Top Crypto Influencers of 2026 to Follow for Market Insights

2026-02-04

Bittime - Entering 2026, traders and investors will no longer rely solely on charts to interpret crypto. Information flows rapidly, and the opinions of certain figures often trigger shifts in sentiment.

Crypto influencers are now chosen not because of the hype but because ofanalytical track record, technological understanding, and ability to read macro contexts.

The following names stand out for the consistency and quality of their insights. They are not simply price commentators, but sources of perspective that help traders and investors understand market direction more comprehensively.

Key Takeaways

- The best crypto influencers of 2026 are known for the quality of their analysis, not just their popularity.

- The combination of technical, macro and institutional voices forms a more balanced market picture.

- Following the right influencers helps read the context behind price movements

Vitalik Buterin and the Direction of Blockchain Technology

Vitalik Buterin remains a key figure in blockchain discussions, particularly Ethereum. His role isn't that of a market observer, but rather a technology architect influencing the direction of industry development. His insights on scalability, network security, or protocol design are often the subject of widespread discussion in the crypto community.

Rather than talking about price, Vitalik focuses on long-term fundamentals. This approach makes him a valuable resource for those seeking to understand crypto from a technological perspective, not just speculation.

Read Also: Who Was Jeffrey Epstein? Facts, Cases, and the Epstein Files That Shook the World

Michael Saylor and the Institutional Bitcoin Narrative

Michael Saylor is known as a figure who shaped the Bitcoin narrative among institutions. His perspective positions Bitcoin as a strategic asset directly linked to monetary policy, inflation, and long-term hedging.

His comments often reflect the views of large corporations on crypto. For investors seeking to understand how institutional capital flows are interpreting Bitcoin, Saylor's insights provide context rarely found in retail analysis.

Read Also:Murad's Meme Coin Portfolio Plummets, Losing $58 Million in Six Months

Balaji Srinivasan and the Long-Term Macro Perspective

Balaji Srinivasan brings a broader perspective than just the crypto market. He frequently links blockchain to geopolitics, technology, and the changing structure of the digital economy. His insights help readers see crypto as part of a global transformation, not a separate phenomenon.

For traders and investors seeking a long-term perspective, Balaji offers a way of thinking that encourages deeper analysis of industry direction.

Cathie Wood and the TradFi to Crypto Bridge

Cathie Wood positions crypto within the broader framework of technological innovation. Her research-driven approach connects blockchain with other sectors such as artificial intelligence and financial technology.

His analysis is often used to assess how traditional investors assess the potential of crypto in long-term portfolios. His voice is relevant for those seeking to understand crypto adoption from an institutional perspective.

Read Also: OpenClaw AI Security Risks You Need to Know

Anthony Pompliano and Market Insight Media

Anthony Pompliano, also known as Pomp, is known for his extensive discussions and in-depth interviews with global financial figures. He presents crypto in easy-to-understand language without sacrificing analytical depth.

This approach makes him a key figure for readers seeking to understand the relationship between economic policy, traditional markets, and crypto.

Changpeng Zhao and the Market Infrastructure Perspective

Changpeng Zhao remains a respected voice despite his changing role. His experience building global trading infrastructure makes his commentary relevant in the context of liquidity, regulation, and exchange dynamics.

CZ's insights help us understand how the crypto ecosystem operates behind the scenes, particularly regarding capital flows and market stability.

Read Also:Fair Shares Airdrop: Daily Task System & How to Participate

Crypto Rover and Altcoin Daily: Daily Market Analysis

Crypto Rover is known for its technical approach, which focuses on momentum and market structure. Its analysis is often used by active traders to predict potential short-term movements.

Meanwhile, Altcoin Daily provides a broader fundamental overview, encompassing project developments and altcoin narratives. The combination of the two provides complementary technical and fundamental perspectives.

Ivan on Tech and Lark Davis as Market Educators

Ivan on Tech acts as a bridge between complex blockchain technology and practical understanding. His content helps readers understand how the technology impacts asset value.

Lark Davis offers strategic analysis with a focus on risk management and a portfolio approach. Both are relevant for readers seeking to develop a medium- to long-term understanding.

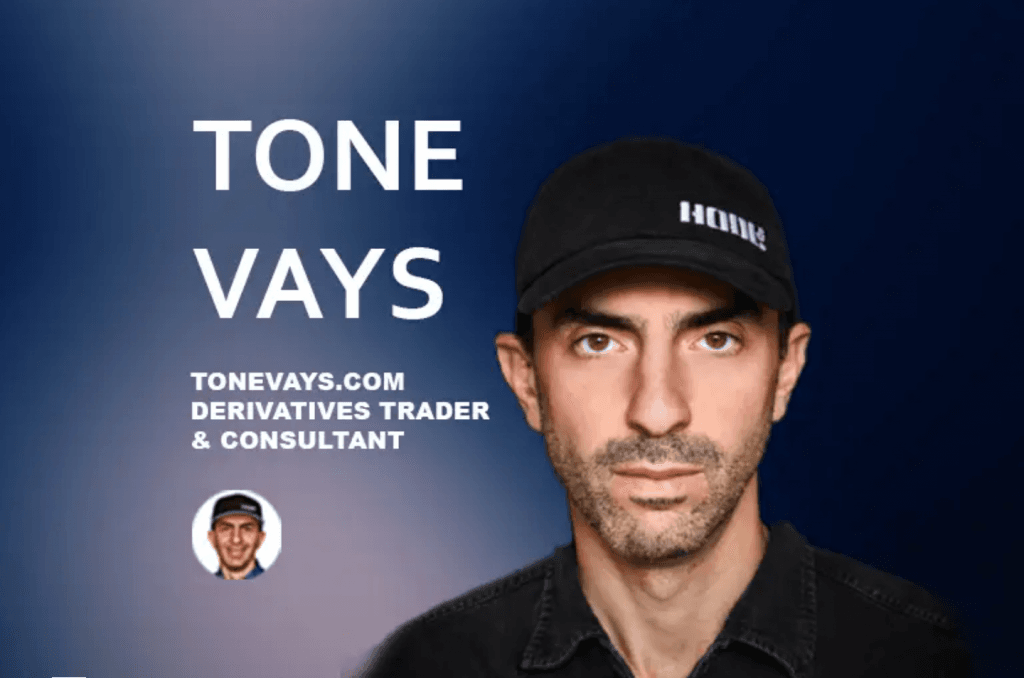

Tone Vays and Wendy O: Two Different Approaches

Tone Vays is known for his disciplined approach based on technical analysis and strong focus on Bitcoin. His views often provide a balance to overly optimistic market narratives.

Wendy O combines education, market psychology, and retail experience. Her approach helps readers understand the emotional dynamics that often influence trading decisions.

Conclusion

In 2026, crypto influencers will serve as information filters amidst the torrent of news. Those worth following won't be the most vocal, but rather those who consistently provide context and data-driven analysis.

Following influencers with diverse backgrounds helps build a more comprehensive market perspective. However, their insights should be used as a complement to personal research, not a substitute for independent judgment.

FAQ

Why are crypto influencers important in 2026?

Because they often provide context and analysis more quickly than mainstream media.

Does the number of followers determine quality?

Not always. The credibility and consistency of the analysis are far more important.

Which platform is most relevant?

Twitter X is effective for quick insights, while YouTube is suitable for in-depth analysis.

Can influencers be used as an investment reference?

Use as an additional reference, not the sole basis for decisions.

How to avoid misleading influencers?

Be wary of sure-fire claims, promises of instant profits, and promotions without transparency.

How to Buy Crypto on Bittime?

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with CoFTRA, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.