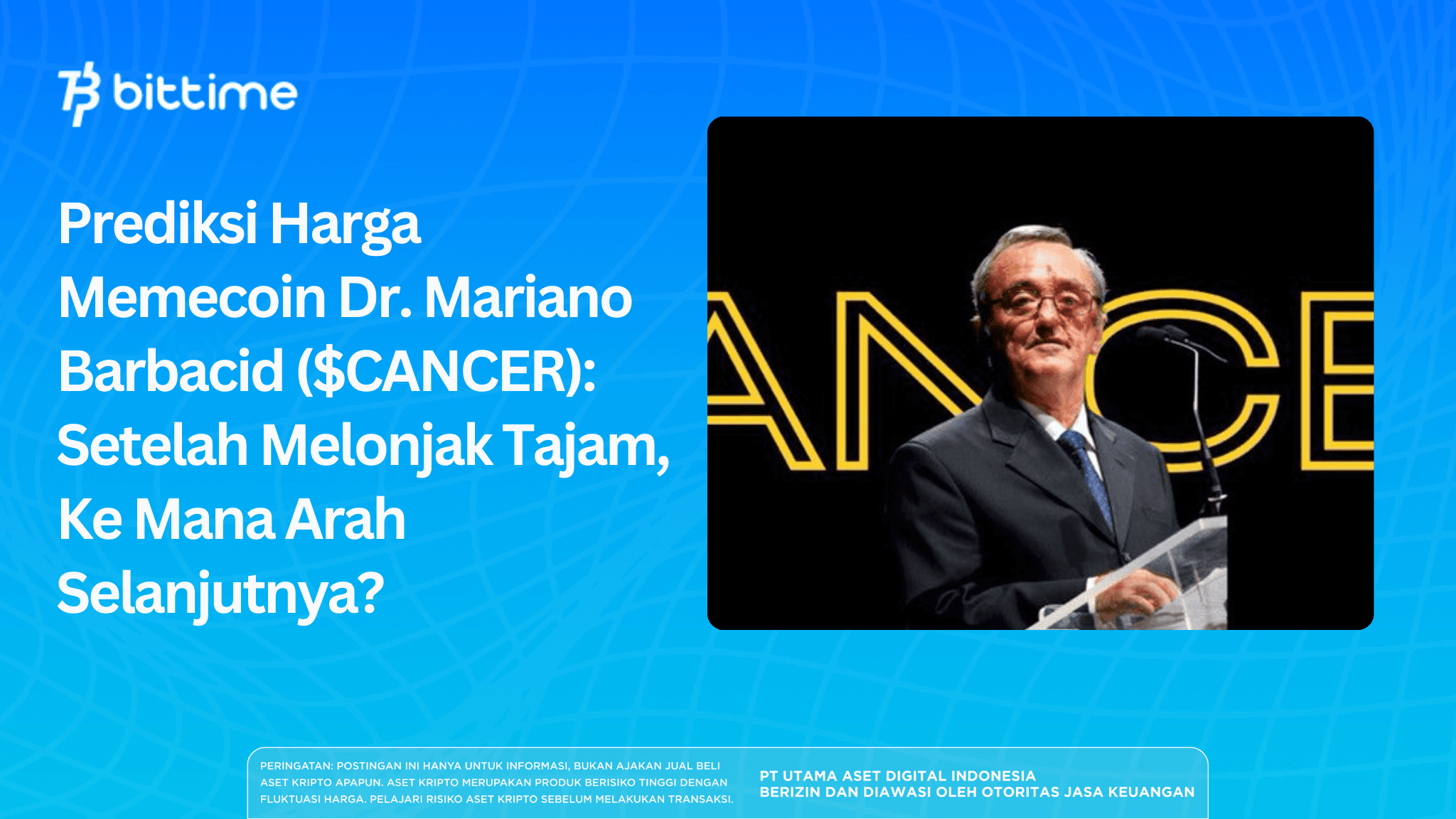

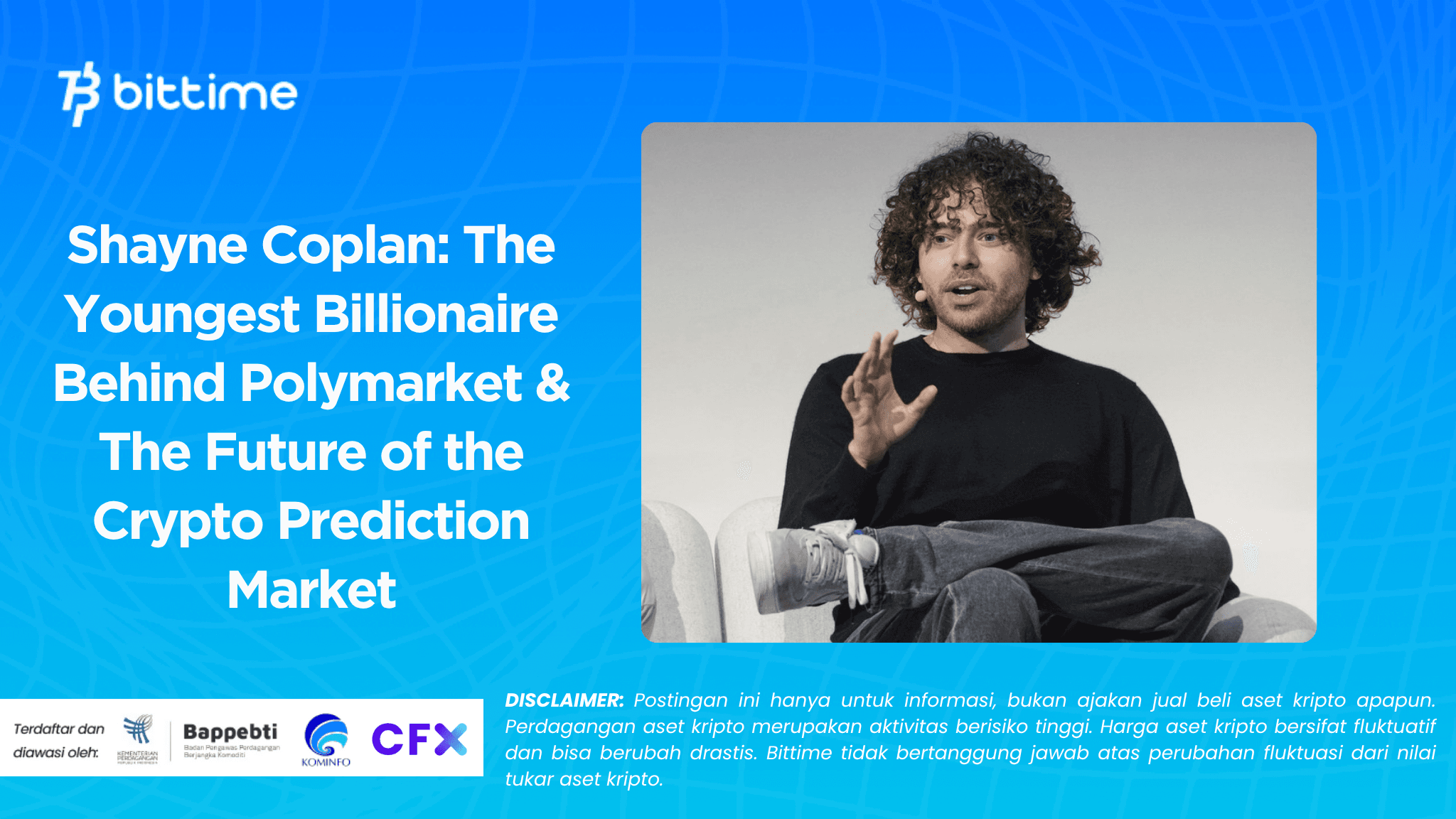

Shayne Coplan: The Youngest Billionaire Behind Polymarket & The Future of the Crypto Prediction Market

2025-10-09

Bittime - In the highly competitive and heavily regulated crypto world, few founders break into global headlines like Shayne Coplan.

He founded the blockchain-based prediction platform Polymarket at a young age and is now the youngest self-made billionaire after Intercontinental Exchange (ICE) announced plans to invest up to $2 billion in Polymarket at an $8 billion valuation.

This article covers his background, career journey, regulatory conflicts, and how he is leading the transformation of crypto prediction markets.

Who is Shayne Coplan?

Shayne Coplan was born in 1998 in New York. He began studying Computer Science at New York University but decided to drop out to focus on crypto projects.

His interest in crypto peaked when he participated in Ethereum’s pre-sale at a young age.

Inspiration from prediction market theory (for example Robin Hanson’s work) shaped his idea to found Polymarket in 2020.

Through courage and vision, he not only built a prediction platform but also gained media recognition — appearing on Forbes' 30 Under 30 and named “Person of the Year 2024” by Decrypt.

Read also: Profile: Timothy Ronald — Wealth, Business, and Controversies

Polymarket’s Journey & Innovations

Polymarket was created as a blockchain-based prediction platform that lets users bet on real-world events — from politics and sports to global economic outcomes.

Founded by Shayne Coplan in 2020, the platform grew quickly thanks to its decentralized prediction market concept that is transparent and easy to access.

Key milestones in its history include:

2024: Peak Popularity During the US Election

Polymarket reached global momentum during the 2024 US election, with more than $3 billion wagered on the platform.

That event made it the world’s largest blockchain-based prediction market and demonstrated Web3’s potential in finance and entertainment.

2022: Regulatory Dispute with the CFTC

Polymarket’s popularity drew regulator attention. In 2022 the U.S. Commodity Futures Trading Commission (CFTC) accused the platform of operating derivatives without a license.

Coplan agreed to a $1.4 million settlement and blocked U.S. users as a compliance measure.

2024: DOJ Inquiry & FBI Search

After the election, the FBI searched Coplan’s New York apartment and seized his devices as part of a Department of Justice investigation.

However, the case was closed in July 2024, marking the end of a difficult regulatory chapter for Polymarket.

2025: Legal Moves & QCX Acquisition

In mid-2025 Polymarket acquired QCX, a CFTC-licensed derivatives exchange, for $112 million.

This pivot transformed the company from a “grey area” operator into an entity formally operating under U.S. law. The acquisition provided a strong legal foundation for broader global expansion.

By combining bold innovation with regulatory resilience, Polymarket is now seen as an icon of Web3’s transition toward financial legitimacy.

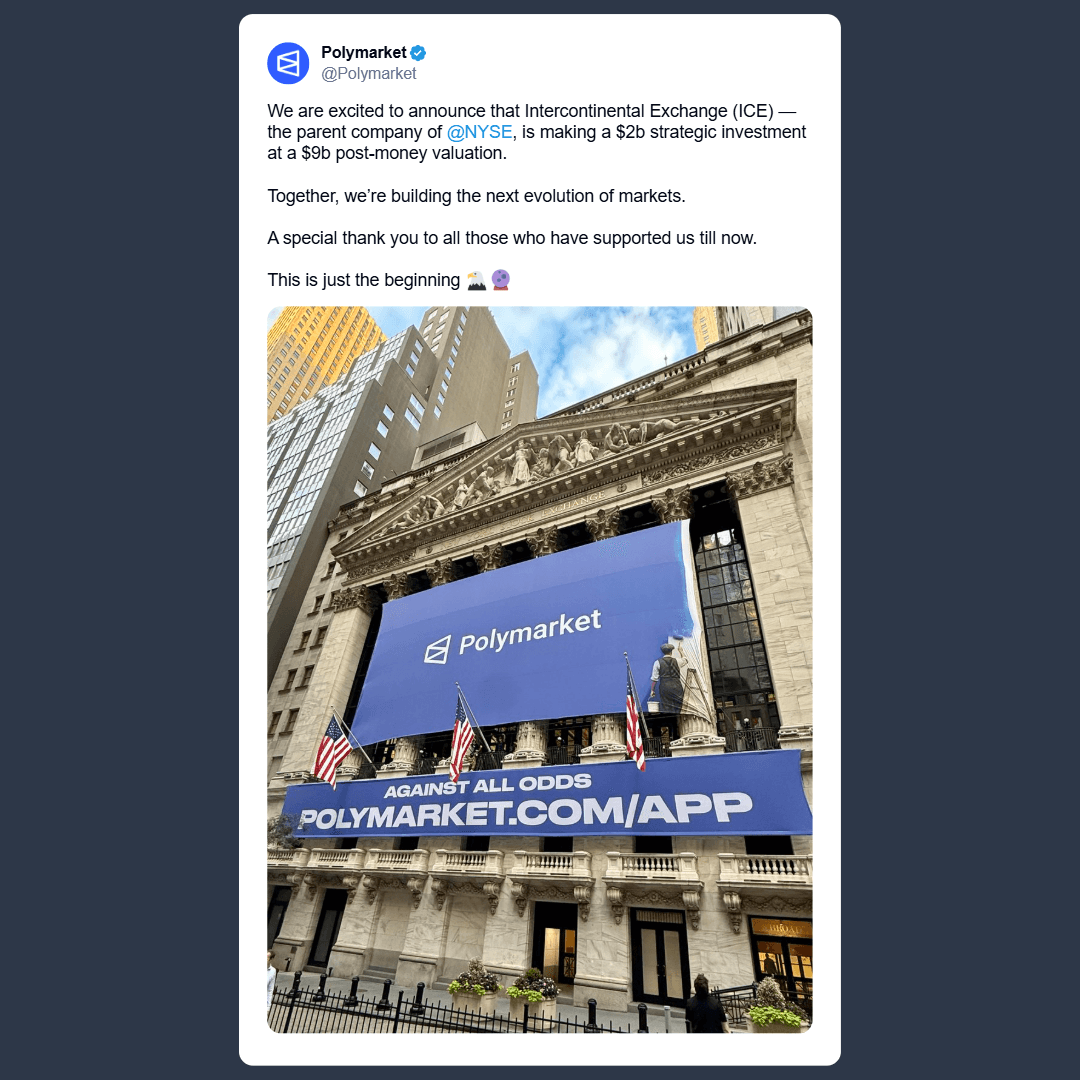

Recent Achievements & Mega Investment

Most recently, ICE (owner of the New York Stock Exchange) plans to invest up to $2 billion in Polymarket at a pre-investment valuation of $8 billion.

This move is strategic for ICE as it seeks exposure to digital prediction markets and recognizes Polymarket’s long-term potential.

With institutional backing from ICE, Polymarket’s market position becomes stronger and its regulatory legitimacy is reinforced.

Read also: Erik Finman: The Young Dropout Who Got Rich from Bitcoin

Strategic Steps & Challenges for Polymarket

Even at the height of success, Polymarket and Shayne Coplan still face hurdles.

- Regulation & Compliance

Although Polymarket has moved toward regulatory compliance (through the QCX acquisition), regulatory risk remains significant — especially regarding whether prediction activity is classified as gambling or derivatives. - Allegations of Manipulation & Wash Trading

There have been accusations that some reported volume on Polymarket was due to wash trading or manipulative activity aimed at inflating volume metrics. - Banned in the U.S. & Geo-blocking

The platform must ensure U.S. users do not bypass blocks via VPNs or other means, to avoid renewed regulatory action. - Dependence on Political Contracts / Episodic Volume Spikes

Large volume spikes are often tied to political events or elections — maintaining that level of activity in normal times is challenging.

Read also: Who is the Founder/CEO of Stellar (XLM): The Story and Biography of Jed McCaleb

Outlook for Polymarket

Given recent developments, Polymarket’s prospects look promising.

With institutional capital from ICE and a regulatory path via the QCX acquisition, Coplan stands at a turning point as the company shifts from an amateur startup toward a more established financial entity.

If Polymarket maintains transparency, compliance, and can attract institutional users, the crypto prediction platform could become a foundational element of a new financial market — connecting public opinion, real-time data, and market decisions.

Taking a leading role in the “mainstream prediction market” is not easy, but with momentum and strong backing, it may be achievable.

How to Buy Crypto on Bittime

Want to trade or buy Bitcoin and invest in crypto easily? Bittime can help. As an Indonesian exchange registered with Bappebti, Bittime ensures transactions are safe and fast. Start by registering and verifying your identity, then deposit a minimum of Rp10,000 and you can buy digital assets right away.

Check exchange rates like BTC to IDR, ETH to IDR, and SOL to IDR on Bittime to follow market trends in real time.

Also visit the Bittime Blog for reliable updates and educational content about Web3, blockchain technology, and investing tips to deepen your crypto knowledge.

FAQ

What is Shayne Coplan’s educational background?

He initially studied Computer Science at New York University but dropped out to focus on crypto projects.

How does Polymarket make money?

Polymarket’s business model used to be unique: the platform initially didn’t charge transaction fees, prioritizing growth over quick profits. With expansion and large investments, monetization is more likely to appear (for example via data licensing).

Is Polymarket legal in the United States?

Since 2022, Polymarket has blocked U.S. access to comply with its settlement with the CFTC. With the QCX acquisition (a CFTC-licensed exchange), they are working to re-enter the U.S. market under regulatory compliance.

What does ICE’s $2 billion investment mean?

The investment is more than capital — it’s institutional confidence in Polymarket. ICE will also distribute Polymarket event data and collaborate on tokenization initiatives.

What happened when the FBI searched Coplan’s home?

In November 2024 the FBI searched Coplan’s apartment and seized electronic devices as part of a DOJ investigation into alleged U.S. user activity on Polymarket. Coplan described it as political, and the official inquiries were largely resolved following regulatory settlements.

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.