Understanding Defituna (TUNA): What It Is, Its Function, Tokenomics & Price

2025-12-01

Bittime - Defituna (TUNA) is starting to be widely discussed because it offers an integrated trading ecosystem and liquidity provision.Solana network.

In recent months, the project has emphasized efficiency Automated Market Maker (AMM), passive income opportunities, and attractive tokenomics for traders and liquidity providers.

This article discusses what Defituna is, how it works, the function of the TUNA token, as well as an overview of its price and market metrics.

What is Defituna (TUNA)?

Defituna (TUNA, Contact: TUNAfXDZEdQizTMTh3uEvNvYqJmqFHZbEJt8joP4cyx) is a Solana-based DeFi platform that combines spot markets, liquidity pools, and lending mechanisms in one system.

The project is built by a team with strong experience in the DeFi sector, particularly in the development of early primitives such as AMMs and liquidity strategies.

Defituna is designed to provide an efficient trading experience with tight spreads, fast execution, and greater market depth through synergy between traders, liquidity providers, and lenders.

One of Defituna's core concepts is a complete ecosystem that reinforces each other.

Traders get a liquid market, liquidity providers get the opportunity for high returns, and lenders provide the assets that fuel leverage.

This structure creates an economic model that rotates independently without dependence on external parties.

Read also:15 Best DeFi Tools to Optimize Your DeFi Investments

How Defituna Works

When users trade on the Defituna platform, they interact with the spot market. The system supports two types of orders: Maker orders, which allow users to set their own price and wait for execution, and Taker orders, which allow users to enter the market instantly. Behind these transactions lies liquidity pools which provides assets for order execution.

Liquidity providers place tokens into a pool, and a smart contract automatically manages the buying and selling mechanism. Liquidity providers effectively act as market makers. They earn revenue from transaction fees, as well as potential additional returns through leverage strategies.

On the other hand, lenders provide assets that allow liquidity providers to increase their position capacity.

This mechanism increases market efficiency and provides lenders with returns from the interest rates paid on borrowed assets.

The combination of these three roles forms a structure that provides better market stability than traditional AMMs.

Read also:What Is Momentum (MMT)? Its Development and Roadmap

Defitune Ecosystem

Defituna not only provides a spot market but also various liquidity mining strategies, a lending system, TUNA staking, and support for builders through SDKs and smart contracts. The Defituna team aims to create the most efficient AMM experience on Solana, with a high-quality user experience as its top priority.

This platform also provides DeFi education, such as understanding pseudo-delta neutral liquidity provision, the risk of impermanent loss, and guidance on liquidity-based trading strategies.

By providing an educational layer, Defituna tries to target both beginners and advanced users.

Read also:What Is Boundless (ZKC)? The ZK Infrastructure Token Listed on Bittime

Defituna (TUNA) Price Today

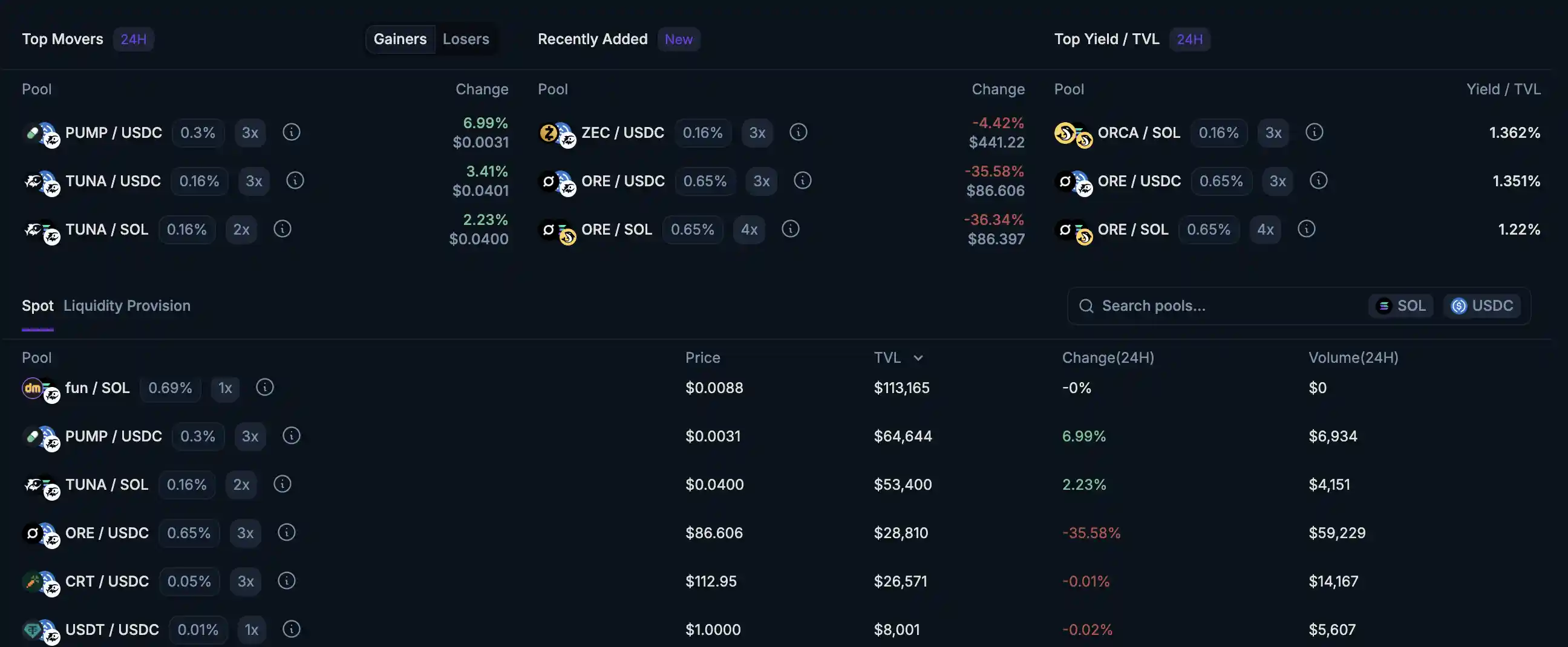

Based on data listed in the source, the price of Defituna (TUNA) is at the level of 0.04009 dollars with a weekly decrease of 13.46 percent.

The market cap was recorded at 13.03 million dollars, while the 24-hour trading volume reached 53.09 thousand dollars or around 87.68 percent higher than the previous period.

The volume to market cap ratio is at 0.963 percent, indicating active trading but still relatively small compared to total capitalization.

The number of token holders reached 1.99 thousand wallet addresses, which shows a still growing but stable community.

The total supply of TUNA is nearly one billion tokens, with a circulating supply of around 331.5 million units, according to the team's report.

Tokenomics Defituna (TUNA)

The TUNA token acts as both a utility token and an asset for ecosystem participants. Users can stake to earn passive income from platform revenue. Staking is a crucial element of the Defituna ecosystem as it incentivizes the community to support the platform's growth.

TUNA Tokenomics is designed to align the interests of traders, liquidity providers, lenders, and stakers.

With a total supply of 1 billion tokens and a Fully Diluted Valuation (FDV) of $40.1 million, the token distribution reflects the growth stage of the DeFi project, which is still in the expansion phase.

The platform's revenue-based incentive model makes TUNA more directly linked to Defituna's trading performance.

Defituna Prospects

Defituna's primary advantage lies in its integrated ecosystem design and focus on AMM efficiency. By combining spot markets, liquidity provision, and lending in one platform, Defituna has the potential to attract Solana users seeking high yields and a fast trading experience.

If liquidity adoption increases, TUNA has the potential to gain a stronger position in the Solana DeFi market.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is Defituna?

Defituna is a Solana-based DeFi platform that combines trading, liquidity pools, and lending.

What is the function of the TUNA token?

TUNA is used for staking, ecosystem utilities, and incentives for platform participants.

Can TUNA generate passive income?

Yes, through TUNA staking which provides a share of the ecosystem's revenue.

What is the current price of TUNA?

TUNA price is around 0.04010 dollars based on source data.

What are the main advantages of Defituna?

Integration of spot market, liquidity provision, and lending in one mutually supportive system.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.