Signs Bitcoin Is Starting to Correct After Hitting an All-Time High

2025-10-13

Bittime - Bitcoin has again recorded a new all-time high and attracted the attention of investors worldwide.

However, the resulting euphoria is often followed by a price correction. Signs of a Bitcoin correction after an all-time high usually emerge gradually through technical signals and changes in market behavior.

Understanding these patterns is important for investors to avoid getting trapped at price peaks and to be able to anticipate subsequent movements.

Market Reaction and Liquidation of Long Positions

After Bitcoin reached a record high, many traders opened long positions in the hope of continued price increases. However, as soon as there was a slight decline, highly leveraged positions began to be automatically liquidated.

The ripple effect of this liquidation often triggers sharp price declines. This phenomenon indicates that the market is undergoing a natural adjustment after a euphoric phase.

Such corrections don't necessarily signal the end of a trend, but rather serve as a moment to restore balance between buyers and sellers in the market.

Momentum Indicator Divergence

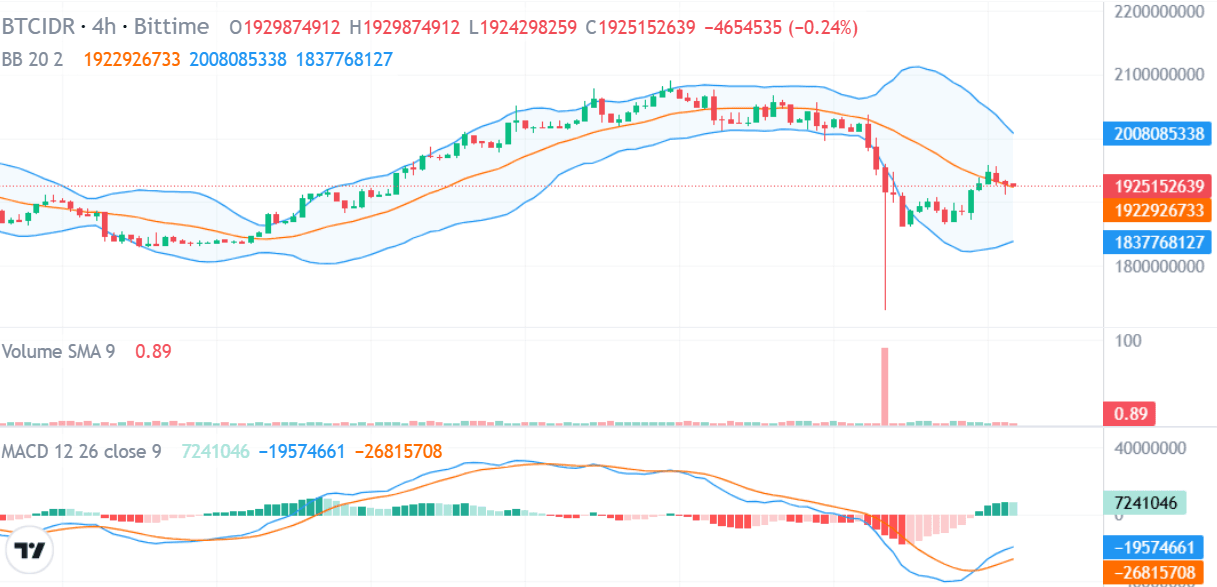

One of the classic signs that Bitcoin's price is starting to weaken is the appearance of divergence in technical indicators such as the RSI or MACD.

When the price sets a new record but the indicator does not follow suit, it means that the momentum strength has begun to decline.

This condition indicates that the market is starting to lose steam to continue its uptrend. If this divergence is followed by increased selling volume, Bitcoin is likely to enter a short-term correction phase.

Decline in Open Interest and Shift in Futures Positions

After prices peak, open interest data on the futures market typically declines sharply. This decline indicates that many traders are closing positions, especially long ones, due to high volatility.

In the context of a correction, a decline in open interest is often seen as a signal of a “healthy reset,” that is, the clearing of speculative positions before a new trend forms.

However, if prices continue to fall and open interest increases, it means that selling pressure from short positions is starting to dominate the market.

Supply Zone Rejection and Breakout Failure

The supply zone is a price area where sellers tend to be active. After an all-time high, Bitcoin often experiences rejection in this area. Failure to break through the supply zone is an important signal that selling pressure is strong.

Breakout failures are generally followed by massive profit-taking by market participants, causing prices to correct back to the support level.

In some cases, corrections like this actually provide an opportunity for long-term investors to accumulate at lower prices.

On-Chain Data and Long-Term Holder Activity

In addition to technical analysis, on-chain data can also provide clues about market direction. When the amount of Bitcoin held by long-term holders increases, it indicates confidence that the downturn is temporary.

Conversely, if the volume of transfers to the exchange increases, it could be that many investors are preparing to sell their assets.on-chainHealthy ones usually show accumulation during corrections, not distribution.

That's why large investors or whales often take advantage of this momentum to buy back Bitcoin at a lower price.

Conclusion

Corrections after all-time highs are a normal phase in Bitcoin's price cycle. Some signs to watch for include liquidation of long positions, technical indicator divergence, declining open interest, rejection at the supply zone, and changes in on-chain data.

As long as key support levels remain intact and long-term holder activity remains stable, a correction can be considered a healthy pause before the uptrend resumes.

However, if selling pressure is accompanied by large volume and support fails to hold, a potential reversal should be considered.

FAQ

Does a correction after an all-time high always mean a downtrend?

Not always. Corrections are often part of a natural consolidation process before the market rebounds, especially if fundamentals remain supportive.

How much correction is considered reasonable?

A correction in the range of 10 to 20 percent is still considered normal. Beyond that, investors need to monitor external factors such as changes in monetary policy or pressure from global markets.

What indicators are most important during a correction?

Momentum indicators such as RSI and MACD, open interest data, and on-chain flows to and from exchanges are three key signals frequently used by professional traders.

Is a correction always a good buying moment?

Not always. The best time to buy is when the market shows signs of stability, technical support is strong, and on-chain data indicates accumulation, not distribution.

How to anticipate the next major correction?

Investors can monitor trading volume, price patterns in resistance zones, and the behavior of large investors. Portfolio diversification and disciplined risk management remain key to navigating Bitcoin volatility.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with Bappebti, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Check the exchange rate BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Also, visit the Bittime Blog for interesting updates and educational information about the crypto world. Find reliable articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your crypto knowledge.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.