Crypto Scalping: Definition and 5 Strategies

2025-01-14

Bittime - Scalping in the world of cryptocurrency trading is a technique used to profit from small price fluctuations in a very short time. In practice, traders who use scalping techniques carry out a number of small transactions in one day to take advantage of rapid price movements.

Although this technique offers attractive profit potential, scalping is more suitable for experienced traders who have the ability to make quick decisions in a limited time.

What Is Crypto Scalping?

Crypto scalping is a trading strategy that focuses on buying crypto assets at the bid price and selling them at the ask price within a very short period of time, usually between 5 to 30 minutes.

The main goal of this technique is to earn small but frequent profits, by making many transactions in a day. This requires a deep understanding of technical analysis, as well as the ability to respond quickly to market changes.

Read also: The prices of XRP, XLM and ADA coins rose during a red market

Due to the rapid and frequent price movements of cryptocurrencies, this technique requires experience and tools such as crypto charts, trading bots, and APIs to maximize opportunities. Scalpers often work with crypto pairs that have high volatility and large trading volumes, allowing them to earn more consistent profits.

5 Strategi Scalping Crypto

There are various approaches that can be used in crypto scalping. One popular strategy is range trading, where traders buy an asset at a support level and sell it when it reaches resistance. This approach is more effective in stable markets with limited price fluctuations.

Additionally, there are also arbitrage strategies, which involve buying a crypto asset on one exchange at a lower price and selling it on another exchange at a higher price. This strategy requires monitoring multiple exchanges simultaneously to take advantage of price differences.

Read also: Bitcoin vs Altcoin Sentiment Comparison: Which Will Pump Higher?

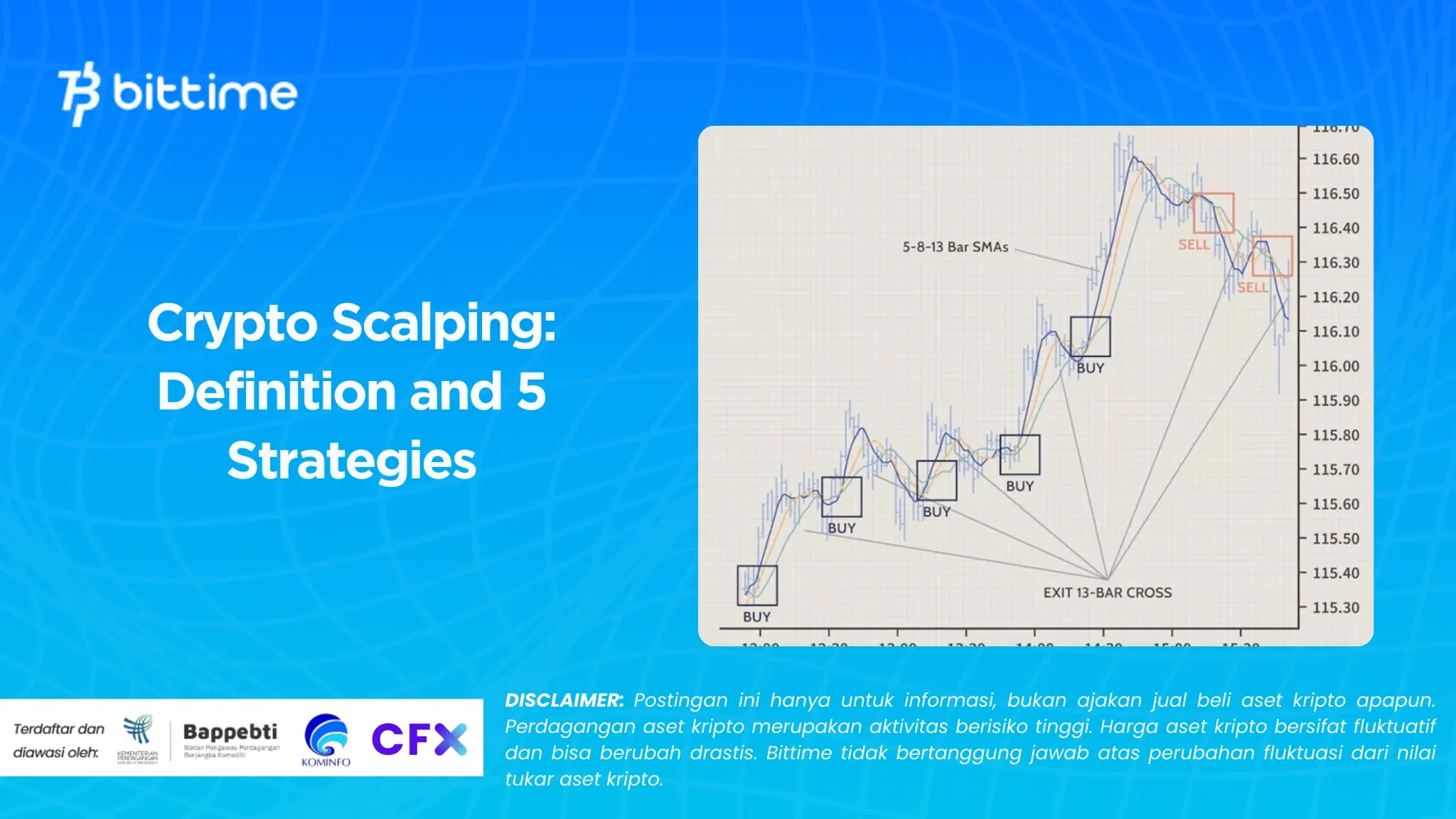

Apart from that, the bid-ask spread strategy is also often used. In this case, the scalper looks for a market with a large difference in bid and ask prices, and then makes transactions with a small profit margin. Then, there is also the moving average crossover technique, which compares short-term and long-term moving averages to identify market trends and determine the best time to buy or sell.

Finally, price activity is a strategy that focuses on analyzing price movements using indicators such as RSI or SMA. By analyzing price patterns, traders can determine the right time to make a transaction and take advantage of price fluctuations that occur in a short time.

Advantages and Disadvantages of Crypto Scalping

Scalping has a number of advantages, such as fast income opportunities and more controlled risks because transactions are carried out in large quantities and in a short time. It also allows traders to take advantage of short-term price movements without relying too heavily on larger market trends.

Read also: 9 Best Bitcoin Mining Tools for those of you who want to mine BTC

However, scalping also has its drawbacks. The fast decision-making process can be stressful, and this technique also requires a lot of time to monitor the market. Additionally, due to the large number of transactions carried out, transaction costs may increase, which can reduce profits.

Is Crypto Scalping Profitable?

Scalping can be a profitable technique if done with the right knowledge and good skills. This is not an easy method, as it requires a deep understanding of technical analysis and the ability to read market trends quickly.

Apart from that, scalpers must also be able to use tools such as trading bots and technical indicators to speed up the decision-making process.

However, despite its great potential, scalping is not a suitable strategy for everyone. This technique is more suitable for traders who are experienced and ready to face the challenges that come with a large number of transactions and quick decisions that must be made.

Best Crypto for Scalping

To scalp effectively, it is very important to choose cryptocurrencies that have high volatility and large trading volumes. Cryptos such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Binance Coin (BNB) are choices that are often used by scalpers because their prices often fluctuate within a fairly large range every day. Thus, these assets provide a good opportunity for traders to take advantage of rapid price movements.

Scalping vs Day Trading dan Swing Trading

The main difference between scalping and day trading lies in the trading duration. Scalping is done in a short time, usually only a matter of minutes, while day trading lasts longer, it can be several hours or a full day. In addition, scalping usually involves more transactions in a day than day trading.

On the other hand, swing trading is a strategy that prioritizes medium-term price movements. Traders will hold their positions for several days or weeks, looking to profit from larger price fluctuations. In contrast to scalping which relies on quick decisions and daily transactions, swing trading focuses more on medium-term profits.

Conclusion

Crypto scalping is a trading technique that demands skill, speed, and a deep understanding of technical analysis. By taking advantage of small but frequent price movements, traders can make profits in a short time.

However, this technique requires persistence, intensive market monitoring, and high transaction costs. For traders who are experienced and can manage risk well, scalping can be a profitable method.

FAQ Scalping Crypto

What is scalping in crypto trading?

Scalping is a trading strategy that involves buying and selling crypto assets over a short period of time (a few minutes) to gain small profits from rapid price movements.

What are the main strategies in crypto scalping?

Some of the main strategies in crypto scalping include range trading, arbitrage, bid-ask spread, moving average crossover, and price activity.

Is crypto scalping profitable?

Scalping can be profitable if done with the right skills and strategy, but it requires experience, a lot of time, and technical tools to monitor the market quickly.

How to Buy Crypto on Bittime

Want to trade sell buy Bitcoins and crypto investment easily? Bittime is here to help! As an Indonesian crypto exchange officially registered with CoFTRA, Bittime ensures every transaction is safe and fast.

Start with registration and identity verification, then make a minimum deposit of IDR 10,000. After that, you can immediately buy your favorite digital assets!

Cek course BTC to IDR, ETH to IDR, SOL to IDR and other crypto assets to find out today's crypto market trends in real-time on Bittime.

Additionally, visit Bittime Blog to get various interesting updates and educational information about the world of crypto. Find trusted articles about Web3, blockchain technology, and digital asset investment tips designed to enrich your knowledge in the world of crypto.

Reference

Business Community, Crypto Scalping: How Does It Work and Is It Profitable, accessed January 13, 2025.

Author: MF

Disclaimer: The views expressed belong exclusively to the author and do not reflect the views of this platform. This platform and its affiliates disclaim any responsibility for the accuracy or suitability of the information provided. It is for informational purposes only and not intended as financial or investment advice.