Will AI Progress Trigger Mass Unemployment? Will the Financial Sector Collapse?

2026-02-20

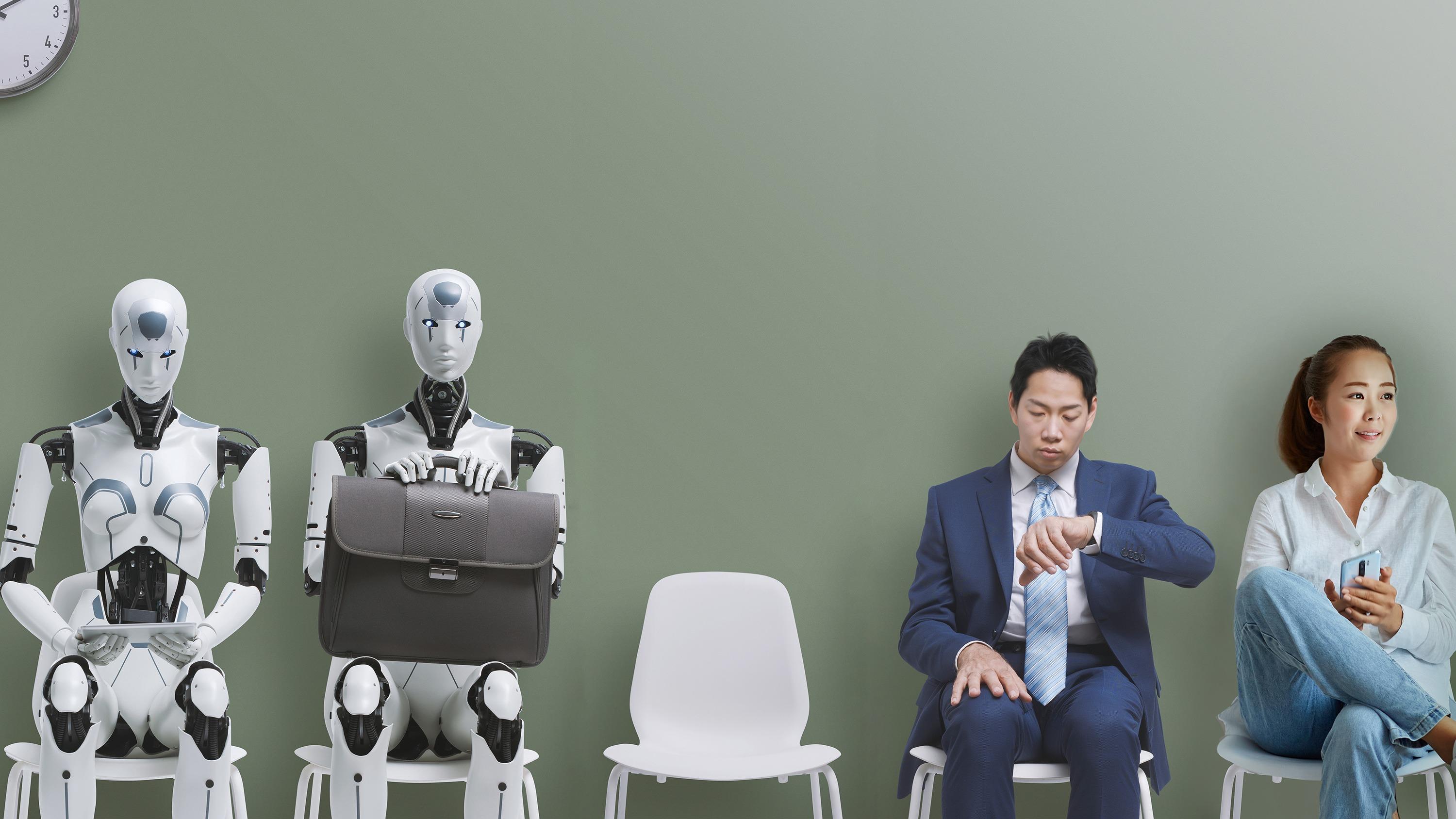

AI is advancing faster and faster, and it raises a big question: can AI and mass unemployment trigger an economic shock—甚至 making the impact of AI on the financial sector feel truly serious?

That concern comes up because many office jobs are increasingly automatable, while modern economies depend heavily on credit. If a wave of layoffs driven by AI automation happens at the same time as high household debt, the risk of global loan defaults can rise as well.

We’ll walk through the chain in simple language, then offer a calmer way to read the market—from stocks to crypto. This is educational content, not an invitation to invest.

Key Takeaways:

- AI can reduce office jobs, and the follow-on effects can spill over into credit and banks.

- Financial-sector risk often emerges through a simple chain: income falls, installments default, and bank asset quality deteriorates.

- Markets sometimes react faster through moves in tech stocks and crypto, including discussions about the AI–Bitcoin relationship.

Why Is the AI and Mass Unemployment Issue Emerging Now?

AI is no longer just a typing assistant. Many companies are starting to use it for routine work that used to require large teams—such as administration, report analysis, customer service, and even basic marketing.

That’s why the topic of AI and mass unemployment comes up so often. Unlike earlier industrial revolutions, the most vulnerable group today is not only factory workers, but also office workers whose tasks are repetitive and can be “replicated” by systems.

However, “AI will eliminate all jobs” is also too extreme. What’s more realistic is a reshaping of work: some roles disappear, some change, and some new roles are created.

The real challenge lies in the transition period. When the transition moves too fast, the economy can feel heavy because many people haven’t had time to switch tracks—while living costs and loan installments keep running.

Layoffs due to AI automation: roles most quickly affected

- Repetitive back-office tasks: data entry, basic reconciliation, standard report creation.

- Entry-level customer service: repetitive questions and processes with clear scripts.

- Generic marketing content: basic copy, summaries, simple ad variations.

- Routine analysis: daily dashboards without complex strategic decision-making.

How to assess whether a job is “AI-vulnerable”?

- The tasks are highly repetitive and template-based.

- Decisions rarely require deep human context.

- Outputs can be evaluated quickly using clear rules—for example, right/wrong or format compliance.

Also Read: Crypto Trading Strategies for Beginners—Don’t Do This!

The Impact of AI on the Financial Sector: From Loan Defaults to Systemic Risk

<blockquote class="twitter-tweet"><p lang="in" dir="ltr"> Economic Crisis Caused by AI?<br><br>According to Arthur Hayes, Bitcoin’s price drop from $126K to $60K is a signal that something is off in the global economy:<br><br>1. A Signal of Breakdown<br><br>Nasdaq (yellow) vs Bitcoin (white)<br><br>Usually, Bitcoin moves in step with Nasdaq. But since October 2025,… <a href="https://t.co/8kMPK14eRn">pic.twitter.com/8kMPK14eRn</a></p>— Republik Rupiah (@RepublikRupiah) <a href="https://twitter.com/RepublikRupiah/status/2024453914318278986?ref_src=twsrc%5Etfw">February 19, 2026</a></blockquote> <script async src="https://platform.twitter.com/widgets.js" charset="utf-8"></script>

When household income is disrupted, the first thing people usually feel is their installments. This is where the impact of AI on the financial sector becomes relevant. Banks and finance companies live off payment cashflows. When payments slow, asset quality deteriorates.

If deterioration becomes widespread, funding costs rise and banks become tighter in extending credit. The effect can feel like a sudden brake on the economy—because credit is the “fuel” for spending and investment.

The commonly discussed mechanism is straightforward: job cuts increase default risk, non-performing loans weigh on bank performance, and related sector stock prices come under pressure.

In certain scenarios, panic can show up as large-scale withdrawals. This is often framed as part of a tech-driven financial crisis—not because AI is “evil,” but because the transition is too fast and the credit system isn’t ready to adjust.

Global loan-default risk: why the effects can move fast

- Consumer credit is widespread—from credit cards and mortgages to vehicle loans.

- Banks track health through credit-quality ratios. If they worsen, lending can be tightened.

- When credit tightens, businesses hold back expansion, and economic pressure intensifies.

What the financial sector typically does to cushion shocks

- Tighten credit assessment and increase loss provisions.

- Adjust operating costs, including internal automation.

- Shift focus toward segments with more measurable risk.

- Test capital resilience through stress tests and economic-downturn scenarios.

Also Read: 7 Solid Ways to Trade Crypto for Beginners, Complete with Tips and Tricks

Does the Market React First? AI’s Impact on Stocks and the AI–Bitcoin Connection

Markets often “sense” change faster than official economic news. That’s why many people watch AI’s impact on stocks and crypto assets as indicators of liquidity sentiment.

In some circulating narratives, when tech stocks look stable but liquidity-sensitive assets weaken, some analysts view it as an early alarm that credit and financing are tightening. This isn’t proof of a crisis, but it can be a signal to be more cautious.

On the other hand, AI can also fuel optimism through the productivity theme. Software companies and AI chip providers may benefit, so related stocks can stay strong even if the real economy hasn’t fully stabilized.

This “two worlds” condition makes reading markets tricky. That’s why it’s safer to use multiple indicators at once, not just a single chart.

The AI–Bitcoin connection: why they’re often linked

- Bitcoin is often seen as sensitive to changes in liquidity and credit availability.

- When risk rises, investors may reduce volatile assets first.

- When central banks loosen liquidity, risk assets often rebound faster.

How to read market signals without panicking

- Separate “narrative” from “data.” Narratives can shift quickly; data usually moves more slowly.

- Watch sector moves. If only one sector is hit, the problem may be specific.

- Beware of over-generalization: asset divergence doesn’t always mean a recession.

Also Read: Join the Bittime Futures Public Beta Waitlist and Get Trial Funds Rewards up to 1500 USDT

Global Recession Threat in 2026 and Global Economic Pressure: Scenarios to Understand

The term “global recession threat in 2026” often comes up because of a combination of pressures: slowing growth, geopolitical uncertainty, shifting capital costs, and rapid technological transition.

AI can become an “additional trigger” if labor-market changes happen too quickly. But a recession isn’t destiny. Many other factors matter, including fiscal policy, central-bank responses, and how quickly people and companies adapt.

For readers who actively track assets, the key is understanding that economic shocks usually have phases. The early phase often feels deflationary: consumption slows, credit tightens, and risk assets come under pressure.

After that, policy can shift to limit broader damage. This is why discussions about “central banks may ease” often appear in debates about tech-driven financial crises.

Practical steps to handle economic uncertainty

- Clean up debt: prioritize high-interest installments and prepare a payment buffer.

- Strengthen skills: choose skills that are hard to replace, like communication, negotiation, and problem-solving.

- Protect cashflow: set aside emergency funds and avoid excessive speculation when markets are volatile.

- For investors: focus on risk management, not chasing perfect predictions.

Conclusion

AI can accelerate productivity, but the transition can also create friction in the labor market. If a large-scale wave of layoffs due to AI automation occurs, the effects can spill into credit, amplify global default risk, and pressure the financial sector.

Still, this remains a scenario—not a certainty. The healthiest approach is to read signals calmly: understand the cause-and-effect chain, monitor AI’s impact on stocks, and understand why people discuss the AI–Bitcoin connection when liquidity shifts.

If you want to track the market and stay updated on crypto news without missing the context, you can check Bittime Exchange to explore assets, and read daily insights on Bittime Blog.

FAQ

Will AI definitely cause mass unemployment?

Not necessarily. AI can remove some tasks, but it can also create new roles. The biggest risk lies in an overly rapid transition.

Why can AI’s impact on the financial sector be large?

Because modern economies depend on credit. When income falls, installment defaults rise, and bank asset quality comes under pressure.

What are easy-to-understand early signs of global economic pressure?

You usually see credit tightening, weakening consumption, and rising volatility in risk assets. But one indicator alone is not enough.

Is the AI–Bitcoin relationship real?

The “relationship” is more about liquidity channels and risk sentiment. When liquidity is tight, volatile assets often come under pressure first.

How can you handle the 2026 global recession threat wisely?

Focus on cashflow, debt management, skill-building, and risk management. Avoid impulsive decisions driven by headlines.

How to Buy Crypto on Bittime?

Want to trade (buy and sell) buy Bitcoin and invest in crypto easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start by registering and verifying your identity, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to see today’s crypto market trends in real time on Bittime.

Also, visit Bittime Blog to get various exciting updates and educational information about the crypto world. Discover trusted articles about Web3, blockchain technology, and digital-asset investment tips designed to expand your knowledge in crypto.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.