy order.

Does PEPon pay dividends?

Dividends are generally reflected in the token structure or pricing mechanism rather than distributed as traditional cash dividends to holders.

Is PEPon suitable for beginners?

It can be accessible, but beginners should understand tokenized stock mechanics, exchange risks, and regulatory considerations before investing.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.