Zcash Price Analysis 2026: Is It the Right Time to Buy ZEC Coin?

2026-02-02

The price of Zcash (ZEC) has been under pressure recently. As one of the most established privacy coins in the crypto market, the project is once again being tested by a combination of internal issues, weak technical conditions, and global regulatory uncertainty.

In addition, trading volume also declined, indicating market caution. Could this be an accumulation opportunity heading into 2026, or a signal of further risk? Read this Zcash (ZEC) price analysis for 2026 to find out!

Key Takeaways

- ZEC prices are under pressure due to the governance crisis and the still bearish technical structure.

- Zcash remains ahead in terms of privacy technology through zk-SNARKs.

- Zcash (ZEC) price analysis 2026 depends on the restoration of confidence and clarity of the project's roadmap.

What is Zcash (ZEC)?

Image Source: Zcash

Zcash (ZEC) is a decentralized cryptocurrency focused on privacy and transaction anonymity. First released on October 28, 2016, the project is built on the Bitcoin codebase, making it one of the oldest privacy-enhancing crypto projects.

Unlike Bitcoin, which is pseudonymous, Zcash uses zk-SNARK technology, which allows transactions to be verified without revealing sensitive details such as the sender's address, recipient's address, or transaction amount.

While Zcash transactions remain recorded on the public blockchain, this critical data is hidden by default. Interestingly, the project also offers transparency options for auditing or regulatory compliance, making it flexible for various needs.

Read Also: Brevis (BREV) Price Prediction 2026-2030: Latest Analysis

ZEC Price Performance Today

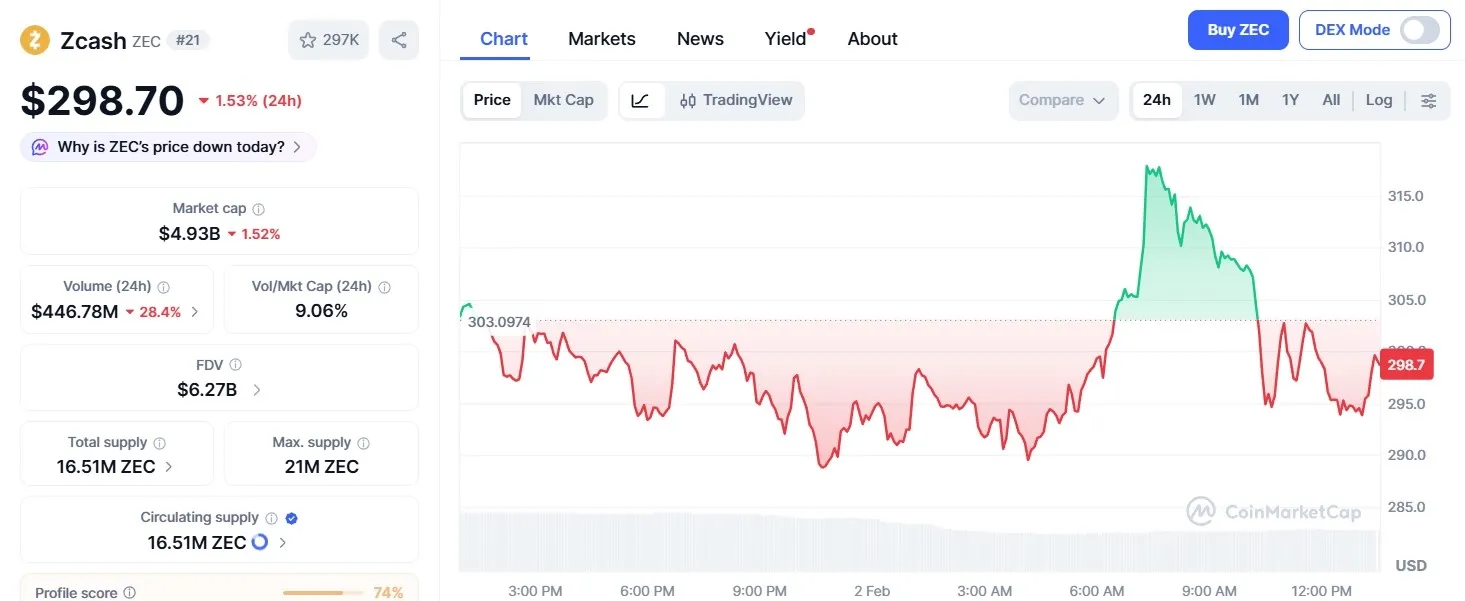

Image Source: Coinmarketcap

Based on latest charts, ZEC price today is in the $298.7 area with a market capitalization of around $4.9 billion.

The 24-hour trading volume recorded a sharp decline, which usually indicates a lack of aggressive buying interest in the short term.

Technically, ZEC price also appears to have failed to hold above the psychological level of $310, which previously served as a strong support area.

Read Also: Clovis (CLO) Price Forecast 2026-2030: Long-Term Outlook

Zcash (ZEC) Price Analysis 2026

So, what factors are causing pressure on the Zcash (ZEC) price? Here's the analysis:

1. Governance Crisis (Bearish Impact)

One of the biggest factors is the governance crisis. In January 2026, the entire core Zcash development team at Electric Coin Company reportedly resigned following conflicts with the foundation over funding and the direction of protocol development.

This situation creates a significant leadership vacuum. Investors are questioning the continuation of the roadmap, including the development of Zebra nodes and the enhancement of FROST privacy.

In the history of privacy coins, internal shocks like this have often triggered prolonged sell-offs.

2. ZEC Technical Analysis (Bearish Momentum)

Technically, the ZEC price structure continues to show lower highs and lower lows, indicating an unending downtrend. The price is also below a key support area and approaching a key Fibonacci retracement zone.

The RSI indicator is in the oversold area, but there is no confirmation of a reversal yet. Meanwhile, the MACD indicator continues to show seller dominance.

If the price falls and stays below $290, the potential for a further decline to the $260 to $200 area is still open based on historical liquidity zones.

3. Macro Uncertainty and Regulation

External factors also weighed on the ZEC price. The delay in the US regulator's decision on a crypto ETF due to the government shutdown has tilted market sentiment defensively.

On the other hand, privacy coins like Zcash are also facing regulatory pressure in various regions, including Europe and the United States.

Under these conditions, crypto assets with high anonymity are usually more vulnerable to underperformance due to concerns about being delisted from major exchanges.

Read Also: Bounce Token (AUCTION) Price Prediction 2026-2030: Latest Chart Analysis

Zcash (ZEC) Outlook 2026

Well, is this the right time to buy ZEC Coins? Despite currently being under pressure, the Zcash 2026 price analysis is not completely pessimistic.

If internal conflicts can be resolved and the development roadmap is clear again, Zcash still has the potential to emerge as a relevant privacy solution.

Demand for digital privacy is expected to continue to increase as data oversight becomes stricter.

However, this potential can only be realized if Zcash is able to balance technological innovation with regulatory compliance.

Read Also: Oasis (ROSE) Price Prediction 2026: The Potential of a Privacy & AI Token

Conclusion

Zcash (ZEC) price analysis 2026 shows that ZEC is currently in a challenging phase. Pressure from the governance crisis, bearish technical signals, and regulatory uncertainty make price movements still volatile.

For long-term investors, a price below $300 may seem attractive, but the risks are significant. ZEC has the potential to be an opportunity if the project manages to regain confidence and continue its technological innovation.

Conversely, without clarity on direction, price pressures could continue into 2026.

Read Also: Dusk (DUSK) Price Prediction 2026: RWA Token Opportunity Analysis

How to Buy Crypto on Bittime

Want to trade sell and buy Bitcoins and easy crypto investing? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is secure and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately purchase your favorite digital assets!

Check the course BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles on Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

FAQ

What is Zcash (ZEC)?

Zcash is a privacy-based cryptocurrency that uses zk-SNARK technology to hide transaction details.

Why has the price of ZEC dropped recently?

ZEC's price is under pressure due to an internal governance crisis, bearish technical signals, and global regulatory uncertainty.

Is Zcash still worth long-term investment?

The potential is still there, but it depends heavily on the recovery of the development team and clarity of the future roadmap.

Will ZEC price rise in 2026?

Yes, if there are fundamental improvements, governance stability, and positive sentiment towards privacy coins.

Is Zcash technologically safe?

In terms of privacy technology, Zcash is still considered one of the most advanced in the crypto industry.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.