What is Unlimited Wealth Utility (UWU)? A Complete Explanation

2025-12-23

Amidst the booming meme coin trend on the Solana network, Unlimited Wealth Utility (UWU) makes a lot of traders are curious because the price movement looks aggressive in a short time.

So, what is Unlimited Wealth Utility (UWU) actually, and is this token worth considering? This article will discuss UWU Coin in full, starting from its definition, token data, risks, to price analysis based on the latest charts.

What is Unlimited Wealth Utility (UWU)?

Unlimited Wealth Utility (UWU) is Solana-based tokens which combines the concept of meme coins with the “utility” tag.

In terms of branding, UWU Coin tries to appear as a high-risk crypto asset with the potential for quick profits, something that is quite common in the meme coin ecosystem.

However, until now, there is no official and transparent explanation regarding the real utilities offered by UWU.

There is no clear whitepaper, detailed roadmap, or verifiable development team information. This is why UWU is often categorized as a high-risk token.

Read Also: What is Canton (CC)? Layer 1 for Institutions and RWAs

Data Token Unlimited Wealth Utility (UWU)

Here is a summary of the UWU Coin data based on available information:

Blockchain: Solana

Contract Address: G4cPnwTLd6oKA6FQgm5ckJmw3tEYapQRmqpQEnQYbonk

Total Supply: 1.000.000.000 UWU

Circulating Supply: 0

Number of Holders: ±395 wallet

FDV: around $254,000

Volume 24 Jam: ±$196.700

CMC level: around #4032

The absence of circulating supply is one of the big red flags, because it has the potential to facilitate price manipulation by certain parties.

Read Also: What is Codatta (XNY)? AI & Big Data Token Listing on Bittime

Unlimited Wealth Utility (UWU) Risks You Must Be Aware

Here are some risks of Unlimited Wealth Utility (UWU) that you must be aware of:

1. Technical Risk Indicators on Contracts

Based on community reports and smart contract analysis tools, UWU has several red flags such as:

- Non-standard contract methods.

- Potential blacklist or account freezing function.

- Token ownership is concentrated in a particular wallet.

These characteristics are often found in projects that end up back-pulling.

2. Reputation and Community Report

Several discussions on YouTube and Reddit mention the chance of a scam is 35% or more. There are also reports of users claiming:

- Balance cannot be withdrawn.

- Account is frozen after deposit.

- Asked to pay “additional fees” for withdrawals.

In addition, ScamAdviser also provides low trust score against projects with similar names and patterns.

3. No Valid Market Cap Data

Since the circulating supply is recorded at zero, UWU Coin has no real market cap. This situation is often used in pump and dump schemes, where the price is raised rapidly and then sold in bulk by the original owner.

Read Also: What is DeAgentAI (AIA)? An AI Token Now Available on Bittime!

UWU Coin Price Analysis Today

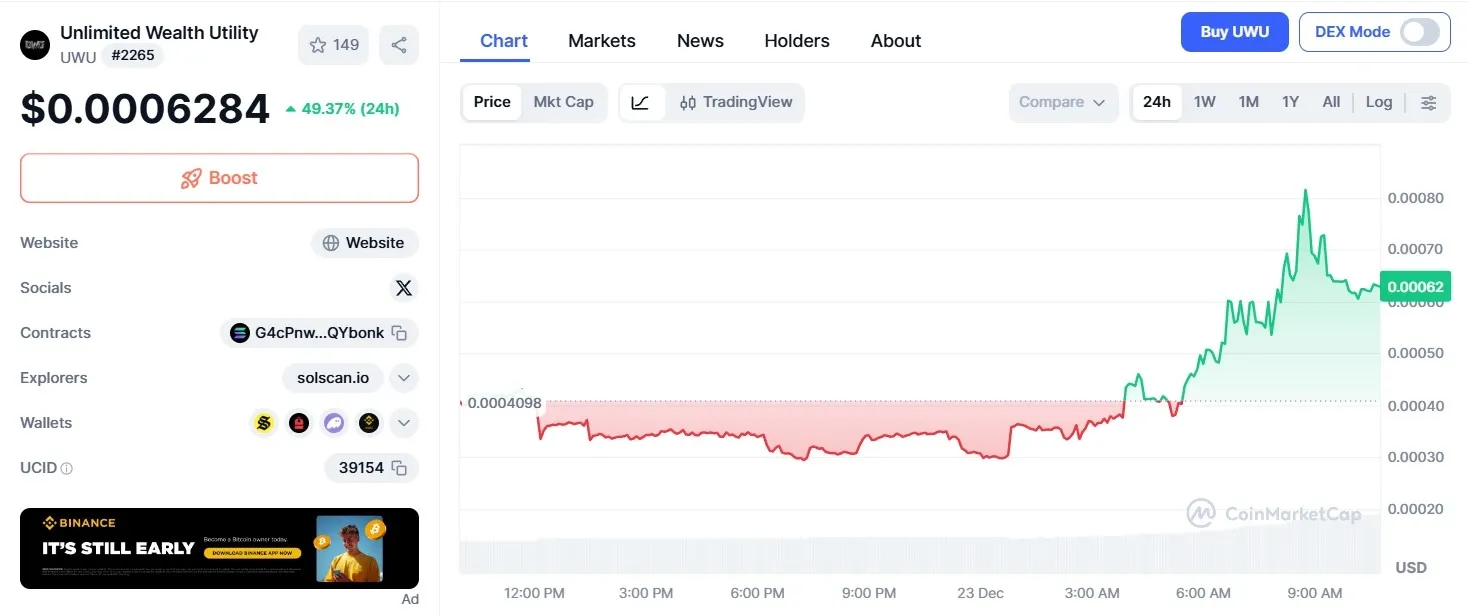

Based on the latest chart, several interesting things are visible from a technical perspective:

- UWU Coin price today be in the range $0.00062.

- In the last 24 hours, UWU has increased by around+49%.

- Visible long sideways phase before the sharp spike happened.

- After the spike, the price started to experience a slight correction.

Simple Technical Analysis

- Strong support seen in the area of $0.00040 – $0.00045.

- Nearest resistance is around $0.00075 – $0.00080.

- The movement pattern shows a fast pump, especially high-risk meme coins.

- Volume increases significantly when prices rise, then starts to decline during corrections.

Technically speaking, UWU Coin is more suitable for very short term speculation, not a long-term investment.

Read Also: What is Palapa Token (PLPA) from Bittime Platform?

Is UWU Coin Worth Buying?

The honest answer: very risky. UWU Coin is better viewed as a speculative asset or "gambling token." Without team transparency, clear utility, and strong fundamental data, the potential for losses remains substantial.

If you still want to try:

- Use funds you can afford to lose.

- Do not connect the main wallet.

- Check the contract via Rugcheck and Dexscreener.

- Avoid FOMO when prices have risen high.

Read Also: What is Recall (RECALL)? Function, Tokenomics, and Pricing

Conclusion

So, what is Unlimited Wealth Utility (UWU)? UWU Coin is a Solana-based meme token with high risk, minimal transparency, and many indicators pointing to a potential rug pull.

While its price movement may seem attractive in the short term, fundamentally, this project cannot be considered safe. For experienced traders, UWU Coin is probably only suitable for quick scalping. Beginners should be more cautious or even avoid this token.

Read Also: What is a Semantic Layer (42)? Tokenomics and Price Analysis

How to Buy Crypto on Bittime

Want to trade sell and buy Bitcoins and easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is Unlimited Wealth Utility (UWU)?

Unlimited Wealth Utility (UWU) is a Solana-based token that carries the concept of a meme coin with utility claims, but has no clear real-world use case.

Is UWU safe for investment?

It's not exactly safe. UWU has numerous red flags, including zero circulating supply, concentrated holders, and negative community reports.

Why can the price of UWU Coin increase drastically?

Price increases are usually driven by speculative volume and short-term hype, not by project fundamentals.

Does UWU have the potential to rug pull?

The risks are quite high. Many technical indicators and patterns are frequently found in rug pull projects.

What to do before purchasing UWU?

Do DYOR, check contracts on Rugcheck, analyze charts on Dexscreener, and never use your principal.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.